Just one word – investment?? And your response will be that you have been doing it since you were wearing half pants or a frock. Remember how you always managed your personal budget with your pocket money. You saved in earthen pots and pig faced reservoirs. Remember the piggy banks? But again was this money enough? No. It was not as this was saving and not investment.

Saving will not result in wealth creation. Our piggy banks never contributed even a rupee to our wealth. Money was idle but not growing. But is money a tree which grows by itself? Yes. Money can grow on its own, provided it gets a balanced climate and the environment it requires. A tree requires sunlight, water and minerals, investments also need a few essentials to grow. And with the right amount of these, it needs time to show its true colors. Few things like growth and character need time to develop and so do investments. They also need time and patience to bear fruit.

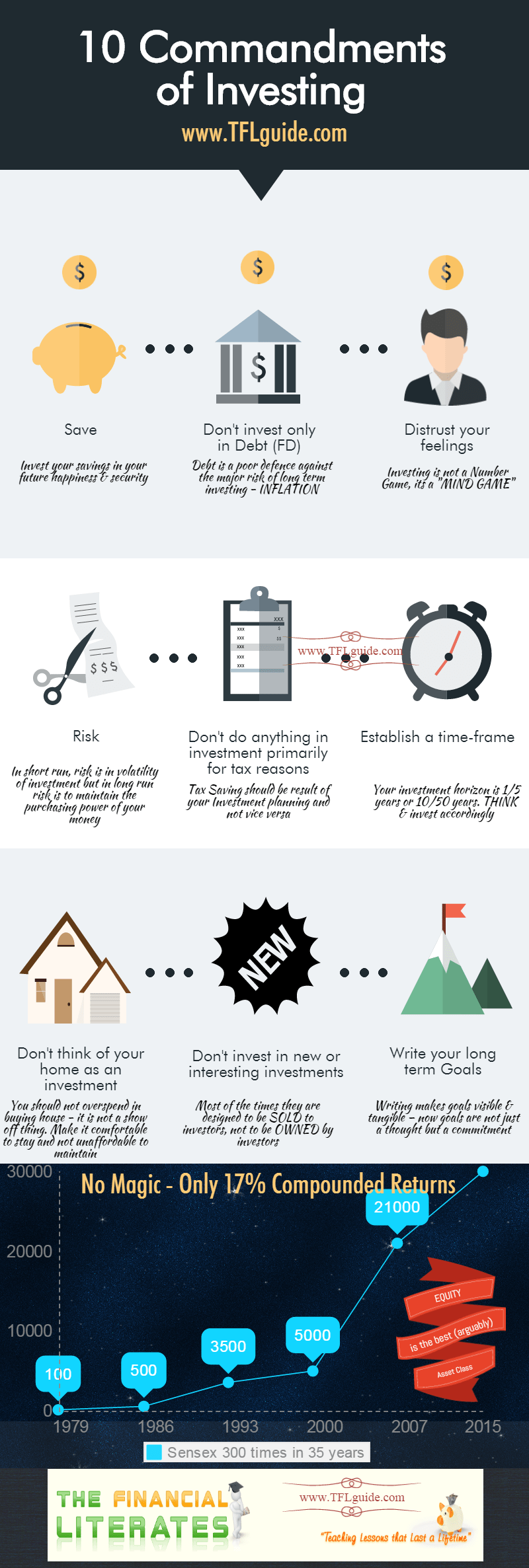

Let’s check this infographic – 10 Commandments of Investing – may help you in growing your money tree. (if you like this, must share with your friends)

Another great article Hemant! I have recently started following your blog and the way you put things in perspective is great. I’ve learnt quite a few lessons myself and plan to follow more of your investment guidelines.

Thanks and keep up the good work!

Hi Hemant, Another good and very impressed article for me. You have opened my eys.

I already started thinking and follow as per your guidelines.

Thanks for this article and looking forward for another one.

Hi Hemant,

im a NRI, working in singapore. I would like to invest .

am i eligible to to invest ?

Please guide me.

Hemant, Your Infographic is so useful and insightful.

I have taken a print-out and kept it as a page opener in my investment records file. Though nearing my retirement age, these fundamentals still remain so true for me as an investor.

And finaally on your chart on Sensex returns, I drew one comparing the growth of my post tax salary, sesnsex, price of 10 grams of gold and per sq ft rate for a 3 BHK apartment in Adyar, Chennai from 1985 to 2015 and the look of the graph is amazing with sensex giving better yield and return than gold and property. And the post tax salary growth always gave enough indications that opportunities to save and invest in equity was always there, if one only makes a decision and start. No wondr I have asked my chemical engineer daughter to start save, invest in equity and only then think about expenses and spending her monthly salary income.

Hemant, continue the good work. Regards, Dr. S. Hariharan.

Thanks Dr. S. Hariharan for appreciating our effort 🙂

This is very explanatory infographic. Apart from FDs, investments in PPF ,national saving schemes, annuity plans,equity saving schemes always give you tax benefits under section 80C.

Returns from equities may be high but fluctuate. What has been earned in one year may be lost in the next. Even capital can be eroded. There can therefore be no compounding in equities. The compounding rate is arrived at in hindsight to enable comparison with fixed income investments like FD, PPF, NSC etc. which are the right examples for compounding. Financial advisers should know that the lay investor’s understanding of the principal of compounding comes from his experience with FDs and cannot be replicated with investment in equities. I am quite sure the financial advisers know this but not clear why they misapply the principle of compounding to equity investing.

Hi Mahavir,

I completely agree with Volatility point but I in long term it’s important to keep the purchasing power. You should check this https://www.retirewise.in/debt-return/

Comments are closed.