When people move from one country to another, they often face a lot of confusion about how taxes work. This is especially true for Non-Resident Indians (NRIs) who live in one country but still have to pay taxes in another country, like India. The rules can be difficult to understand and change frequently, which can make it hard for NRIs to manage their money effectively. But by learning about NRI TDS, NRIs can better handle their taxes and make the most of their finances.

What is TDS – India

TDS or Tax Deducted at Source is a tax collection mechanism in India where a person or company responsible for making certain types of payments like salary, rent, interest, commission, etc. is required to deduct a certain percentage of tax at the time of payment and deposit it with the government. This mechanism is also used for NRIs and in most cases harsh in comparison to resident Indians.

In This Article, we have covered everything you want to know about Indian TDS:

- TDS on NRI

- TDS on sale of property by NRI

- NRI TDS on all types of investments and incomes

- Simple Process Of Refund of Tax

- Few other tips & tricks

TDS in India

Income earned or accrued by NRIs in India is subject to tax in India. Section 195 of the Income Tax Act covers Tax Deducted at Source (TDS) on payments/interests received by non-resident Indians (NRI). The rates and conditions for TDS are different for Non-Resident Indians compared to Indians.

Let us see the TDS for NRI on different sources of income & how to get back TDS amount

Must Read – How Can NRI Save Tax?

TDS for NRI

If an NRI earns income in India, they are liable to pay income tax if the total income for the financial year is more than Rs. 2,50,000. Some of the forms of income that are subject to tax in India (TDS for NRI is charged on most of these)

- Interest income earned on bank savings and deposit accounts (NRO accounts)

- Rent earned on property owned in India

- Payment received for services rendered in India

- Profits earned on the sale of bonds, mutual funds, and shares

- Sale of property/gold etc. owned in India

Read – Tax Rate for NRI on Indian Income

TDS on NRI property sale

Whether a resident or nonresident – if you are selling a property there will be capital gain tax. But when NRI sells property there are TDS deducted by the buyer – if the property is sold within 2 years of purchase (short term gain) 30% & if it’s sold after 2 years of purchase TDS rate is 20%.

| Nature of Capital Gains | Description | TDS Rate on Sale of Property by NRI |

| Long Term Capital Gains | Property held for more than 2 years | 20% |

| Short Term Capital Gains | Property held for less than 2 years | Income Tax Slab Rates of Seller |

How to reduce TDS on property sale by NRI

If you’re an NRI selling a property in India and want to reduce your TDS liability, you can file an application in Form 13 with the Income Tax Department. This application is for obtaining a Certificate for Nil/Lower Deduction of TDS, which can significantly reduce your TDS liability. As the form filing process can be complex, many NRIs opt to hire a Chartered Accountant to handle it for them.

TDS on Tax on Interest earned from Bank Accounts

TDS on NRO fixed deposit interest

Interest earned on a Non-Resident Ordinary Account (NRO) is taxable. A TDS of 30.90% is applicable to it. If the Interest amount is Paid more than 10 Lakh, TDS Will be 33.99 %

TDS on NRE fixed deposits

Interest earned on Non-Resident External (NRE) FD and Foreign Currency Non-Resident (FCNR) accounts is not taxed in India. Therefore there is no tax deducted at the source.

Detailed Post – NRI Mutual Fund Taxation in India

TDS on Dividend

Earlier there was no tax and therefore no TDS was deducted on dividends earned on equity shares and mutual funds. But in 2020 union budget tax on dividends was introduced & for NRIs it’s 20%.

TDS on Capital Gains

If an NRI earns short-term capital gains by selling equity shares or equity mutual funds, the gains are subject to 15% TDS. Equity mutual funds are mutual fund schemes that have 65% or more investments in equity. You can check the below table for TDS on capital gains Non Residents:

| Type of Fund | Short term capital gains | Long term capital gains |

| Equity Funds | 15% | 10% |

| Other Than Equity Funds | 20% | 10% (for unlisted) & 20% (for listed) |

Short-term gains are profits made by selling equity shares or equity mutual funds within a year of purchase for other funds it’s 3 years.

Budget 2023 – Previously, the government had set a TDS rate of 30% for debt mutual funds. However, this has now been reduced to 20% or possibly even lower, depending on the Double Taxation Avoidance Agreement (DTAA) in place between India and the country of the investor.

Must Read – NRI taxes India

TDS on Insurance Policy

To simplify matters, here is a brief overview on taxation rules that have been amended recently and impact NRI policyholders –

- Payments made by policyholders of Life Insurance, Annuity Products, Pension Plans, and Health Insurance products who are NRIs will be subject to TDS. Life insurance policies that are exempt from this are those policies that are exempt under section 10(10D) of the Income-Tax Act 1961.

- The policyholder will need to submit the following documents to ascertain the applicable tax rate

- – Tax Residency Certificate (TRC), duly verified by the Government of the country of which the policyholder is a resident.

- – Self-attested Form 10F (since the TRCs issued by different countries may not contain all the particulars mandatorily required to be included under section 90(4) or 90A (4) of the Income-tax Act.

- The Indian Central Government has entered into Double Taxation Avoidance Agreement (DTAA) with many countries so that a taxpayer (who is a resident of one of these countries) can claim beneficial provisions either of DTAA or of the domestic law to be applicable.

- The rate of TDS will be determined as per rules of Income Tax Act 1961 and DTAA with the residence country of the policyholder if it has been signed. For availing of the benefits of DTAA, a policyholder needs to submit a Tax Residency Certificate containing defined particulars and other required documents. The maximum rate will be 30% + surcharge and education cess.

Read – Tax for NRI on Indian Income

NRI TDS on Other Income

One can earn income through other means such as rent or income from professional services. Here are the TDS rates for such other income –

| Income | TDS |

| Rent | 31.2% |

| Professional Services | 10% |

| Royalty | 10% |

| Technical Fees | 2% |

| Any income that does not fall in any of the above categories | 30% |

Important Points To Remember –

- An education cess of 4% is applicable to all the TDS.

- If the income earned is more than Rs. 50,00,000, a surcharge of 10% is applicable.

- There is TDS on rent paid by individuals more than 50000 per month (when the landlord is resident) – but in the case of the NRI landlord, there is no lower limit.

- If you buy any property or make an investment when you are a resident Indian but earn income when your status changes to NRI, then the rules applicable to NRI will be in force for tax matters.

- NRIs have to file an income tax return if he/she has earned income of more than Rs. 2,50,000 or any income via short-term or long-term capital gains.

Sometimes it is a challenge for Non-Resident Indians (NRIs)to handle taxation matters when there are amendments to existing rules and provisions.

Read – Tax Strategies For NRIs

How to avoid TDS on NRO account?

There’s a common query that can NRIs submit form 15 G & avoid TDS. TDS is not the final tax that one has to pay but people would like to avoid the hassle of claiming the refund. Forms 15 G & 15 H are allowed for resident Indians but unfortunately, this benefit is not available in the case of NRIs.

“In a few cases, if you want to avoid TDS – The form 10 F & Tax Residency Certificate (TRC) can be useful.” wiseNRI

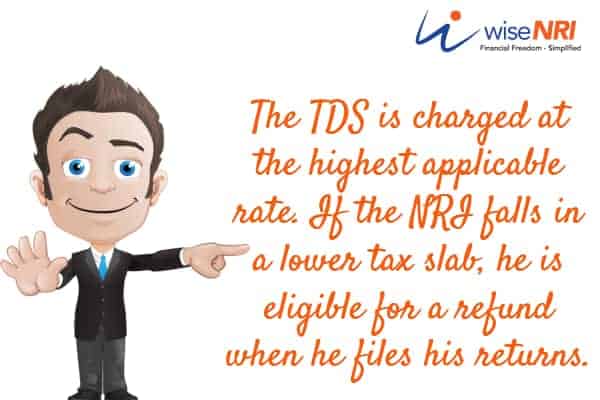

NRI TDS Refund

It is a rule that any payment made to an NRI is to be made after the deduction of tax at source (TDS). In many cases, NRIs have to pay income tax for global income earned in the country of residence. This results in double taxation for the amount earned in India. NRIs can claim a refund of TDS or excess tax paid in two ways –

- File IT returns for the relevant financial year.

- Utilize the Double Taxation Avoidance Agreement (DTAA) to avoid paying excess tax.

File IT returns for the relevant financial year

File income tax returns. You can visit this website to file your returns. The excess tax, if any that was deducted will be the amount due for refund.

Here are some details on the filing of IT returns –

- A non-resident or a person not ordinarily resident in India, earning income in the form of salary and interest, is required to furnish a return of income in ITR-2 form.

- If the NRI earns income in India via business/profession, ITR-3 has to be filed.

- If the NRI earns income from business & profession (opted for the presumptive income scheme as per Section 44AD, Sec 44ADA, and Section 44AE), ITR-4 can be filled. There are some exceptions to the rule –

- Income > Rs. 50,00,000

- Business turnover > Rs. 2,00,00,000

- Own foreign assets and/or capital gains

- Earn agriculture income > Rs. 5,000

- Earn income from more than one house property

- Earn income from winning Lottery or Horse racing

- Individuals who are directors in a company

- Individuals who have investments in unlisted equity shares

The Tax Refund for NRI is processed by the Income Tax department within a few months (3-6 months) of filing returns. Refunds are made in electronic form, directly to the bank account of the taxpayer and in some cases an interest of 6% p.a. is given.

Check – How to File Return Online.

Utilize the Double Taxation Avoidance Agreement (DTAA) to avoid paying excess tax

DTAA is a tax treaty signed between India and other countries so that people do not end up paying tax on the same income twice in different countries.

There are three ways to avail the benefit of DTAA –

1) Exemption Method – Here, you are taxed in one country and exempted from tax in the other. Tax is deducted at source as per the rate applicable as per the DTAA agreement between India and the relevant country.

2) Deduction Method – The NRI pays tax in the country where income is earned. This income is subtracted from the total income and tax is paid as applicable to the difference.

3) Availing Tax Credit – The total global income is taxed in the country of residence of the NRI. Then tax relief can be claimed from the country where the income is earned.

The NRI should have the Tax Residency Certificate (TRC) and Self-declaratory-cum indemnity form to avail of DTAA.

Taxation rules for NRIs are not simple. Moreover, there are new changes in taxation introduced almost every year. Do understand the regulations properly and file your returns on time using the right documentation. If you are unsure, consult with a financial planner or tax expert who has experience dealing in personal finance matters of NRIs.

Hope this clarifies matters related to NRI TDS Refund. Feel free to ask your questions in the query section.

Is TDS on dividends refunded on filing returns

Hello Jayprakash,

Yes, if the TDS (Tax Deducted at Source) on dividends exceeds the actual tax liability after considering your total income and deductions, you can claim a refund by filing an income tax return in India. The excess TDS amount will be refunded to you after the tax assessment.

I am non resident, earn a salary in India with TDS at 10%, am I still required to file a tax return?

Hello Trishna,

Yes, as a non-resident earning a salary in India with TDS deducted at 10%, you’re required to file a tax return if your total income in India exceeds the basic exemption limit. Even though TDS is deducted, filing a return is necessary to declare your income and claim any refund.

Lower tds on sale of property by nri

I am a buyer with my wife being Co owner but only Co applicant in loan with no EMI/ financial obligations. I am buying property from NRI and there are 2 sellers with equal ownership. Is it necessary to have TAN for both the buyers or payor tan will comply?

Hello Rajan,

As a buyer with your wife as a co-owner but only a co-applicant on the loan, TAN (Tax Deduction and Collection Account Number) is typically required for the payor, which is usually the person making the payment. As the buyer, ensuring that the payor TAN is compliant should suffice unless there are specific circumstances or legal requirements necessitating TAN for both buyers, which can vary case by case. Consulting with a tax advisor or legal expert is advisable for precise guidance based on the transaction’s specifics.

I would like to open NRI Dement account from overseas. Which securities allows that?

Hii Deven Patel,

Many leading Indian banks offer NRI Demat accounts that can be opened from overseas. Banks such as HDFC, ICICI, Axis, SBI, and Kotak Mahindra among others, typically allow NRIs to open Demat accounts. Ensure compliance with RBI regulations and check specific eligibility criteria and documentation requirements with the chosen bank for NRI Demat account opening from overseas.

If nri has income only on short term capital gains and long term capital gains, will they get a basic exemption limit of 2,50,000?

Hii Karan,

the basic exemption limit of ₹2,50,000 is applicable for Indian residents. However, NRIs have different tax rules. They are not eligible for the basic exemption limit on income earned through short-term or long-term capital gains in India. Both short-term and long-term capital gains are taxable for NRIs without any exemption.

I want to find out if nri has to pay TDS on property purchase in india

Hello Vinod,

Yes, NRIs (Non-Resident Indians) are subject to TDS (Tax Deducted at Source) on property purchases in India. As per Indian tax laws, when an NRI purchases property in India from a resident Indian or another NRI, the buyer is required to deduct TDS on the total sale consideration. The TDS rate is generally 1% of the property value for transactions exceeding Rs. 50 lakhs.

i live in australia. And i earned bit of dividend last year. In which TDS was cut and i have to file return. It’s really small amount but still i have to as it will become big in coming year.

Hey Arjit,

As an NRI living in Australia, if TDS was deducted on your dividend income in India, you are required to file an Income Tax Return (ITR) in India to claim a refund and report your income. Even if the amount is small, filing the ITR will help establish a tax history and compliance record. It’s important to file the return accurately and on time to avoid any penalties or future complications.

Dividend income TDS refund for NRI is possible

Hey Kandaraja,

Yes, dividend income TDS refund for NRI is possible. As an NRI, if the TDS (Tax Deducted at Source) on your dividend income is higher than your actual tax liability, you can claim a refund by filing an Income Tax Return (ITR) in India.

Can I claim the 20% dividend?

I claim refund of tax deduction of my NRO account.But from next year tax deduction will be less than 1000 rs. As there is balance in account is less than 20000 rs. Will I need to file return and claim refund if I don’t want to claim refund

Hey Vadgamauk,

No, you will not be required to file an income tax return or claim a refund

If I paid foreign currency payment and cut of tds is that refundable?

Hey Harin ,

Yes it’s refundable, but it depends on various factor like , your tax liability, tax treaties between countries, and any provisions for claiming a refund or credit for taxes paid in a foreign country.

Can i change my nominee

Do you help in filling form 13 and getting the certificate for no tds deduction on propert sale?

Besides NRIs there may be some PIOs & USA citizens (other than permanent residents) getting pension from Indian Government sources. These USA citizens of Indian origin can benefit thru USA-India DTAA by not paying any TDS or income tax in India on Indian government pension only & only if they are tax residents & citizens of USA. This benefit is not available to permanent residents and to non- government pensioners. I am already getting this benefit.

Hey Charanjit ,

You may be able to benefit from the USA-India Double Taxation Avoidance Agreement (DTAA). If you are tax residents and citizens of the USA, you may not be required to pay any TDS (Tax Deducted at Source) or income tax in India specifically on their Indian government pension. But this benefit is not available to permanent residents and non-government pensioners.

I am coparcner in HUF created for ancestral property sold. Amount is lying in Savings Bank a/c with Bank. I am having NRE& NRO a/c

When I purchase a home from nri thro loan, does the bank pay the amount of 20% of tds amount or I will have to pay to IT department from my own funds

Hey N Mukundan ,

you have to pay from your own funds.

I want to know what is the procedure to get refund on TDS on a property sale

How I am able to pay tax and TDS deduction for NRI. I am an OCI but PAN Card and Aadhar card linked but my mobile no sim is missing and not able to get OTP to see TDS deducted

I have 3 bank accounts in India. All are active . Each have NRE and NRO account. I have done many transactions through it for past 10 years. I have pan and aadhar(recently received and linked also). I have a registered pan account with income tax dept . How to know whether I have tax payable to IT?

Hey Jayachandran,

First of all Check your bank transactions and income sources. Than assess if your total taxable income exceeds the applicable tax threshold. After that calculate your tax liability based on the income tax rates. And

Determine if you need to file an income tax return and pay any outstanding tax amount.

Hello –

I recently sold my flat in India. The buyer deducted 20% TDS on the sale price. I purchased 54EC bonds worth the capital gain and will be filing taxes in India to get the 20% TDS refund. I’m a resident of US. As I bought bonds (and did not have to pay taxes in India on capital gain), does it mean I will owe taxes in the US?

NRI has Indian income below 2.5 Lakhs only from NRO Interest and NSE Listed Company Dividends. Any step by step guide for NRI including which form to use on IT website to claim back TDS on NRO Interest and Dividends ?

Do you offer service to apply form 13 in India

I am an NRE, and I could not file my TDS refund from 2017 to 23 and can I submit now? Which form and online?

As NRI can i claim refund of TDS deducted on share sales

I am nri and working as hr consultantto indian company. How much tds will they deduct.

as a NRI, can i get tax refund on TDS after missing the belated TAX returns filing deadline?

Hello Karthikeyan

As a Non-Resident Indian (NRI), you may be eligible to claim a tax refund on TDS (Tax Deducted at Source) even if you have missed the deadline for filing belated tax returns in India. However, the process for claiming a tax refund can vary depending on your individual circumstances.

India government pension how much TDS deducted from NRO account

Hi Vandana

The amount of TDS (Tax Deducted at Source) that is deducted from a government pension in India will depend on various factors, such as the amount of pension, the individual’s tax bracket, and whether any exemptions or deductions apply.

For NRIs, the TDS rate for government pensions is generally 30%, unless there is a tax treaty between India and the country of residence that provides for a lower rate of tax.

I am an NRI and 1 years ago sold a flat in India, TDS is dedicated during sale and I got 16A from buyer. Now I am constructing another house in India so can I refund the tds paid ?

Hello Nishant

Yes you may be eligible to claim a refund of the TDS amount if you have reinvested the sale proceeds in another residential property in India within a specified time frame.

You will also need to provide the TDS certificate (Form 16A) issued by the buyer, along with other supporting documents, such as the sale deed, purchase agreement, and receipts of payment for the new property.

I am an NRI, and my only income in India is NRO FD interest of 3.5L per annum in the year 2022 Mar to 2023 Mar. Accordingly TDS will be deducted by bank at ~31%, approximately 1,08,500.

Can I claim a refund of this 1,08,500, if so when is the last day to file the ITR and will I get full refund (if the tax free slab is 3 lakhs per annum?)

Hi Rajeev,

You can claim a refund of the excess TDS deducted by filing an income tax return (ITR) in India. The last date for filing the ITR for the financial year 2022-23 is July 31, 2023, for individuals who are not required to get their accounts audited. If you file your return before the due date, you can claim a full refund of the excess TDS deducted, provided your total income for the year is below the taxable threshold of Rs. 2.5 lakhs for NRIs.

I have to file ITR for year 22-23 while expecting TDS refund after this filing. Is it possible to get TDS refunded if I file ITR now?

Hi Bala,

Yes, it is possible to get TDS refunded if you file your ITR for the 22-23 financial year now. If the TDS that has been deducted from your income exceeds the tax liability for that year, you can claim a refund by filing your ITR. However, it’s important to note that the refund will only be processed after the tax department has verified and processed your ITR. The process of getting the refund may take several months.

what is the TDS To be deducted with NRI is selling a property

Hello Abhishek,

TDS on the Sale of Property by NRI in 2022 is required to be deducted at 20% + Cess + Surcharge

I am an NRI and have rented my property to a resident. My tenant has deducted TDS and credited to the govt. However he has not filed the returns and has not provided the TDS certificate. My question is who has to file the returns, is the tenant or the NRI landlord ? What happens if the TDS is not filed within the quarter, is tenant penalized or landlord ? Not sure if this is a tedious process and who has to engage the CA to do this TDS process – does tenant have to engage the CA to sort this out or the NRI landlord ? Appreciate a reply. Thanks

Hello Domnic

The tenant must fill in Form 15CA and submit it online to the income tax department &

Kindly consult with your CA.

I parches new flat from NRI and transfer all transection in NRI account… Now i don’t know what is impact my TDS

Hi Shaikh,

It will be applicable on the sale of a flat not on the purchase of a flat.

Hi Shaikh,

As per my knowledge, Whenever any property is purchased/sold, TDS is required to be deducted. The buyer when paying the amount to the seller will deduct some amount (technically called as TDS) and pay the balance to the seller. This amount which has been deducted by the buyer would then be required to be deposited with the Income Tax Department by the buyer.

TDS on sale of property by NRI

Hi Sagar,

TDS on Sale of Property by NRI in 2022 is required to be deducted at 20% + Cess + Surcharge

how do get my old tax returns

TDS was deducted in March 2021 on maturity of my 10 year insurance policy in India. The gain over the 10 year period was 2,90,625 rupees. I am tax resident in the UK and would like to claim a refund from India tax office.

Hi Prem Lal,

Please consult with your CA.

What is the TDS rate in icici prudential policy of 2015

i am an NRI. I sold property in November 2019 in India and the buyer withheld 30% tax. The buyer gave me a counter foil showing he deposited the tax withheld and a TDS Certificate. Now I am filing my taxes and learnt from India Tax Dept. that no TDS Return was filed by the buyer. The TDS CERTIFICATE he gave me was not complete or something. I have informed the buyer and asked him to file and send me the TDS Return Certificate. The buyer says he made a mistake and now has to pay a huge penalty. He wants me to pay the penalty to get the TDS CERTIFICATE.

Hi Tina,

Kindly Consult With your CA.

Great job opportunities for CAs by making tax laws

simple.

I would like to know , when NRI want to sell his immoveable property…. Is TDS applied to capital gain or to sale price?

Hi Mariner,

NRIs who sell the property situated in India have to pay capital gains tax in India. Long-term capital gains are taxed at 20% and short-term gains shall be taxed at the applicable income tax slab rates for the NRI based on the total income which is taxable in India for the NRI. And the buyer will deduct TDS @ 20%.

Hi Vaman, my name is Arun not Mariner, I don’t know how it became Mariner.

Anyway coming back to TDS,, naturally it is always upon capital gain like stcg

30% n ltcg 20%. But sofar I think it will be deducted at sale price by the buyer at the time of Sale deed. However later on via ITR it can be recovered as per calculations of income tax officials, but it is very complicated for NRIS .

Am I right sir, or u can advise me better

Thanks in anticipation.

Om Shanti

Yes you are right .TDS is on sale value.

TDS is on sale value

How to get lower tds certificate

Hi Melwyn,

Kindly consult with your CA.

Hi, I live in the UK and have dividend income in India.this was taxed at 20% at source and the DTAA allows only 10% tax credit. I have filed my IT return in India and want to revise it to get 10℅ refund. I have the tax residency certificate also. What is the best way to do this – tax authorities seem to be saying it has to be done in Advance before the month of May for the next tax year. Is that correct?

Hi Raj,

Kindly consult with your Tax consultant.

We wish to inform that the Section 195 of Income Tax Act 1961 deals with Payments to Non Residents and for following TDS rate applicable for FY 2021-22 is determined at CP (Customer Profitability) level. Net Taxable Income under CP Tax Rate0 – 5,000,000 31.20% on income5,000,001 – 10,000,000 34.32% on income10,000,001 – 20,000,000 35.88% on income20,000,001 – 50,000,000 39.00% on incomeAbove 50,000,000 42.744% on income In this case, policy holder is NRI. Hence TDS is deducted @31.20% on policy income.

Hello, I have a request. Can you please publish an article about the 20% TDS on property sale for NRIs. Thank you

Hi Amit,

Kindly check this link.

https://wisenri.com/nri-tds/

Need to know capital gains tax implications of selling property in india

Hi,

long term capital gain taxed at 20% plus a cess of 3%.

I will be selling my inheritance property in India that will be shared amount 7 members I am an NRI and have to pay 20%as TDS what is the other Taxes I have to pay And how could I get back the TDS paid

Hi Willam,

As per my understanding, You can get your TDS Back by Filing the ITR in India.

How to submit TDS as I bought the property in India

Hii Niharika

It is suitable to take advice from tax consultant

I’m NRI, living in Dubai, and purchased a property in India and paid TDS. It’s an under-construction property. I don’t have any income in India. Can I get a refund of TDS paid? Kindly advise if I’m eligible for a TDS refund as I have zero tax in India and no income in India.

Hi Lenin,

As per my Knowledge, Yes you can it refund by Filing the ITR But it is better to consult with a Tax Consultant.

Hi I’m OCI and sold flat to Indian resident. Now the buyer is not responding to my request on Form 16A. What remedy do i have to claim my TDS. Thank you

Hi Gabriel,

You should consult with your CA.

TDS refund for NRE.

Hi Rafiq,

You can claim refund by filing the ITR

i am a NRE but have been paying TDS. can i get an exemption and if not then refund and if so how?

Hi Atma,

You can claim refund by filing ITR.

Hi Hemant, I am an NRI. I want to invest in ICICI Pru Guaranteed Income For Tomorrow. The brochure says that Get tax free maturity amount u/s 10(10D) so does this mean that the maturity benefit paid out annually will be tax free for me and there will be no TDS. Please advise.

Hi Rachna,

It is tax free but if the TDS is deducted , you can claim it by filing an ITR.

TDS during MF redemption can be refunded for NRI? If yes then how?

Yes Suman,

You can claim it by filing an ITR.

If NRI buys the property, then how is the TDS returned.

Hi Anwar.

You can claim TDS by filing an ITR.

If TDS is deducted does I have to file Income Tax returns for earnings above 5 lakh?

Hi Jijay,

If your income is not above Rs 2.5 lakh in any FY then you can claim TDS refund by filing ITR.

I have recently sold a flat to a resident who has deducted TDS @ 23.92% on the total sale value. Since I have already purchased a new flat, how can I get the refund of deducted TDS? Also, will the refund will include Surcharge, etc

Hi Anil,

You should consult with your CA for this.

I will be selling some mutual funds after a year of holding them I am an NRI. How do I claim back TDS and what will be the TDS? Are TDS and long term capital gains the same in this case? Ie 10%?

Hi Puneet,

You can get your answer by reading below article.

https://www.wisenri.com/nri-mutual-fund-taxation-india/

I am NRI, I have an NRO account, the only income I have is interest income, no other income, what Form do I have a file to get a refund of TDS deducted by ICICIBANK?

Hi Surendra,

You should consult with a CA for this.

I hope you have s PAN number. If tax is deducted by the bank, they should have credited the TDS with Income tax department and filed TDS returns. Ask for Form 16 A , certificate of tax deducted.

Check with Form 26 AS of your PAN by logging to the income tax website.

File ITR for claiming full TDS refund assuming you have no taxable income .

Do not delay filing ITR

Well explained article. I’m looking for answer concerning surcharge and Education cess. I’m an NRI who sold a property (long term capital gain) recently. The buyer has deducted TDS + surcharge + Education Cess as per the IT prescribed rates through bank and then TAN. When I got the Form 16A, the amount reflected is only the TDS amount from the challan. How do I claim retrun for the surcharge + Education Cess?

Thanks in advance,

Ajith

Hi Ajith,

You can consult with a CA for this.

I am an NRI, I have no income from India other than a Dividend of Rs 150000, they have deducted TDS @ 34%. Can claim a refund of this amount?

Hi Manikandan,

Yes you can.

I recently sold equity through my demat account. But instead of deducting TDS on gains they deducted TDS on full sale proceeds. Why is it so?

Hi Dilip,

I think for this you need to talk to your Demat broker.

Can a foreign company or NRI claim refund or adjustment of tax deducted in india against the tax payable in his country?

Hi Suresh,

It depends on the DTAA between those countries.Kindly consult your tax expert for better advice

I Want TDS rate with surcharges on dividend for NRI.

Hi Jugal,

As per I concern the TDS rate is 20% while a surcharge at the rate of 15% is also added.

if i claim nri tds refund in his non-nre account would it be liable with 30% tds on tds refund?

Hi Vinay,

As per my knowledge ,no ti would not be liable.

The 30% with held tax on NRO bank fixed deposits,Can NRI get s refund of it by submitting IT Return if the income ( bank interest only)is less than Rs. 250000.

Hi Bikas,

Yes you can do so.

Do you have any publication on NRI financial matters in India

.

Not yet.

Can NRIs invest in any type of Post Office Schemes? I am a NRI. Can I invest in Post Office Time Deposits? If not, why?

Hi, Ashwin

As per my Knowledge, No, NRIs cannot invest in post office savings scheme, because they are not allowed to do so.

If my resident mother do shares gift to me (NRO demat). When I sale shares, do I use original purchase price to calculate capital gain or do I use 0 price to calculate.

Hi Sandy,

As per my knowledge, use the original purchase price to calculate capital gain.

Good article. Question: If close resident relative give shares gift to NRI (NRO acct) relative and when NRI sale the stocks, what is the purchase price to use to calculate capital gain? Is it original purchase price or zero purchase price (as NRI received it as a gift). Example: Resident sister bought reliance 10Shares @100Rs on 01.Jan.2015. Gifted to her NRI (on NRO demat) brother on 01.Jan.2020 (on this day reliance price is 500Rs). When brother sale on 01.Aug.2020 what cost of purchase can use to calculate capital gain? Thank you

There is no tax on interest income from NRE and FCNR accounts of an NRI. Are they suppose to pay tax in Australia on that exempted interest income from these accounts and how much keeping DTAA in mind as Australia has DTAA agreement with India.

Hi Nish,

As per my knowledge, it depends on conditions mentioned in the DTAA of residing country with India, I would suggest you talk to a tax advisor there.

Very good article. Few queries and will be glad if you could address these.

1. Is it mandatory to file NRE interest income which is tax exempt to be declared in ITR2 assuming he/she doesn’t have any other source of income from India?

2. If some one has not reported NRE interest income previously for many years, can he/she declare in current year?

I some how feel, there isn’t much clarity on filing ITR 2 for NRI just to showcase exempt NRE interest income if he/she doesn’t have any other source of income from India.

Hi Krish,

as per my Knowledge

Since it is not taxable, and the person doesn’t have any other income in India it is not necessary.

Yes the income can be declared in the current year and the process would be followed accordingly.

Very good article. It covers everything on TDS.

Thank you.

Thanks Sugun 🙂