Why do people take risks? The answer is simple. It’s because there is a very sweet, tempting, seducing, deadly, venomous, killing relationship between RISK and RETURN. The greater the risk one takes, the greater is the possibility of getting good returns. (here I am talking about asset classes not investments or investment vehicle) So, in order to get more returns, you need to take risks. You cannot fight a war if you are not at the battlefield. You may be the king or a pawn, but you need to take some risk to win the war. In this article risk means Volatility… Read – 15 types of Risk that effect your investments

It is not necessary for you to keep taking all the possible risks. You may choose your comfort level and choose investment assets as per your risk appetite.

What investors lost (opportunity) between 2009 & 2014 elections?

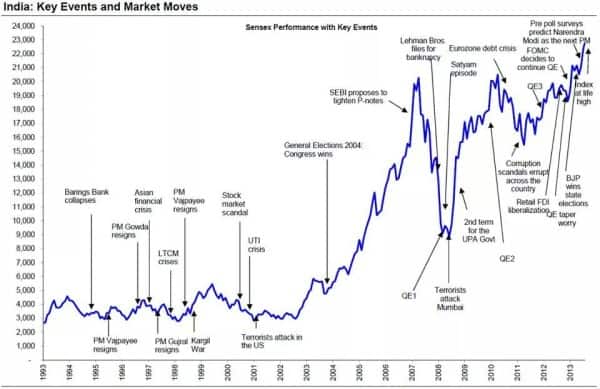

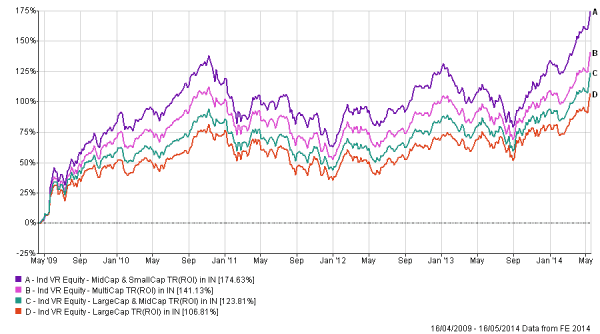

But right now I am just talking about equity & its performance between 16th April 2009 & 16th May 2014 (61 Months or 5 Years 1 Month). If you notice economic situation has not improved in this period but equity markets gave spectacular returns. WHY?? Because

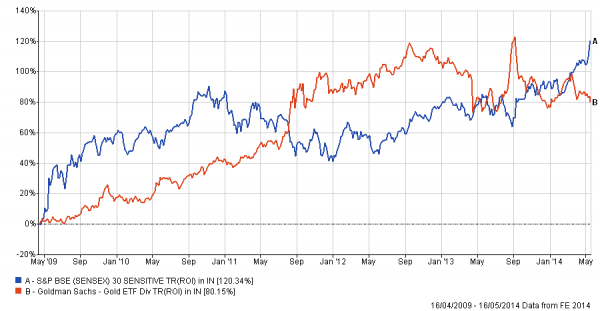

Index performance

Sensex generated 120% returns in this period – 17% compounded annualised growth rate…

Fund Category performance

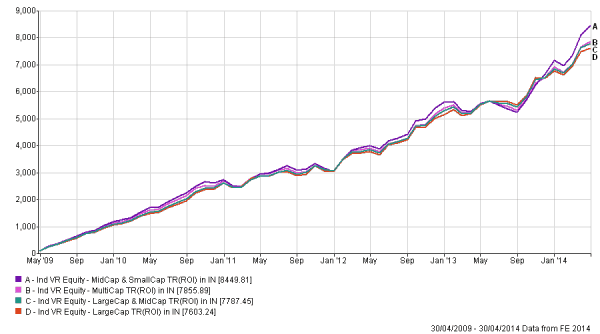

SIP in Fund Categories

Rs 100 invested for 61 Months – total investment Rs 6100

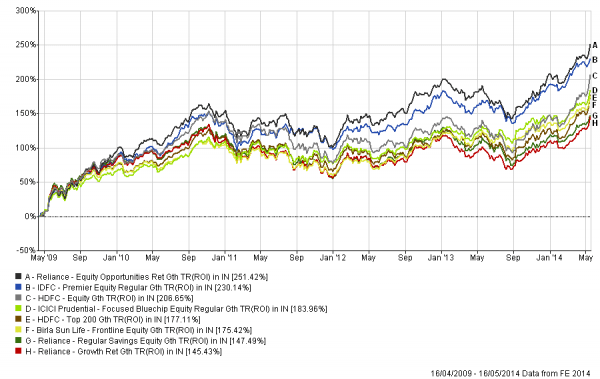

Funds Performance

These are not best performing funds – only selection criteria is biggest asset size in their category (top 2 funds)

Equity Vs Gold

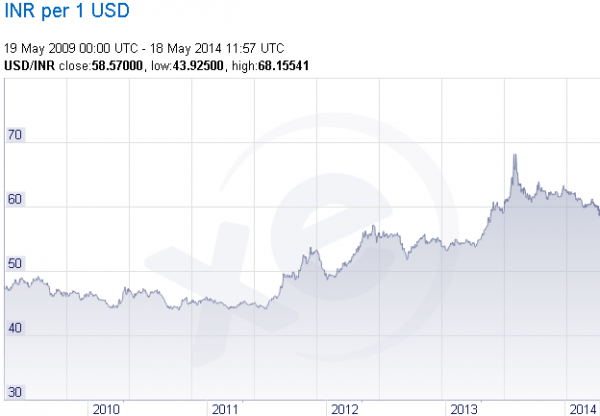

Lot of investment went into physical gold or gold related mutual funds in this period. Sensex generated 17% & Gold 12.5% …. Return difference absolute 40%… If we talk about gold performance – 25% of the returns are due to Indian currency depreciation. (5 years back INR per $ was Rs 47 & right now it is 58.5)

The market is a complex animal and cannot be predicted by anyone. Even professional managers can’t predict its future moves. The more investors try to achieve this, the lesser are the chances of a good return. In stock markets, inactivity plays a greater role than activity since a buy and hold strategy delivers better results than regularly timing the markets.

Exactly 2 year back (May 2012) I shared one article, when Sensex was at 16000 level – “Its tomorrow that matters”. Must read this article, I hope you will learn a very important lesson:

Good returns are seldom made on investments made in good times.

Rather, good returns are typically made on investments made in adverse times.

Feel free to share your views or ask any question in comment section.

treat equity/ mutual fund like fd n for long term……expect a bit more than fd n invest in equity/mutual fund only that money which u don’t need immediately or r prepared to loose….

Well said Rajiv…

Why everyone say that we need to put the money in MF which we are prepared to loose? No one from middle class will have money which they are prepared to loose. If that is the case no one is going to invest in MF. We need to understand that MF investment is only for lost term and the money invested in MF should not be considered as contingency fund.

Good returns are seldom made on investments made in good times.

Rather, good returns are typically made on investments made in adverse times.

Dear Hemant

inversely can we say NOW is the time to invest in RE, GOLD… and may not the time to invest in stocks?

Hi Shinu,

I think you have understood it wrong & I don’t want to comment on Gold, already wrote couple of posts in past.

Regarding good returns – here I was talking about returns with lower risk. In last 1 year (adverse times), mid & small cap index doubled.

i have started MF monthly sip in Reliance Gold Saving G Fund Rs. 1,000/- from the year 2011. but return is minus suggest me can i continue for 5 year or stop this sip.

sunil

ITS EXPECTED MODI WILL GOVERN BETTER THAN MMS BETTER TO SWITCH FROM GOLD ETF TO EQUITY SIP AS EQUITY SHOULD GIVE 15% ANNUAL RETURN HEREON FOR NEXT 5 YEARS….

Hi Himant, Pl enlighten me how would war effect stock market and investments?

Respected Sir

. Please guide me about MNC fund? & it is good for long term, in which countries should i invest ? USA or EUROPE

WE HARDLY KNOW ABOUT INDIA N INDIAN COMPANIES BETTER TO INVEST IN INDIA THAN MNC FUND….

Thanks for your valuable reply.

I think Mr. Nilesh Sawant is interested in global funds and that’s why he is asking about choice of USA or EUROPE but as he used the word MNC fund his question and the answer seems to be differnt. There are MNC funds and there are GLOBAL funds.

Dear all

from charts we can understand the movements of stocks, but one principle is difficult to chart that is buy at low and sell at high, securing the gain when market is moving upside. One can protect the gains and as well as rebalance the funds in time.

Comments are closed.