What are Alternative Investment Funds in India?

An Alternative Investment Fund (AIF) is a private investment vehicle. It is established or incorporated in India for a specific investment policy. It enables the pooling of funds from investors. Investors can be Indians or foreigners. It is a financial asset that does not fall into the traditional asset class (equity/income/cash).

It is not covered by SEBI regulations but by a set of regulations known as the SEBI Regulations, 2012. They are commonly known as AIF Regulations.

Also Check: Structured Products- Alternative Avenue of Investment

Why AIF was introduced?

There has been a surge of venture capital investments in India for the past few years. Moreover, Indian businesses attract a lot of foreign investments too. This resulted in many regulations leading to fewer effects of concessions for the promotion of start-up companies or companies in their early stages.

The Government, therefore, decided to set up a new category of investments that will push money in socially and economically desirable sectors. It will be a different asset class for investors.

There will be lesser constraints for investments leading to increased long-term capital flow in India. Capital can be diverted to useful economic activity insisted of being invested in unlisted securities and other businesses. It will be used as an alternative to existing funding methods.

The emergence of the AIF Regime

Now until about 2012 India only governed only Venture Capital Funds from the mid-’90s and so, and then there was a real regulatory empties, to bring within the fold of a wider set of regulations all soughts of an alternative private fund. Today the entire gamete of entirely private pooled funds are covered in the AIF Regime

How are the Alternative Investment Funds structures?

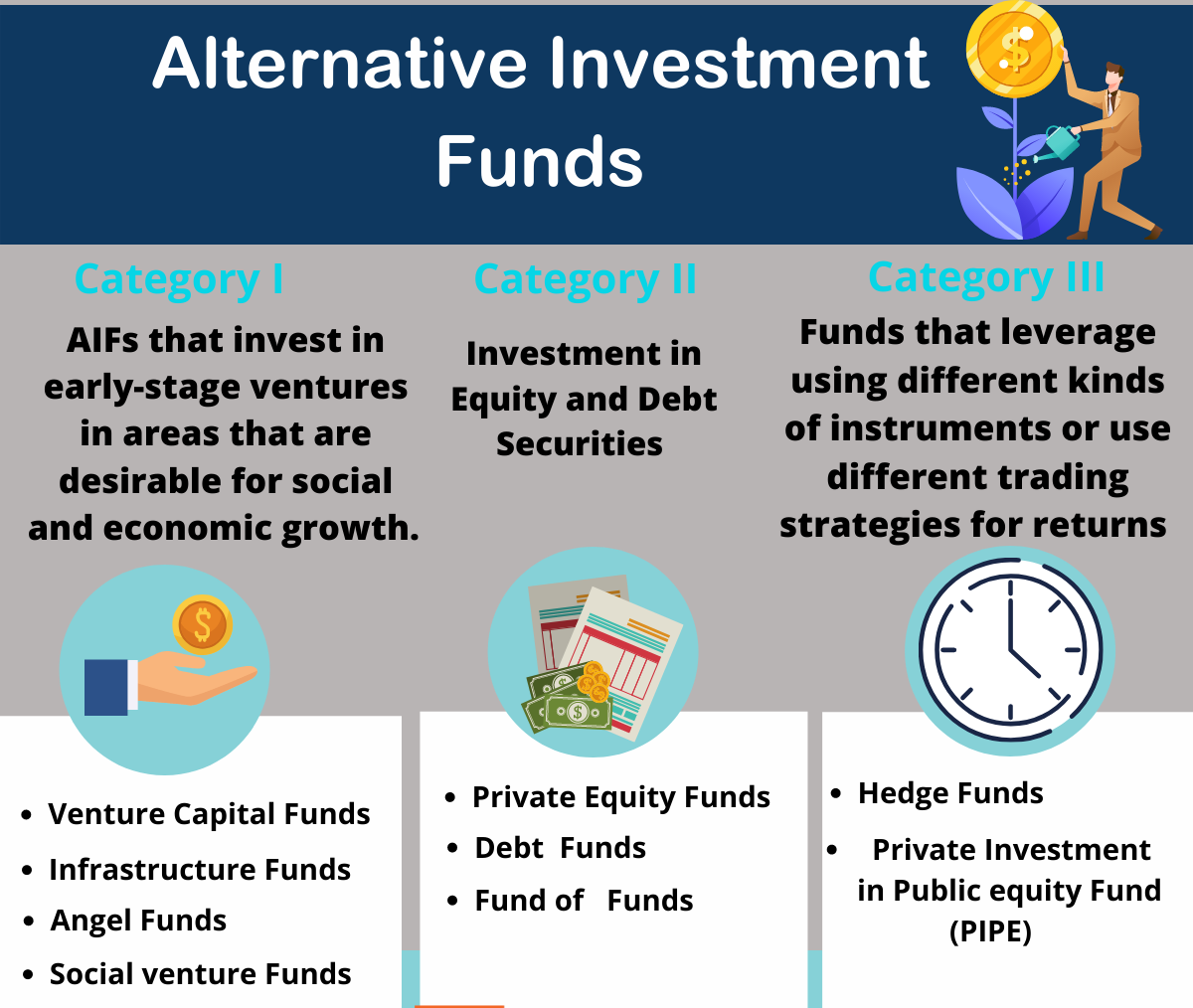

There are 3 categories of Alternative Investment Funds. These are designed by the Government and by the regulator to allow the concessional benefits available depending on which category you fall.

Must Read – Aligning Investing with Life Goals

Category I

AIFs that invest in early-stage ventures in areas that are desirable for social and economic growth. The investment vehicles can be venture capital funds, SME funds, social venture funds, infrastructure, or angel funds. Angel funds are treated a little differently.

Category II

Funds that do not fulfill features of funds In Category, I and Category III are Category II funds. These funds provide for day-to-day operations. For example, real estate funds, private equity funds, and funds for distressed assets falling under the purview of AIF regulations are Category II funds.

Category III

Funds that leverage using different kinds of instruments or use different trading strategies for returns are included in this category. These can be hedge funds or open-ended funds. The Government nor regulatory bodies give any specific incentives or concessions. Various types of funds such as a hedge, PIPE funds, etc are registered as Category III AIFs.

The mentioned category has its own sets of investment constraints specified.

Must Check –Benefits of long-term orientation in Life & Investing

Is it possible for an AIF to collect some sum of money from some investor?

The minimum corpus for an AIF is Rs. 20 crores. For angel funds it is Rs. 10 crores. An individual investor should invest a minimum of Rs. 1 crore. If the investor is an employee, fund manager or director, or angel fund investor, the minimum is Rs. 25 lakhs. If the shares of the AIF have been given to the employee as part of compensation, there is no minimum limit.

The maximum number of investors is 1000 for all funds except for angel funds in which the limit is 49 investors.

What should I know about the taxation of AIFs?

AIFs that belong to Category I and Category II AIF enjoy tax benefits of their pass-through status. This status means that any income accruing or arising to, or received by, a unit-holder of Category I AIF and Category II AIF shall be chargeable to income-tax in the hands of the unitholder. The tax treatment would be in the manner as if the income has accrued or arisen to, or received by the unitholder as if the investments were made directly by the unitholder.

The tax pass-through status has not been accorded to Category III AIF though there are some demands for the same.

The tax implications on residents and non-residents should consider the clarification issued in the Finance Act, 2016.

Also Read: Sovereign Gold Bonds – All You Need to Know

FAQs about Alternative Investment Fund in India

1) Can AIFs have joint investors?

AIFs can have the following as joint investors provided the investment is not less than Rs. 1 crore –

- Investor and Investor’s Spouse

- Investor and Investor’s Parent

- Investor and Investor’s Child

2) How does one register an Alternative Investment Funds

SEBI provides a Form A as per SEBI Regulations which has to be completed with relevant documentation. An application fee of Rs. 1 lakh is required. If the AIF is approved by SEBI, registration fees as applicable should be paid.

3) Can AIFs change the category in which they have been registered?

An AIF can change its category after registration provided investments as per the category it has been registered are not done. The application in Form A has to be filled up again with the application fee. But registration fees are not required to be paid when approved.

4) Are the fund close-ended or open-ended?

Alternative Investment Fund under Category I and Category II can be ONLY close-ended. The minimum tenure is of three years. Category III AIFs are allowed to be open-ended or close-ended.

5) How are investor complaints against AIFs addressed?

AIFs need to have a procedure for the resolution of disputes laid out.

SEBI has a web-based centralized grievance redress system called SCORES.

Complaint Redress System (SCORES) at http://scores.gov.in/. Investors can lodge their complaints on the website.

6) What are Angel Funds?

Basically, these types of funds come into the category of Venture Capital funds where the fund manager pools money from various investors (angel) and further invests in the startups for their development.

7) What should investors look at before investing in AIF?

The investor needs to ensure the Risk-Reward Ratio of the fund, how the fund is structured, the expected hurdle rate of the fund, the expense ratio, and the management fees. These are some of the factors but not all are the investors need to consider.

8) Where can an investor look out for information on AIF?

Investors can visit the website of SEBI

If you have any questions or experience related to AIF – you can add them in the comment section.