To be successful in any facet of life, there is one thing that is most important – discipline. Whether you want to be a successful businessman or a good student, you want to keep yourself fit or you do anything is life, discipline is a must. Investment is no exception to it.

Read More- Aligning Investing with Life Goals

Why Regular Investing is beneficial?

1. Formula of Savings

India is a country of saver and we save almost 30% of our income. This saving is one of the highest in the world. Savings is nothing but a function of “income minus Expenditure”. Mostly we have income which we receive on monthly basis, may it be salary, rent, interest, and even in case of business, we look at monthly revenue. At the same time, expenses are also monthly nature it to be Rent paid, phone, petrol, grocery, etc. all our budgeting is done on monthly basis.

2. How do we Invest

But when it comes to investments, are they monthly in nature? No, they are not. For most investors, investment is either a Financial Year-end exercise or some lump sum investment made on an irrational basis. It is a very sad fact that most investors are not disciplined in their investment approach. The best way to make an investment is to the moment you have saved your money. This solves two purposes,

- One that your investments get the maximum time and hence the power of compounding working best for you.

- The other purpose regular investment solves is that it makes sure that you don’t over-spend. You must of observed that when you go to the mall, many times you buy what is not planned or something which attracts there and we become an impulsive buyers. This happens only when there is an excess balance lying in a bank account and then it becomes very easy for anyone of us to swipe the card and buy. Many times, we buy items which are not necessary for us but just become there is Saved money with us, we tend to over-spend.

Must check – Every Investor Should know The Two Poisons of Investing

3. Power of Compounding

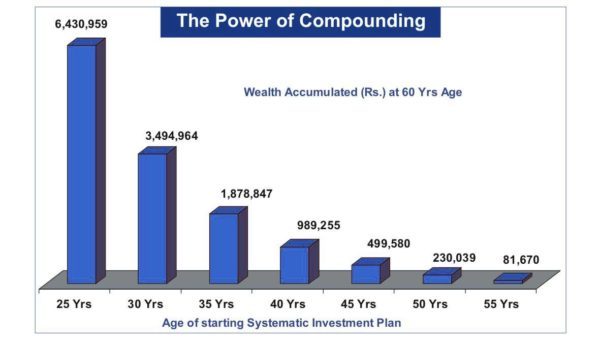

we shall not be speaking anything and let the picture speak THOUSAND words.

Wait a minute, did I say THOUSAND……

So let’s see what Rs.1000/- per month of investing at 12% rate of return p.a. can do to you at a different point in time of your life.

4. New Formula of Savings

So change your formula of saving & adopt a new rule “pay yourself first”, pay for your retirement first, pay for future goals first even before paying for current expenses. So now onwards its

Now if you were to start regular investing, you will make such that there is what differentiates between a good investor and a bad investor.

5. Where to invest

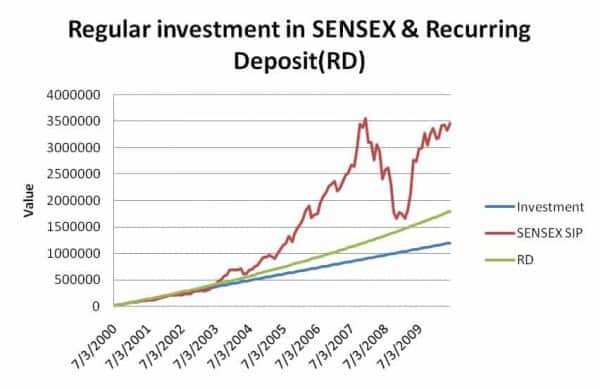

Now the point is that where should you invest regularly. you may save regularly in traditional investment options like Bank or post office Recurring deposits but if you have term goals like education funding for your kid or saving for your retirement, the best is to invest regularly in Equity Mutual Funds. This is commonly known as a Systematic Investment Plan (SIP). Equities give the best return in long term and beat inflation comfortably. Traditional investments fail to beat inflation and hence are not recommended for your long-term financial goals.

Read – How Mutual Fund Work

6. Learning from Past

To talk specifically, if someone would have invested Rs.10000/- in SENSEX on the first working day of the month from the last 10 years i.e., starting from July 1, 2000, Till June 1st12010, his investment of Rs.12 lacs would have given him Rs.34,53,917, a return of 20.34%p.a.

But if you would have invested the same amount in post office/Bank Recurring Deposit(RD), the same would have given you an Rs. 17,97,161 at 8% p.a.

Please let us know: Are you regular when it comes to investments?

Hi..Im saving 25% of my income through SIPs. It gives me a sense of security and guarantee. Also it keeps a check on my expenditure and forces me to plan the expenses. Im not sure whether Equity Mutual Fund is the best way to invest but investment as a concept no doubt should be followed by all.

@ Ashish

You are on the right track, keep going.

Thanks for nice article.I understood that it is best way to invest in SIPs.

But I have not yet started.How to start investing in SIPs?

Can you please suggest some best SIP plans for me?

@ Ravi

Hire some advisor he can guide & help you in starting your SIP.

There is no fund or sip which is best – we all know best after postmortem of past performance. 😉

Choose any 2 good consistent funds(not best) one large cap & one mid cap and start your SIP.

Which is best short term regular investment plan?

I started SIP few months back (1000 Rs. monthly HDFC tax saver and 1000/- monthly ICICI PRU tax plan), how much return I will get after 10 yrs, please advise of index fund and diversified Mutual Funds

Hi Jitendra

Equity linked savings scheme (ELSS) is the best tax saving instrument, with added advantages of Systematic Investment Plan. If we assume a return of 15% in next 10 years your end corpus will be approximately Rs 5.5 Lakh out of which your contribution will be Rs. 2.4 Lakh. Keep an eye on New direct tax code as it is expected that ELSS will not be a tax saving instrument after that. I will suggest you to go for diversified equity fund as still India is in developing face & fund managers can find good companies that can substantially outperforms the market – so they can generate better performance than the INDEX. You can invest in DSP BR Equity or Reliance Regular savings fund. Index funds & exchange traded funds are good for developed markets as outperforming market is very difficult in these places. So for investor, reduction in cost is important.

Hemantji,

I started Sip in HDFC Top-200(G)

Principle Emerging Blue Chip Fund(G)

ICICI Pru Dynamic Fund(G)

Sundaram PSU(G)

Raliance Growth(G) Schemes Rs.2000p.m

My Horizon for investment is 6 Years & i want to start a SIP of Rs.1000p.m in Axis Tripple advantage Fund(my one time inv.Rs.25000 @NFO)

Can i achieve my Goal of Child Education (which is in 5 th Std. now) ?

Pls suggest me that i can start a SIP with AXIS

Haresh Soni

Hi Haresh,

I don’t think you should start SIP in Axix Tripple Advantage bcoz even your existing portfolio need changes.

Hi Hemant,

I had go through a lot from your article you publish in your site. There is a lot

to make thing brief to every one . But what i observed as I am regular visiting you site since last 9 months on behalf of that still Iam not able how to decide or make a bench mark to purchase a fund which will full fill my financial requirement.

For Example:- I read you SIP article.

Every thing is in brief but how a novice consider that he should use this fund for SIP investment. Or he should consider a advisor / broker to begin this type of investment.

Hi Munish,

I will write something on this but that does not mean you should not hire an advisor.

Hi.

I liked ur article n uderstood many thngs from it …

But my question is that investing 1000 or 2000 in SIP is enough or someone should invest more … and it is a tax saving also or not …

And during buying a plan what are the things we should keep on mind .

Thanks

Gagan

Hi Gagan,

The amount of investment should depend on once goal – if your goals are very small or very far may be this amount will be sufficient. So one should first check what are his goals then see what his existing investments are & after that should calculate that gap or how much he need to invest per month or per year. There are special funds for tax saving known as Equity linked savings scheme which will give tax benefit under section 80 C. When we are talking about selection of fund on should stick to long term consistent performing funds.

Hey Hemant,

I want to save for Sons Education for which I have 17 yrs & tgt amt is 70 lacs kindly suggest me a SIP for the same?

Hi Hemantji

I would like to invest in SIP for long term for the future of my children. I wish to invest rs 10000 per month. pl suggest in which sip should i invest, and should i take the dividend route or the growth route.

Hi Dinesh,

Check this

https://www.retirewise.in/2011/02/systematic-investment-plan-mutual-fund-sip-best.html

Hi Sneha

You have not mentioned how much you can invest per month.Depending on the amount you can invest in two or three diversified equity funds with good present and past performance.However, after investing keep tracking the performance of your funds on regular basis.You can also check the link given below by Hemant for Dinesh.

Thanks Anil,

I can start an SIP for 2000 and can gradually increase the same. Also i have invested in SIP of like DSP BlackRock Top 100 Equity-Growth, Birla Sun Life Frontline Equity Fund Plan A -Growth and Reliance regular savings equity fund – GROWTH OPTION for 8 months now. Though these funds have good rating I have not breakeven in the same. Do i still continue the SIP?

Hi Sneha

For your additional SIPs you can consider the following funds :

1 ICICI Prudential Focused Bluchip Equity

2 HDFC Midcap Opportunities

3 UTI Opportunities Fund

You can wait for around three to four months. After that check the performance of the funds in your portfolio by comparing with peers and benchmark index and exit the funds having consistently poor performance.

Thnxx Hemant,i will follow your suggestions.

I am 31 years, in bangalore working as a software engineer and have an earning around 70k per month. I have taken an LICof 15 lakh and invest in PPF and Reliance Tax Saver option-Growth Plan. Last month I started investing in HDFC Top 200(2000 per month). I was considering to invest in the following:

Midcap :

IDFC Premier Equity Fund – Plan A – Growth or sundaram bnp paribas midcap fund

Large Cap

DSP BlackRock Top 100 Equity Fund – Growth or Franklin India Bluechip Fund – Growth – Growth .

Please let me know

1. if this is a right time to invest considering the market volatility. Should I wait for some more time berfore investing?

2. Which of the options should I proceed with for each mid cap and large cap.

Thanks.

Hi Seemanth

Investment in equity mutual funds is done via SIP to meet your long term goals.Once SIP is started it has to be continued for more than five years.In the short term there may be ups and downs in your returns but if you remain invested for a long time you are likely to get around 12% annual returns.In fact SIPs work best during market volatility.All times are good for investing through SIP mode.Growth option is best for wealth creation.

Hi Hemant,

I want to invest through SIP in some 4-5 mutual funds. How to make such investments on line?.Briefly let me know the easy procedure I have to adopt, scince Iam a beginner in this field.

With Regards

I want to invest in SIP Mutual Fund.

Hi Hemant,

I want to invest through SIP in some 4-5 mutual funds. How to make such investments on line?.Briefly let me know the easy procedure I have to adopt, scince Iam a beginner in this field. total 4-6 thousand per month

With Regards

Comments are closed.