Financial Planning involves many things – our money, our efforts, our goals, our personality, and our behavior.

Must Read – Steps of Financial Planning Process

It is a long-term activity as well that extends to many years/decades. While we do try our best to plan our finances optimally, we do run into some problems –

- The unexpected loss of income source

- Mismanagement of income and expenses

- Unexpected financial burden

- Underperformance of Investments

- Our behavior

Yes Our Behaviour is a Big Problem With Your Financial Planning

Yes, our behavior towards our finances is a crucial aspect of optimum financial planning. Social, cognitive, and emotional factors play an important role in financial decisions. Sometimes, they make us behave in a manner that is not in the best interests of our financial status.

Must Read – Behavioral Finance – Make Smarter Financial Decisions

Here are some examples of bad behavior –

- Manas buys a stock that has appreciated in price significantly for the last couple of months because he has been hearing his colleagues talk about it and everyone around him has been buying it. He might end up buying it at a high valuation which can lead to losses later on

- Shilpa invests her money only in bank FDs. She is scared to invest in any other assets fearing losses. This is irrational as she has to understand and analyze other investment options and decide on a healthy mix of investments.

- Many products are heavily advertised. When it was time to file tax returns, Riya invested in a few random products that caught her eye to save some taxes. This is not the best way to make investment choices. Riya should understand her risk tolerance and financial situation and only then invest in appropriate assets.

My New book is all about Investor Behaviour – available on Amazon

What can an investor do in this situation where behavioral biases affect his financial decisions?

In some cases, an active mindful change in behavior will improve decision making. For example, in the examples above, Shilpa can visit financial portals and blogs to understand other investment options.

Manas should let go of the herd mentality and research and analyze on stocks before investing in them. If he feels, he is inexperienced or not knowledgeable to do so, he can invest in equity mutual funds rather than invest directly in stocks.

Another important consideration that will help one in making better decisions is to entrust the financial plan to an advisor.

Must Check – Do You Need a Financial Planner?

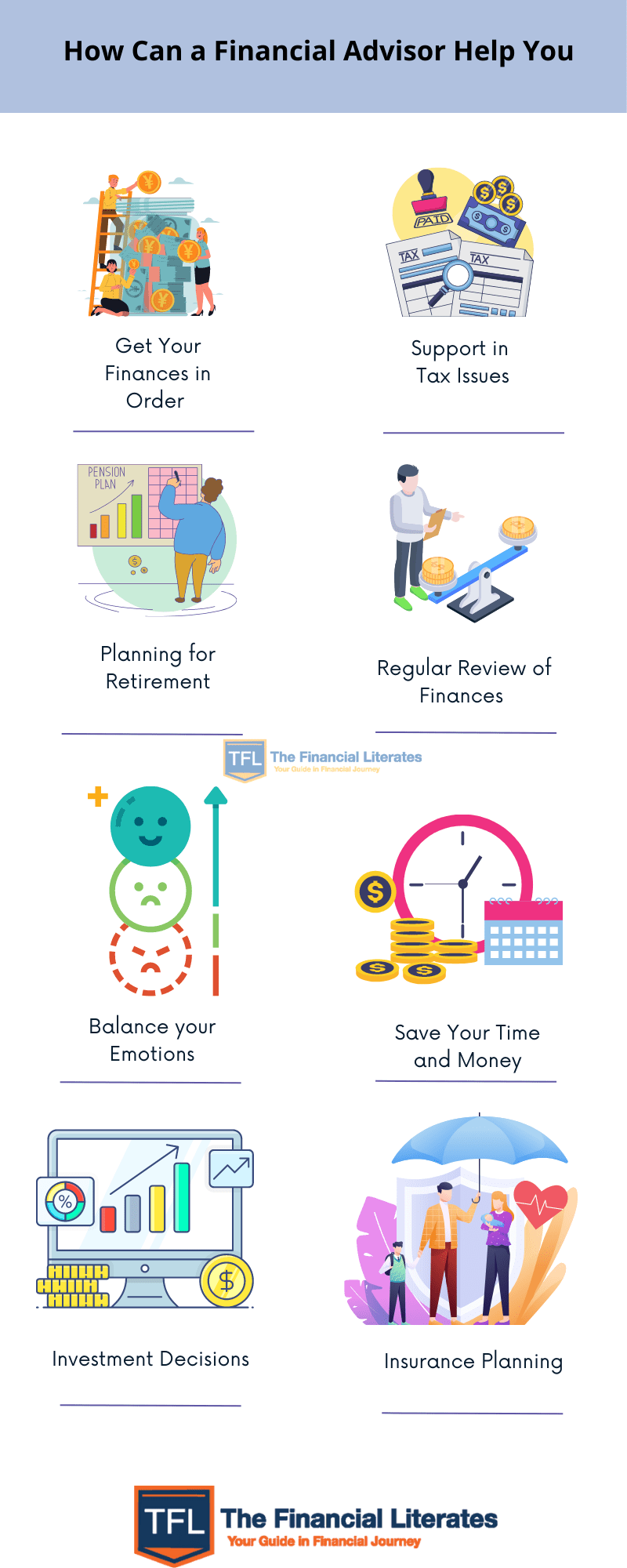

How a Financial advisor helps you to solve your Financial planning problems?

Get your finances in order

You might be overwhelmed with all the work to be done to manage your financial life. A financial planner will easily get your portfolio in one place. He will set up nominations, joint holders, and other banking and financial steps that will ease your financial life. He can assist in making a will and in estate planning. He can ensure that documentation is complete and accurate.

Support in tax issues

A financial planner can plan the taxes such that the tax outgo is minimal. He can help with solving issues related to tax.

Work with you on setting up and achieving your goals

When you set your goals, you might let your emotions color them. An advisor will give advice on setting your goals without any emotional bias.

He will buy and sell assets at the right time (not timing) based on your requirement without getting attached to an asset. He will sell off underperforming assets as he will not have any emotional attachment to them.

Read – 10 Financial Planning Thumb Rules

Regular review of finances

Unless we are highly disciplined, we tend to ignore regular reviews of finances. We forget to check our investments. Sometimes we do not remember to pay insurance premiums. When we are busy or face extreme emotions, finances tend to take a backseat.

The planner will manage finances and review investments regularly for his client. It is his job and he will not let emotions or surrounding situations affect financial planning.

Balance your emotions

When the stock market crashes and your portfolio shows a notional loss or you purchased a property a couple of years back only to see the real estate market stagnating, it is difficult to not be panicked.

You might take some rash decisions as emotions overcome logic. In these cases, a financial advisor can encourage you to think logically and suggest the best course of action. It might be to stay put with your investments or sell off some bad investments. He will give you a true picture of the financial scenario.

Save Your Time and Money

You are busy with work, family, and social commitments. You may not want to spend time and effort in managing your finances with the doubt looming over your head that you may not be making the best decisions. In this case, it is better to have a financial advisor who already knows the stuff and can make decisions quickly.

The investment decisions of competent advisors will generally be better than those of layman investors which will result in saving money and also getting better returns.

Financial planning is not an easy task. It becomes more complex when behavioral aspects such as biases and emotions come into play. It is, therefore, a good idea to consider getting the services of a professional advisor. You need not to give full control but work with him to improve your future.

Get in touch with us to discuss your financial life.

Please share your views Regarding Problem With Your Financial Planning in the comment section.

Nice, it’s an amazing well-written post.

Hi Hemant,

Thank you for sharing this informative article. I learned new things from you. It helped me a lot and I hope that it will also help others. I appreciate your efforts.

Have a good day ahead.

wow nice post thanks 4 sharing Amzaing blog

I found your blog by chance. It’s amazing great effort. Thank you so much.

This is a brilliant post. You have explained it in a most simpler way that anyone could understand the concept of behavioural biases. Thanks for sharing. I found this article really helpful.

This blog is very nice The Biggest Problem With Your Financial Planning, And How You Can Fix It and Financial Planning, financial advisor, equity mutual funds, Financial Planning Thumb Rules, The Art of Thinking Clearly, thanks for this information thanks for sharing us…

Especially in finance & banking, one should never be over-confident about their knowledge. It is always advised to seek help and consultancy from an expert, not to make good but better decisions.

to the Hemant Beniwal, this blog is very amazing and its all about how to fixing financial planning. the money, efforts and goals are key that helps in fixing financial planning. i read your blog and this blog will definitely help me in future. thank you!

This blog post showed very good understanding and it was well-thought out work. I’m obsessed with reading any article for help I can find. Thank you for sharing.

Thank you for sharing this post. It was very useful. Keep posting !!!

I enjoyed reading your article. Please make more interesting topics like this on.

I’ll come back for more 🙂

Nice article.Provides valuable information

Managing your investments and expenses is a vital part of financial planning. Unfortunately, every investor only thinks about instant profits from investments because they do not want to risk their income. We should instead be patient and focus on getting regular profits from our long term and diverse investments.

Managing your investments and expenses is a vital part of financial planning. Unfortunately, every investor only thinks about instant profits from investments because they do not want to risk their income. We should instead be patient and focus on getting regular profits from our long term and diverse investments.

Hi Alia,

Thanks for sharing your views.

Comments are closed.