You may be surprised by the heading because it doesn’t match current market sentiments or your portfolio performance.

Anyways if you are worried about your portfolio, this post may give you some relief.

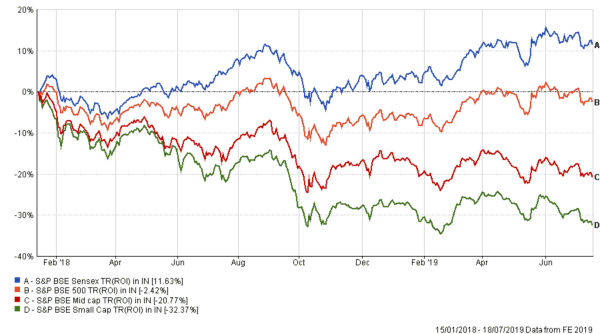

Returns in 2018 and 2019

Why so hue & cry when we are so close to an all-time high?

We can clearly see that only large caps have done a bit better and the rest of the market is down where most of investors money is if they follow the portfolio construction process. (just to add more than 90% stocks are negative in the last 18 months & out of that 60% of the stocks are down by more than 50%)

We can blame many people for this, even government (current or past), companies but this is a normal thing in the economy and equity markets. Hmmm..

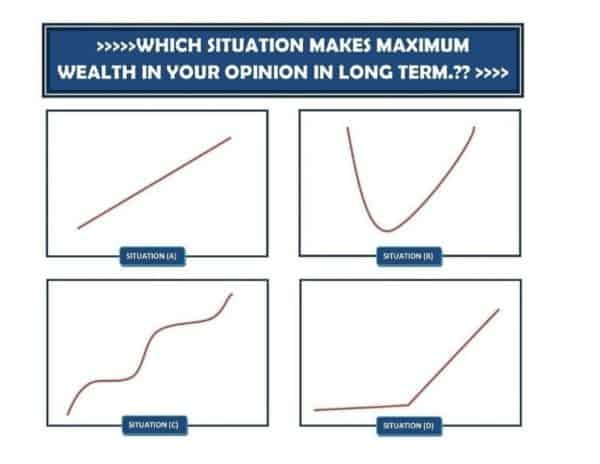

Quiz time – Choose One

Ok, let me ask you a question, in below image which situation will generate better returns. Let’s assume the horizon is 5 years. (bw Investment Horizon plays a very important role in returns )

A. If you are like most people you will think that this is best as we are going higher & higher year on year. It can be good for someone who is retired – other than a constant increase in the portfolio, he is not feeling any pain. But is it possible?

B. Can be good for a person who is a good timer or sitting on the fence with huge cash & can add when the market goes down. 99% of the investors are not in this category – it’s not only about having liquidity but guts & willingness to invest when everything is in red. In such a huge fall it’s tough to choose its risk or opportunity.

C. This looks quite similar to normal markets or maybe the most practical scenario. Few years up, few years down but moving upwards in the long term. I think regular savers should be happy with this.

D. This is the best that can happen with an accumulator – gives you a lot of opportunities to buy units & shares – that are valued higher after a few years. We have seen this happening if someone started in 2011 or 12. But again this scenario is not very practical because markets don’t like to stand at one place for long & even investors lose interest & start looking for alternatives.

No Pain, No Gain

We should be mentally prepared for all the above situations & even worse – we have seen all these scenarios in the past. Remember no pain, no gain. If you don’t believe that you can handle even these kinds of outcomes you should not invest in equity or start from basics that what is equity.

Why 2018 was good for Equity Investors

We tell all your young clients that you should be happy when markets are going down & even pray for it. 2018 was good years for investors as they were able to add more units – 2019 can be better if equity markets fall by another 15-20%.

In 2015 we wrote this to our clients

“These days it’s a common question “Why equity markets are rising?” The economy is not in great shape, companies are not making much profit, global economies are also struggling but equity markets are rising – be frank we have no clue why markets are rising. We pray every day that it should fall & you get more units next month but maybe our prayers are falling short in comparison to bulls 🙂 “

This time it’s different

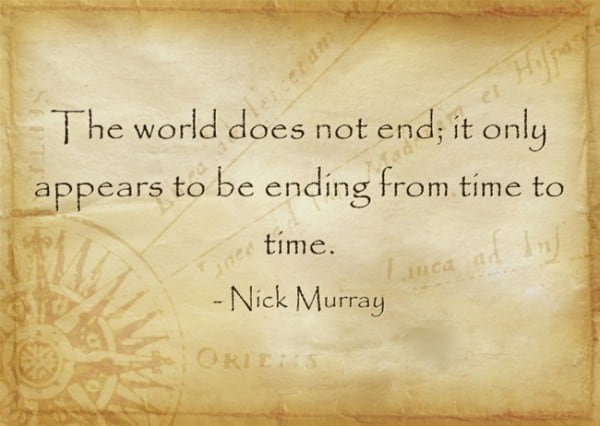

We normally keep hearing these words – in a bull market when everything looks perfect or a bear market when everyone is talking about doomsday.

I wrote a detailed post on this at the end of 2017 – when everyone was bullish about the market. I also touched a sensitive point – SIP Myth. Must read This time it’s different – 4 most dangerous words in the investment world.

But I Read…

The Internet is not making us smart – in simple words, more information means more confusion when it comes to investments.

Even I was looking at some stuff on the Moneycontrol & headlines caught my attention. Mayhem!! doomsday is coming.

Screenshot – is there any need to add that

This is not limited to one website. All pink papers are red at this time & even idiot box is playing havoc.

“Dirty Politics, Corruption, GDP, Inflation, Fuel prices, Current Account Deficit, ISIS & what not” Oh by mistake I added 2013 list.

Updated List “Credit Crisis, NBFC, GDP, Tax, Iran, Jobs & someone said everything is so gloomy that sometimes I feel to leave India & settle abroad.”

These are enough to make anyone insane if he is having significant exposure to equities but this is how it works. Do you remember any time in history when markets were down & news was good?

What Should I do now?

Only one suggestion – avoid news (including twitter) – keep away from too much news

Napoleon’s definition of a military genius is the person “who can do the average thing when everyone else around him is losing his mind.”

Same applies to an investor. Stick to your financial plan & investment strategy. If your panic level is high, talk to your advisor or read a good book.

Let me sell you my new book “Modifying Investor Behaviour – It’s not numbers game, it’s mind game”. Right now for a limited period, it’s available for Rs 69 on Kindle. (BTW you don’t require a Kindle device to read this book)

After this article – things are not going to improve tomorrow & you should feel happy about that.

In case if you are retired – you should remember that corrections are healthy for equity markets. And remember this quote from Nick Murray…

Feel free to add your views & questions in the comment section.

Dear Hemant, a very well written article, driving home the point investor behaviour is such a big factor for a rewarding and less stressful investment journey. Just to add, I have read your book Modifying Investor Behaviour, and it is very insightful with practical advice backed with great data points and historical scenarios. I have thoroughly enjoyed the content and the structure, and find that the most useful investment behaviour and strategy tips (covering your own examples and the successful investor minds) are made available in an easy to read and understand book. Thanks for sharing these articles, helps stick to our investment plan, to keep composure and see downward equity markets in the right way they are actually meant to be seen.

Thanks for Appreciating – Mr Anand 🙂

Very informative blog . I like the content.

It is interesting to read .

Thanks for sharing !! And Keep Posting !!

Thanks For sharing a great post. Its really helpful for us.

Thanks very Informative Article easy to understand.

Thanks 🙂

Comments are closed.