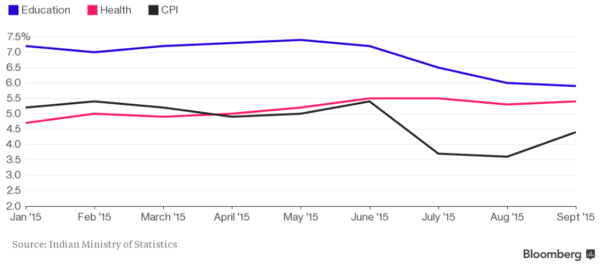

Education is the best gift you can give to your children. But quality education costs a lot of money. Moreover, the cost of education rises steeply. In India, it rises more steeply than in other countries. This chart shows the inflation in education, health, and CPI. As you can see, education costs rise more as compared to the other indicators.

Image courtesy of zirconicusso at FreeDigitalPhotos.net

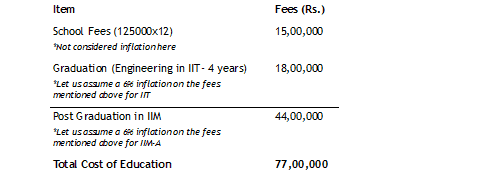

For example,

– The fees in IIT for Rs. 50000 per year in 2008. It increased to Rs. 90,000 in 2013. In 2016, it was announced that the annual fees would be Rs. 2,00,000.

– IIM-A increased the fees from Rs. 18.5 lakh in 2017 to Rs. 19.5 lakh in 2018.

Many students aspire to study abroad in universities in UK, US and Australia. Education abroad is also expensive. For example, a 2 year course of Masters in Finance in Melbourne University, Australia will cost around AUD$ 40,000. The student will also have to bear cost of living expenses -accommodation, food, clothes, airfare etc. He will have to bear visa expenses of about AUD $18,000. He will have to prove he has that much amount in his bank account. If the student has dependents, costs and proof of funds increase.

Must Check – Cost of higher education in India – Calculator & Infographics

Considering all this, if you have a 6 year old child who has another 14-15 years education, the education cost can be quite significant. There is primary education, secondary education, graduation and post graduation. You will have to spend on fees, books, stationery, uniforms, sports kit, school trips, additional coaching, transport, extra curricular activities and in some cases boarding. As per a survey done by ASSOCHAM, in big cities in India, this amounted to Rs. 1,25,000 in 2015 per year. It was Rs. 55,000 in 2005 which is more than a 200% rise!

*Assume, student stays with parents at the time graduation and post graduation. But cost of books and materials are not considered in the amount for graduation and post graduation.

It is quite a large sum. It is therefore imperative to plan the finances for education. You may not be able to zero in on the course your child would take up. But you can find out the cost of 2 to 3 courses and plan for a sum around them.

There are various ways of funding education –

1) Savings – You will have to start saving up for an education fund. This depends on your current income, expenses and future income and expenses.

2) Investments – You will have to invest in a way that you beat inflation. You should have a separate portfolio for education. If you have 15 years, you can invest in a variety of aggressive and conservative products so that the requisite funds can be made ready. You should start SIP plans in equity oriented mutual fund schemes so that the wealth can grow over a period of time. You should invest in balanced funds and equity-linked savings schemes. You can invest in Fixed deposits and recurring deposits that mature around the time, your child will start higher education. You should have an eye on the interest rates as they have been falling now for some time. As the target year is closer, you should switch your investments such that more of it is in debt funds, PPF and bank deposits so that there is capital protection.

If you have fewer years to reach the target, you should have a more conservative portfolio.

3) Scholarships – Many universities and external agencies allot scholarships to students. When the target year is near, check the process and eligibility criteria to obtain one and apply for them. Scholarships give a sense of relief as finances required will be less. But there will be many students applying for scholarships, so you will have to assess the probability of getting one and manage the finances.

4) Loans – Education loans are literally life savers. Most banks in India like SBI, Bank of Baroda, ICICI Bank and HDFC Bank provide educational loans for studying in India and abroad. It is easy to obtain a loan if you fulfil the eligibility criteria. Currently the rate of interest varies from 10%-15%. The repayment tenure is significantly long and persons with stable jobs can easily repay the loan.

Read this before you take Education Loan

5) Earn while you study – When your child has finished graduation and wants to go for post graduation, he/she has the option of working and saving for it. He can take a break from education and work for a year or two. Many students work during the summer breaks or have part-time jobs. If required this money can be used to fund education.

Complete Guide – Child Future Plan

Have you considered that the funds can be managed only if you are well and have a regular source of income? So you should buy a term insurance plan to cover emergency situations. You should ensure that you take care of your mental well being and physical health. You should also remember to have a plan for your retirement and other life goals else you might be forced to dip into the education portfolio. Do remember to have a proper financial plan and you will surely fulfil your dreams.

This post is written by our think tank Vidya

Please share your experience & concerns in the comment section.