In earlier times, senior citizens used to be dependent on their children for financial needs. But this is changing. Rising income, better investment opportunities, and financial awareness have made it possible for senior citizens to be financially independent. Many of them are able to fund their lifestyle using their savings and investment income. But with inflation, increasing longevity, and the rising cost of medical care, senior citizens should continue to look for avenues of income. The government provides some investment options and benefits for senior citizens. As a senior citizen, you should take advantage of the same so that you have financial independence. First, let us look at the best investment options for senior citizens.

Read- Are you ready for your Retirement

Best Investment Options for Senior Citizens

1. Senior Citizens Savings Scheme (SCSS)

SCSS, or Senior Citizen Savings Scheme, is an excellent investment option for senior citizens looking for long-term saving schemes with security and additional benefits. The scheme is available through post offices and recognized banks around the country.

SCSS is a government-backed savings scheme that is a full debt instrument with zero risks. It is valid for those above 60 years of age and offers the security of assured income for the entire tenure of investment.

The maximum tenure of the Senior Citizen Saving Scheme is 5 years. After this, you can extend it for 3 more years.

Let’s look at all the details of the Senior Citizen Saving Scheme:

Eligibility

Persons equal or over the age of 60 can invest. Voluntary retirees can invest once they are 55 years old. One can open an additional account as a joint account with the spouse.

Investment Limit

The Maximum investment of Rs.15 Lakh and the minimum is Rs 1000. Investors can invest a lump sum amount individually and jointly. The total investment amount Cannot exceed Rs 15 Lakh across all your investment in this scheme.

You will get interested on a quarterly basis after your first investment is done. The payouts from this scss made on 31st March/30th June/30th September/31st December – as per your date of investment.

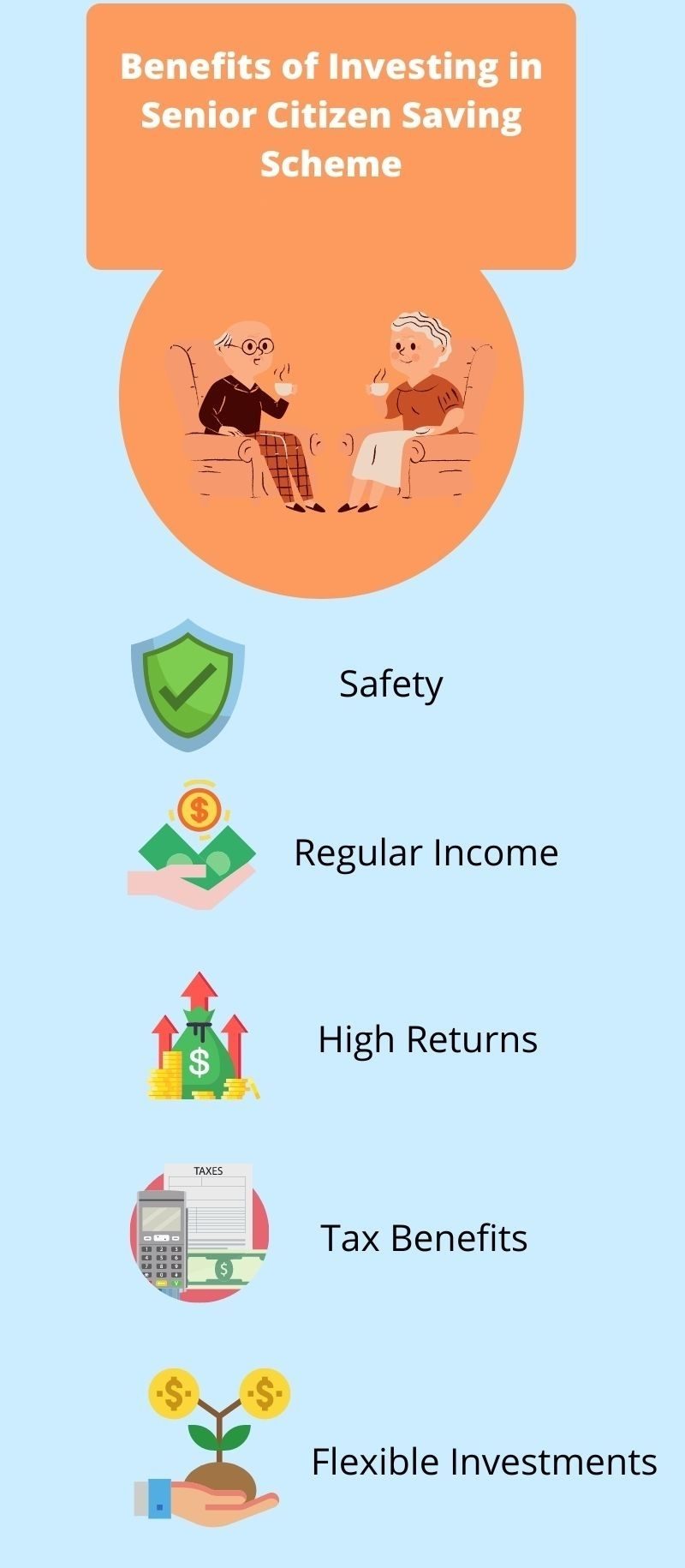

Benefits

The current rate of interest is 7.4%. It is market-linked based on a 5-year government bond yield. Interest is paid quarterly. The interest rate is locked once the investment is done. Low-risk product. Premature closing of the account is possible. Investment can be treated as a deduction under Section 80C.

Limitations

If the interest income you receive from this senior citizen’s investment plan exceeds Rs.50,000 in a financial year, TDS also applies.

Read More – The 3 Stages Of Retirement

2. Pradhan Mantri Vaya Vandana Yojana

The Pradhan Mantri Vaya Vandana Yojana (PMVVY) is a low-risk investment pension plan operated by the Life Insurance Corporation (LIC). The plan has a tenure of 10 years and it offered an interest rate of 7.40% in the previous year. We have Details article on Pradhan Mantri Vaya Vandana Yojana.

3. Senior Citizens Pension Plan (Varistha Pension Bima Yojana)

It is an annuity plan wherein payouts are made periodically to the policyholder.

Eligibility

Anyone who is 60 years or older can invest.

Investment Limits

Minimum – Rs. 63,960 and a maximum of Rs. 6,39,610. The annuity is slightly higher if the frequency of payouts is monthly or quarterly.

Benefits

Returns are around 8%. Premium amount is refunded after 15 years, on death or diagnosis of critical illness/ disease. One can take a 75% loan against it after three years if purchase. Monthly pay-outs are possible. Premature withdrawal is possible though one has to pay a penalty. The amount received at maturity can be reinvested in POMIS.

Limitations – It is relatively illiquid compared to other options. The pension is taxable.

There are other pension plans available offered by private players. The annuity rate is lower but there is no upper limit on how much one can pay for an annuity. They are available for different durations and most of them do not allow premature surrender.

Must Check – Saving for Retirement – Mutual Funds Vs PPF VS Insurance Plans

4. Post Office Monthly Income Scheme (POMIS)

The Post Office Monthly Income Scheme falls under the jurisdiction of the Finance Ministry. This investment option for seniors provides a fixed monthly interest payment. This is a low-risk monthly income scheme, offering considerable capital protection that safeguards those initial years of retirement. POMIS requires you to invest for a minimum of 5 years and no less.

Eligibility

Anyone who is 10 years or older can invest.

Investment Limits

Minimum – Rs. 1500 and maximum of Rs. 4.5 Lakh in the case of a single account holder and Rs. 9 Lakh in the case of a joint account.

Benefits

Fixed monthly interest rate – 6.6%. Monthly pay-outs are possible. Premature withdrawal is possible though one has to pay a penalty. The amount received at maturity can be reinvested in POMIS.

Limitations

Investment is not tax-deductible. Interest earned is taxable. NRIs cannot invest in this product.

5. Bank Fixed Deposit and Company Deposits

Bank FDs are the oldest and most popular form of saving among senior citizens. One can invest money in company deposits for interest returns. The rate of interest is usually higher than Bank FD interest rates.

Eligibility –Banks are allowed to set the age limit for opening accounts. Most banks allow people, 10 years or older to open a sole account and a joint account if younger than 10 years.

Investment Limits – It ranges from Rs. 5000 to more than a crore depending on the bank/ company.

Benefits – Most banks offer interest rates higher than normal fixed deposit rates to senior citizens. It ranges from 2.95%-5.40% for banks. Company deposits offer 7%-8.26%. Income is stable. Some corporate deposits offer higher returns to senior citizens.

Limitations – Interest rates are going down. FDs will not be able to beat inflation. Company FDs carry higher risk. It is better to invest in companies rated AA and above. Interest earned is fully taxable based on the tax slab you fall under.

Must Read – 5 Reasons you should not Retire

6. Mutual Funds

There are no specific mutual fund investment schemes for senior citizens. Depending on the risk appetite, senior citizens can invest some amount in Mutual funds. They can choose mutual funds that have a lower risk. Debt funds, liquid funds, etc. that invest in commercial paper, bonds, government securities, etc. Can also think of adding 20-30% of asset exposure to equity mutual funds based on risk profile.

Benefits – Well-performing funds give returns that can beat inflation. They are managed by professionals so there is better management and less chance of losses. They provide capital appreciation. Monthly Income Plans give regular income too. One can withdraw money from Liquid funds very easily.

Limitations – Subject to market risks. Long-term gains of Nonequity funds are subject to taxation of 20% with indexation. Short-term gains (holding period < 3 years) are subject to the tax rate as per your tax slab.

Must Check- 8 Most Important Mutual Fund Questions – Sahi hai ya Nahin

Annuity

You should check this post to understand annuities – LIC Jeevan Akshay Review There’s specific reason we have not covered annuities in the best investment options for senior citizens in India – you may get a hint in Jeevan Akshay post.

Benefits Available for Best Investment for senior citizens

Best investment plans for senior citizens in India are limited in India – other benefits are even lesser. Here are some of the benefits that you should take advantage of if you are a senior citizen –

- Tax benefits – There are tax exemptions and tax benefits provided to senior citizens.

– Under Section 80D which is for payment of premium on medical insurance, there is a deduction of Rs. 50,000 for senior citizens which is Rs. 25,000 more than that for non-senior citizens.

– Deduction of Rs. 40,000 is available to senior citizens and Rs.100,000 for super senior citizens under Section 80DDB, unlike the usual Rs. 100,000 for others.

– Senior citizens can file form 15H so that TDS is not applicable for interest earned on FDs.

– Senior citizens who do not have business income are exempted from paying advance tax.

- Other Facilities – Senior citizens need not fix an appointment for applying for a passport. They can walk in and will be given preference in terms of waiting time. They are given discounts in MTNL phone bills and priority hearings in the high court. Some hospitals give discounts on medical treatment for them.

Senior citizens deserve to be treated with compassion and concern and therefore some organizations and the government provide certain facilities to them so that their sunset years are easier. Please share if you have come across any other investment options for senior citizens – also share tips, ideas, opportunities & strategies for retired people.

In a one time bulk LIC Annuity scheme what are the tax exemptions given where in fixed pay outs are received by the policy holder till death either monthly/quarterly/half-yearly/or yearly. Please take into consideration the amendments presented in the next year’s budget proposal too. Is T.D.S. NOT DEDUCTED IN SUCH PAYMENTS? This querry is specifically for Senior Citizens

This querry to be more specific refer’s to LIC JEEVAN AKSHYAY VI

An early reply would be appreciated.

Thanking You,

ANJAN ARORA

Please check the interest rates on various options.

Thanks – updated.

Senior Citizens Pension Plan (Varistha Pension Bima Yojana)—

It is an annuity plan wherein payouts are made periodically to the policy holder.

Has this started already by LIC or still to be started?

Dear Venkatesh,

This plan has already started.

Hemant Ji,

Many thanks for the information in this mail

I am a senior citizen age 72. for tax saving I have planned to invest in balance fund which are high brid funds giving return in dividend form and tax free.

I have invested in following funds the return is in dividend form and it is tax free.

1. Birla regular saving balance fund -quarterly dividend -gives 8 to 9 % tax free.

2.Reliance regular saving balanced fund -qurterly dividend -gives 8.5 to 9 % tax free.

3. ICICI Pru. balance adv. fund fund – monthly dividend -gives 7.5 to 8.5 % tax free.

the information may be useful to senior citizens more you can guide.

regards

kiran parekh.

These are some really good investment options for senior citizen, Thanks for sharing the information!

Hello,

I am a Senior citizen age 65 years. Presently no income as i closed my business recently. I have sold one long term property and deposited my sold amount in Capital gains account. I had no knowledge of government Capital Gains Bonds investments and now not eligible for investing as selling date is exceeding 6-months now.

I am completely dependent on this amount for rest of my life. However if i invest outside Government Bond investments, its taxable by 20%

Kindly suggest which funds to invest to avoid these Capital gains taxes and get monthly/quarterly regular income.

Hi Krishna,

Sorry to hear that you were not able to timely invest in 54EC bonds to save tax. My suggestion first has word with CA to calculate tax – investing in property is another investment that you are left with but I am not sure if you would like to lock this amount in retirement. (You can see if some swap can be done where you buy property for your kids & they gift you some amount – talk to CA)

For other investments, it is advisable to contact a financial planner in your city to you for your retirement plan. Retirement is the most important goal & should be planned properly.

Thank You for your thoughtful and valuable response.

Which is best monthly income scheme for senior citizen? Post office MIS or Mutual Fund MIP.

Hi Devdhar,

Depends in your understanding about equity.

Dear Hemant Sir

I am retiring from my service(my Age is 60+) from pvt firm. I need monthly income .Pl. suggest which is the best monthly income scheme (for one time investment)

Regards

Suri

I am going to be 70 next May. My wife and I wish to earn Rs 50,000 a month from FD, Mutual Funds etc. Can you suggest a scheme/schemes where I can invest?

Dear Mr Nayar,

Mutual Fund is a dynamic investment, will suggest to consult a good advisor.

Must read this post

https://www.retirewise.in/systematic-investment-plan-mutual-fund-sip-best/

I

My age is 60+,

Please suggest me some mutual funds scheme for lumsum investment.

Dear Bhushan,

You should consult a financial advisor near your area for the retirement planning.

I am a NRI 59 years old individual. Is LIC Jeevan Akshay VI a good pension plan for retirement. My Agent has mentioned that this plan is good and it is a quarantee amount to be paid. I would like your suggestion and advise on the LIC Jeevan Akshay VI. If it is a good investment which plan should i opt for.

Thanking you and waiting for your early response

Dear Charles,

I will suggest you read below article before buying any annuity plan & consult a financial advisor for your retirement plan.

https://www.retirewise.in/lic-jeevan-akshay-vi-immediate-annuity-plan/

ANY BEST ONLINE ULIP PLAN WITH LOW EXPENSE RATIO,

FOR FEMALE AGE 38 YEARS.

Comments are closed.