A financial plan is a roadmap towards financial freedom for you and your loved ones. Though people desire financial freedom, they are afraid of financial planning. Most people think it is complicated and difficult to understand or implement.

Check – The biggest problem with Financial Planning – how to fix

But it is really about the way you go about it. If you adopt the right approach to financial planning, you will achieve your financial goals.

Here are some ways to succeed with financial planning:

Look at financial planning from a different perspective

You cannot predict what will happen five years down the line or the number of years you need to consider post-retirement. Financial planning is not about accurate predictions but more about taking the right steps so that you set realistic goals and you know your goals. It helps you understand your money habits and you have a fair idea about funds needed for retirement and other goals.

Financial Planning is simple though not easy

We do not say it is a cakewalk. At the same time, it is all about simple steps –

- Spend less and Save more

- Take less debt

- Invest regularly

The steps are simple, but it is not very easy to stick to the steps over a long period of time. You can succeed in financial planning by taking care of simple steps. You need not start off by investing in complex products or getting to understand complicated financial ratio.

Must Read –What is Financial Planning?

It requires time and effort rather than the investment of a lot of money or complicated planning

You should invest time and effort when you kickstart your financial plan. You need to get information about your net worth, savings, and expenditure. You have to think about insurance, investment, and taxes. You have to draft your will. Once your plan is in place, you have to take out some time to review and tweak the plan if necessary.

All this requires time and effort on your part. It also requires a little money for setting up various things in place and if you choose to utilize the services of a financial advisor. If you take small steps regularly, you will accomplish your financial goals without any need for complicated planning.

Must Check – 9 Little Ways to Save Money in India

Financial planning is about discipline and awareness rather than complex concepts and strategies

Terms like Beta co-efficient, correlation, etc. are always in the financial news. You do not need to know all the concepts and strategies to formulate your personal financial plan. You ought to understand your money situation and how you can save and invest to reach your financial goals. You need to be aware of products that you are going to invest in and concepts such as term insurance and investment diversification. Moreover, you have to be disciplined while planning your finances. You secure a higher chance of success when you are mindful of your savings and spendings and conform to the plan created.

It is better to be prepared to manage bad news regarding our finances than ignore the bad news

Some people avoid financial planning as they do not want to face the reality of their financial situation. They are afraid that they might be going over their budget on a regular basis, or they are not earning enough to fund their dreams. This is not smart thinking.

Knowledge is power. If you know your real financial situation, you will take steps to improve upon it. You will definitely succeed if you adopt a realistic plan, make sound but practical choices and adapt your dreams to your financial condition.

You will succeed with financial planning if –

- Your financial plan is comprehensive which means it takes care of savings, expenditure, budgeting, investments, debt, emergency fund, retirement, and financial goals.

- Your financial plan provides a strategy to manage your money.

- Your financial plan is cost-effective and manages taxes efficiently.

- Your financial plan contains realistic and measurable goals and an action plan to achieve the goals.

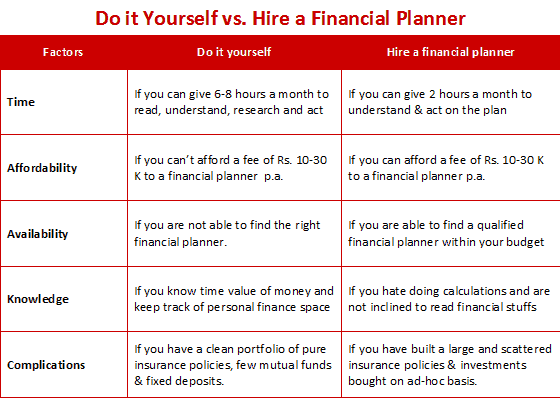

Should you hire a Financial Planner? You decide for yourself.

If you are looking for a Comprehensive, Competent & Complied (SEBI Registered) Financial Planner – you can check this.

If you have any questions regarding financial planning – add in the comment section.

Hey Hemant

I think planning is the most important part of everything. Personally for me “well planned is half done” instead of “well begun is half done”. You pointed out some amazing things like we should be prepare to manage bad news regarding our finances than ignoring. Amazingly written article.

Thanks Rakesh 🙂

good thinking

Thanks

Comments are closed.