You will agree that Mutual Funds are like chocolates – there are so many different kinds & new is always popping up. How are you supposed to decide where to invest?

There were a couple of questions related to Tax Saving Mutual Fund or ELSS that I keep getting on the blog. So I thought of writing this post.

I am not sure if I will be able to answer “Which is the best tax saver mutual fund in India?” but I promise this post will help you in selecting the right one for your tax planning needs. And you will also learn an important lesson to avoid mistakes 🙂

Check performance of Best Tax Saving Mutual Funds in last three years.

Don’t forget to download consolidated factsheet of these funds that I have shared after performance table.

Tax Saving Mutual Funds

End of the financial year is around the corner. It is the time when the salaried invest to save tax. For those investors who have not done their tax planning hardly any time is left. Eleventh-hour tax planners must be now looking for tax saving instruments to park their funds to claim income tax deductions. The tax saving mutual fund is one such instrument.

Tax Saving Mutual Funds are popularly known as Equity Linked Saving Schemes (ELSS). They serve the purpose of combining tax benefits with wealth creation using equities. They are basically meant for tax saving but over the last few years, investors in these funds have tremendously grown their wealth. Some ELSS funds have been top performers and consistently outperformed the Sensex.

Must Read – 11 Unusual ways of smart tax planning

Oops.. but I have to share this before going forward. Mutual Funds write this in bold “Past Performance may or may not be sustained in future.” But who cares.

Which is the Mutual Fund for ELSS or which is the best Mutual Fund for SIP or which is the best term plan? This is the most common trick to ask secrets from Hemant. 🙂 And as usual, my answer is “There is nothing called best – best comes after postmortem”.

If you don’t have much idea about Mutual Fund ELSS (Equity Linked Saving Scheme) – You should read ELSS the best instrument for saving tax.

Do you know “Equity markets in the US have given a return of 10% from 1991 to 2017 but what investor got was just 4%.” (Dalbar Studies)

Can you guess why this happened? Because people were looking for the BEST FUNDS & not concentrating on other factors which are even more important.

Read More – How Healthy Is Your Mutual Fund Portfolio?

My Second Book about Investor Behavior

I have Highlighted this difference between Investment Returns Vs Investor Returns in my new book “Modifying Investor Behavior” – Check back Cover to get an idea.

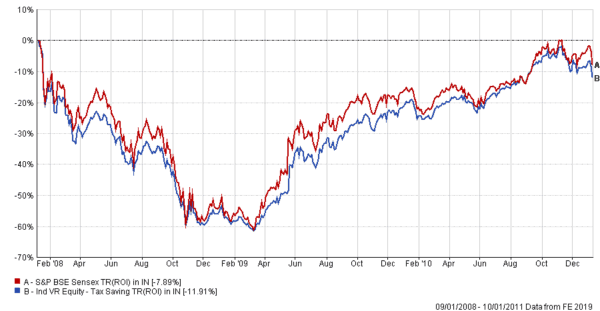

But won’t you like to ask what happened if someone made investments in tax saving funds when the Sensex touched its highest point in the last bull run?

If someone had invested Rs in ELSS Fund on 9th January 2008 (Sensex 20800) & withdrawn it after 3 years on 10th Jan 2011 (luckily Sensex 19100).

Must Read – Compare ELSS Vs PPF

So as a category ELSS have given negative returns in this period & if you notice in the middle of this period funds lost almost 50% of their value. Equity is the most volatile asset class & it always works like this – if you don’t have risk appetite or if you want that your investments should never go negative, please don’t invest in equity or equity related instruments.

So we have seen a single period but this cannot be much help in any judgment. Let’s see what happened in all 3 year periods since ELSS came to existence – for that we have to understand rolling returns.

Definition of Rolling Returns The annualized average return for a period ending with the listed year. Rolling returns are useful for examining the behavior of returns for holding periods similar to those actually experienced by investors.

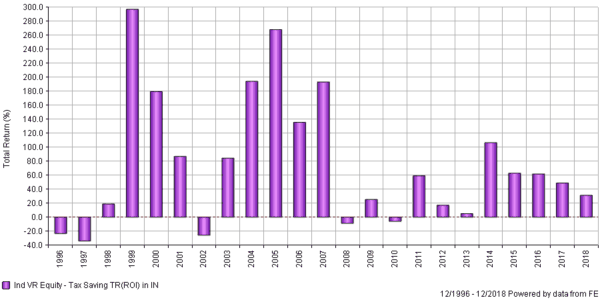

3-year rolling return of ELSS

For example, the three-year rolling return for 1996 covers Jan 1, 1993, through Dec 31, 1996. The three-year rolling return for 1996 is the average annual return for 1993 through 1996.

So you can see there are a couple of negative periods here – all 3 year periods that are starting from a peak of the bull market. Deepest fall, almost a 30% negative in 1997 because this is talking about investments done at the time of Harshad Mehta’s Scam (1993).

Read – High Return Investment

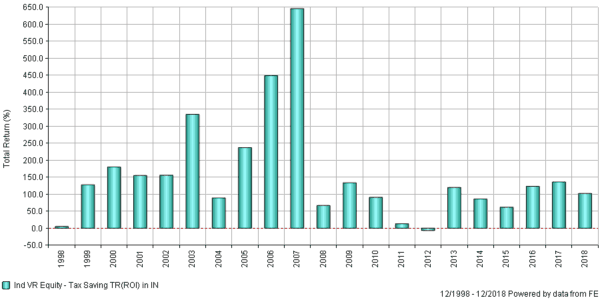

5-year rolling return of ELSS

If we look at 5 year period there is only 1 negative period – ending 2012. If you do a Prima Facie observation – on an average investment has given more than 100% return or doubled in the period of 5 years.

If you look both the rolling charts there are a two important learning:

- First, with an increase in the investment horizon (3 to 5 years) volatility substantially reduces.

- Second, investments done when actual returns were negative have generated a good return. (Check 3 year period)

But the question is which fund to invest. & what about when not to invest in ELSS Funds.

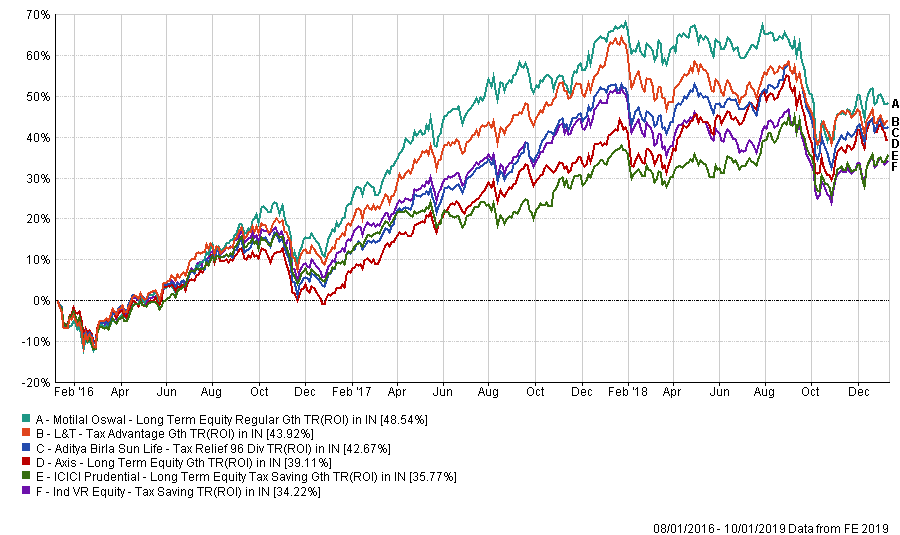

Best ELSS Mutual Fund for 2019

- Aditya Birla Sun Life Tax Relief 96

- Axis Long Term Equity

- ICICI Prudential Long Term Equity Tax Saving

- L&T Tax Advantage

- Motilal Oswal Long Term Equity Regular

These 5 tax saving mutual funds are based on our research but you can take the decision based on your own research or talk to your financial advisor.

Long term Performance of ELSS Funds (CAGR)

| ELSS Funds | 1yr | 3yr | 5yr | 10yr |

| Aditya Birla Sun Life Tax Relief 96 Div TR(ROI) in IN | -6.39 | 12.57 | 18.98 | 19.29 |

| Axis Long Term Equity Gth TR(ROI) in IN | -1.21 | 11.63 | 19.42 | |

| ICICI Prudential Long Term Equity Tax Saving Gth TR(ROI) in IN | 0.22 | 10.73 | 16.21 | 20.50 |

| L&T Tax Advantage Gth TR(ROI) in IN | -11.58 | 12.90 | 16.23 | 18.43 |

| Motilal Oswal Long Term Equity Regular Gth TR(ROI) in IN | -10.20 | 14.10 | ||

| Sector: Ind VR Equity Tax Saving TR(ROI) in IN |

-10.98 | 10.31 | 15.36 | 16.25 |

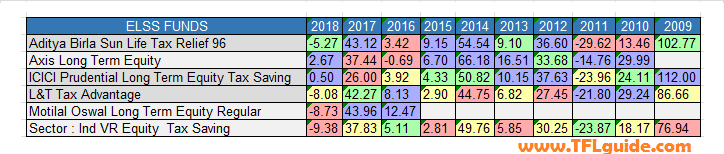

Year on year of Best ELSS Mutual Funds

An optimal way to invest in tax saving mutual funds is by way of monthly SIPs.

Read – You can also have SIP in ELSS

Video – ELSS or PPF Which is better?

Note – Ignore numbers – try to understand the power of equity.

Tax Saving Mutual Fund Vs Diversified Equity Fund

ELSS funds follow the same investment strategy as diversified equity funds. They invest in a portfolio of quality stocks chosen without any market capitalization or sector bias. Investment in ELSS is locked-in for a period of three years from the date of investment. Three- year lock-in period works in favor of these funds. Fund managers can take longer calls and deploy funds without the fear of premature redemption. Because of the stability of the corpus, a higher proportion of assets can be deployed for mid and small caps to get superior returns.

But be aware that few agents try to mis-sell ELSS to earn higher returns.

Who should invest in Tax Saving Mutual Fund?

Investors should go for these funds only if their main aim is to save tax. ELSS funds do not allow you to book profits when markets are rising due to the lock-in period. (or even you can’t apply asset allocation strategies)

Since ELSS schemes invest in equity, over longer investment horizons, they deliver the “highest” long term returns among other tax saving investments. These are suitable for investors with a long investment horizon of more than five years. As these are equity-linked schemes, investors should have a higher risk appetite than pure debt investors.

ELSS is the only tax saving instrument that is pure equity oriented and has the least number of years as lock-in period.

It’s time to stop making haphazard decisions about your INVESTMENTS

and instead talk to us about your GOALS.

Comprehensive Financial Planning Solution

In case you have some questions regarding mutual Funds – feel free to ask. But please don’t ask which is the “Best ELSS Mutual Fund”. 😉

Also, share this with your friends who may be confused about choosing funds to save tax.

Hi Hemant

Thanks for performance tables and charts which enhance the utility of the post.

Hello Hemant and Anil,

What has happened to HDFC tax saver ? Has this fund not been performing well in the last couple of yrs? Because this fund has been one of the best over the yrs..and to not find this fund in the above mentioned list is a bit of a shame because whenever we talk about tax saving fund..HDFC tax saver comes in our mind. So my question to you is are you surprised by this fund’s performance in the recent times?

I am also thinking same, how come HDFC tax saver is not mentioned in the above list. but in moneycontrol website it is gauged as average performer.

HDFC tax saver was very popular till about a few years back.It is an old fund,launched in 1996. But over the years it has slipped in returns and performance rankings and the other tax saving fund from the same AMC is a better performing one. That could be the reason it is not included.

The “returns since inception” is not a good indicator of performance . If a fund was a top performer during the initial years and has been performing poorly for the last few years, it would still have a decent “returns since inception” score

Hi Hemant

I agree with Manoj. HDFC Tax saver has given 30% returns since launch. It is still one of the best fund though value research has given it a rating of 3 stars.

Manoj

I thnik, all HDFC funds have not performed well in the recent rally.

hello sir,

actually m new in corporate and eager to learn to learn more n more about mutual funds and the differences between all.

so i want to ask that if i start a SIP per month n after 15yr maturity i redeem the amount so will it be taxable.

if not the what will b the difference between tax saving fund n these fund if i would invest in LUMSUM as well

There are many categories of mutual funds and tax implications are different in different categories.

what is your take on health insurance plans esp that by lic. giving a premium of 16000 for a 8L cover ( for two ) or starting a RD of 5000/- per month as a cover against future health needs .

Insurance and investment can not be mixed or compared.

Respected sir,

I found this very useful, as per your kind guidance I have invested 35000 Rs in Reliance Tax Saver Fund – Gr. Can you pls. help me to know if this is a right decision or not and the tentative returns I can expect after 3 years.

Regards,

Manoj

It is not possible to predict future returns of any fund.

I feel that HDFC Tax saver should have been also added into your analysis. This is one of the best tax saver funds with a consistent performance. I was surprised by not seeing it included in your analysis.

It is not possible to include all the funds. Fund selection has to be based on certain criteria.

Hi sir.

When investing in mutual fund is it necessary to read scheme information document and statment of additional information

thanks

No investment should be made without understanding.

Is it right that every SIP installment in ELSS is locked for 3 years? Say, I am doing a SIP for 5 year in a ELSS, whether my 40th installment will be locked for another 3 year? On that way I can not withdraw my money in a single shot.

You are right.

Hi Sir,

I just want to know in which tax saving mutual fund i should invest. I have never invested in mutual fund before. Plesase help

You can select one from the table given.

Hi

At first i am really sorry for this elaborate post cum question.Plz bear some patience to read till the end.

I am in a big financial fix.I am 24 yrs old, just 1.4 yrs into a IT job after grad. with a b.tech degree, annual salary around 3 .2 lakhs.I took a LIC endowment plan last yr (paid 2 premiums of 31000 each for the past 2 financial yrs) from our ‘family LIC agent’ (after a lot of persuasion from him) to start insurance and also save tax (hate that decision of mine).I was a novice in personal finance then (now little literate).The plan is for 30 yrs with sum assured 10 lakhs.

Recently, i came across a blog where the disadvantages of endowment plan was enunciated stating the effective return as around 5-6%.They wrote that a good mix of a term insurance (rs 14000) and ELSS investment (rest rs 17000) of this 31000 per yr would fetch much higher returns (securing my nominees by the term insurance and also riding the market using ELSS MFs).

Now, i feel like i have committed a huge mistake and would be even making it worse by continuing this plan for the next 28 yrs.

Should i stop this endowment plan and use the amount in ELSS and term insurance from the next fiscal yr (2013-14) ? I feel like losing 62000 too (saved from this meagre salary for the last 1 yr) since LIC wont pay back any penny if i stop this plan now…..whats the best way ???

Also are ELSS guaranteed to be under the tax saving category for years to come ?? Bcoz if it doesnt, then stoping this endowment plan will be a huge mistake (if i survive till the end of the term of the term insurance, my end resultant cash wudnt be much).

Need some real expert opinion on this.

Plz help me on this.

Thanks in advance.

It is good that you have now realized your mistake. Investment and insurance should never be mixed.Moreover you need insurance only if you have dependents. In case you are not married and you don’t have any dependents you may not require any life insurance at all. It will be better to invest your money in diversified equity mutual funds to meet your long term goals.

I am new to this mutula funds investment. Let me know which one is best for to invest this year and let me know the process

Do your home work properly before any investment. Making investments merely based on advice is not proper.

Nice Article.

One of the things to take care of : Past performance does not guarantee repeat future performance. So do look out for changes in fund managers etc.

It would also have been helpful to get a Annual Growth Rate for these funds from the initial year and have the SENSEX data also put into the column. For the years when there is negative return which one stays closest or drops less versus what happens when the years are good [is the amplification the same or is a fund able to lessen amplification when the returns are bad]. That would nice to see.

Dear Mr.Anil,

What is the significance of Alpha, Beta, Mean, SD while we try to analyze and Fund through ValueResearchOnline….???? Does a Investor really understand these and go ahead or he can decide based on past performance and the Fund Manager Style??

Value Research gives star ratings to funds which can be a good starting point.

Hi,

I am new to this MF investment. I am 50 yrs old and my annual salary for this current Tax Year 2012-3 is Rs.945000

I have saved around 50K under Sec 80 and another 50K has to be saved. I like to deposit by choosing from your table as below.

Axis Long Term Equity – Rs.25000

Canara Robeco Equity Tax Saver – Rs.25000

Please suggest me whether I am right , I have to deposit for how many years on the above and also any other way to deposit to save further tax other than above.

Instead of lumpsum investment SIP mode is better.

Hello Sir,

warm regards. I have gone through your behavioural finance guide and it is very inspirational. Thank you so much for providing such a honest information on Finance behaviour science and methods of assets allocation.

Sir we are working couple in age of 30. Here I would like to mention that in January 2013 following investment in form of SIP is done by us:

SBI emerging business fund-regular plan-growth: 3000INR

Reliance equity opportunities fund-growth plan-growth options: 2000INR

HDFC mid cap opportunities fund-growth: 3000INR

Birla sun life frontline opportunities fund-growth: 2000INR

please suggest me weather I am right in above mentioned investment and what changes can be done.

thanks

Anupam

You are doing fine.

Thank you so much for the reply.

in which mutual fund one should invest

One should not invest in a scheme which one does not understand. One must do research before investing.

are there any tax saving benefits for a single women parent. If any, please provide details.

I am looking out to invest in a Mutual Fund – SIP (Tax saving scheme) and one retirement Plan . can you suggest me anything which i can go for as i am very new into this things.

Please do your home work. Do not seek advice.

I have invested in HDFC Tax saver plan (SIP)..currently 15 th installament is going on. and as per the returns are concerned they are just 3to4% Although earlier returns were quite good but as months are passing returns are decreasing .I am bit worried whether should i continue with plan or not. Lock in period is 3 years …can anybody please suggest me some solution over it..can i change my SIP plan to any other HDFC plan??

SIP return requires long time duartion……….

after 4-5 year you will find the figures like 15-20%

Sir, please suggest an portfolio if an employee earns 3lakhs/year?For rebate in tax and insurance of me, i spend nearly 2500/month in LIC and 1450/month in PLI,5000/year in bajaj super saver plan,16000/year in UTI ULIP and also open an ppf account.Though i save in tax rebate but now i think i am doing mistakes due to lack of knowledge.will u guide me?Also i dont want to open any other plan but i want to switch off an plan against the new plan,please suggest.

Hi Anil,

I am in bit dilemma. Could you please suggest that Which tax plan is better to choose between the direct plan(newly launched from 1st Jan 2013) and regular plan? When a choice is between Quantum and Religare, according to your view, which is better. Thanks in advance for the reply.

Hi Anil,

I want to save tax so I want out to invest 50000 in SBI emerging business fund-regular plan-growth in this year . Is this fund comes under ELSS?

Hi Chirag,

SBI emerging business fund comes under Small & Mid Cap Fund Family. So it does not comes under ELSS.

Dear Anil,

If we do investment for Tax Saving Purpose in Mutual Funds through SIP, is there any locking period in that for redemption of the same. Can you please advice.

Thanks in Advance

Sekar

Yes there is lock in period as mentioned in the post. Please read the post carefully before asking any question.

Hi, Hemanth!

Is it okay to invest in a scheme that has not rated been rated by CRISIL, if it is from a reputed fund house?

Anusha,

Rating agencies have their own parameters basis on which they rank mutual funds schemes. It may happen that a scheme rating may vary among them. CRISIL too has its own ranking methodology. If a fund is not rated by one and is there on the list by other, you should check reason for its exclusion. But if a fund is not rated by ant of the rating agency, then there need to be a strong reason. So you will have to look at the rating methodology and then can only conclude.

Although, you can use these rankings for filtering your selection its advisable to set some of your own and then see how the fund fares.

I have shortlisted following tax saving funds from your given list. Pl help in selecting two out of them.

Sl Fund CRISI Value Research

No Rating Rating

1 Axis Long Term Equity Rank One Five Star

2 Canara Robeco Eqt Tax Saver Reg-G Rank Two Five Star

3 BNP Paribas Tax Advantage Plan (G) Rank One Four Star

4 Religare Invesco Tax Plan (G) Rank Two Five Star

VK,

If this is the list you have finalized you can check on the basis of few parameters such as risk adjusted returns (sharpe ratio), portfolio churning etc.. to see which of these has produced better results. The portfolio of these funds will tell you where are they concentrtaed i..e which of these have more exposure to large cap and which one towards midcap. Analyzing on these will give you the two to choose.

Thank you Sir for your valuable information.I too had the same confusion as Mr. VK had, Now i am clear how to take decision regarding tax saving funds.

Hello sir,

Since last 2 years i am investing in HDFC Tax saver growth..The performance of this fund is below average compared with category..So should in continue my SIP in the same fund or else change to another fund

Pls advise…

Rgs,

Devendran rangasamy..

Deva,

If the fund is under performing for a long time in comparison to its peers then you can look at alternative. However do analyze the reason for underperformance and then make your decision.

PROCEDURE TO START SIP WITHOUT ANY AGENT IN DETAIL.

A Saha,

You can visit any respective company website and you will find the detail of the process to invest.

Sir

I want to invest annually 60 k in mutual tax saving funds ?

Please suggest the best one.

Thank you.

Anil,

You can consider spreading this into two funds. You can pick from the list.

Hi All,

I am 26 years old and doing investment in below SIP and funds please suggest my planning is corrret or not ?

HDFC Gold….INR 1500 from last 1 year

HDFC top 200….INR 1500 from last 1 year

DSP BR Small & Mid Cap….INR 1500 from last 1 year

LIC Money back 30k per year from last 1.6 year

HDFC Life for 7 year with 10 year locking……..24K per year 1.6 year

Can i expect approx 2 crore amount after 25 year from SIP ?

Please suggest.

Thanks

Girraj Sharma

Girraj,

You are investing almost Rs 9000 p.m. Even if a 12% return is assumed you may not reach the target amount with this fixed investment. However, your financial situation will not remain same as your income will increase. So you can enhance these contributions periodically which will allow you to reach near your target goal.

How about your assessment on Best Mutual Fund – 2014 for investing?

sir,

i am canara rabbco (LESS

sir,

i have canara rabaco (LESS) for the AY 2010-11 and Axis long term advantage (LESS) for the AY 2013-14.please suggest me in which fund (LESS) i have to invest for the AY 2014-15. advice me shall i invest now or wait for some time for corracton in market.

with regards

sastry

Sir,

I have started investing in below funds as SIP for next 20 years.Advise if this is good option

1.ICICI pru focusssed bluechip-2500

2.Mirae bluechip emerging fund-2500

3.HDFC balanced -2500

4.Franklin india elss-4000

5.Reliance tax saver-4000

6.Axis Elss-400

7.ICICI pru tax plan-4000

8.Birla top 200 -2500

Informative article. I have many Senior Citizen friends who invest in ELSS Dividend Pay Out option since they require money regularly …& they are quite happy about it !

Sir I want to know the best equity mutual funds in 2017 to invest in as I am new to mutual fund and want to invest in.

Thanks

Sir, I am investing SIP of Rs 10 k in reliance tax saver from sept 2016 .Is it right decision?

Hi Santosh,

If this is the only equity SIP that you are running – I will suggest diversifying.

Hi,

I have a plan to invest in SIP. kindly let me know, when i need to invest in every month. will date matters?

If the select the particular date while starting my investment then i need to continue in the same date till end. correct me if i am wrong.

Hi Gowri,

Date Doesn’t matter in investment in mutual through SIP – in the long term it won’t make any difference in returns.

AMC will ask you about SIP starting date. On that particular date, your SIP amount will be automatically debited from your bank account till the end date of investment. Date should be based on your convenience(income date) – if you want you can change this in future.

I am an NRI. All my income is tax free in india. Kindly advice mutual fund is better or I shall go for ELSS. In my opinion since I am not bounded for saving taxes on my income I must go for equity mutual funds with a lesser locked in period. Kindly suggest…….

Hi Ayush,

ELSS is also mutual fund but as you mentioned regarding your tax status – it will be better for you to go for diversified equity funds.

Really very informative post.Such an amazing experience of reading.I loved it and enjoyed it very much.You shared great content.Keep up the good work.Thanks for sharing.

Aditya Birla Sun Life Tax Relief 96 scheme follows an aggressive multi-cap approach and delivered a positive return in different time frames. It has given 24.47% return since its launch. The fund has a higher allocation to mid-cap stocks which consist of 47% percent (approx.) and balance spread across large cap 43% (approx.) and small cap 10% (approx.). Thanks for sharing a great article.

nice work keep it up

Hemant thanks for such a helpful post.

I am planning to invest in ELSS mutual fund and time horizon would be 15 years. I will be investing 1 lakh per year to save tax . Now my query is , should I invest in one or two ELSS ( definitely not going to invest in more than two) ?.

My first pick would be AXIS and if you suggest two, may I know what would you suggest for second option?. I can take a bit risk for second one.

Waiting to hear from you.. thanks once again.

Do we invest all the money in first one or part money in all then in what proportion. There trends seems to be really impressive, kindly guide me asap

It is a treat to read your works. I completely relish your works and eagerly wait for the next arrival.

Thanks 🙂

Comments are closed.