It is now no more a secret that Equity investment for long term is the key to planning your long term goals and beating inflation. (If not, read this “Indian Equities – Past, Present & Future”) And traditionally to invest in equity market, there are two options available to an investor- Mutual Funds and going direct to buy Stock/Equity Shares form open market. Today we analyze the merits and demerits of these two options.

What is a Mutual Fund?

‘Mutual Fund is a pool of money that is collected from investors who have a common goal and is invested in stocks and securities by professional team with the aim to achieve the fund’s predetermined objective.’

What is a Stock – Direct Equity?

‘Stock or share is a security that represents ownership in a company. As it is commonly said …’A share is a share in the share capital of the company’’

Here are the basic differences between mutual funds and stocks.

Which is a better option to invest – Mutual Fund or Direct Equity?

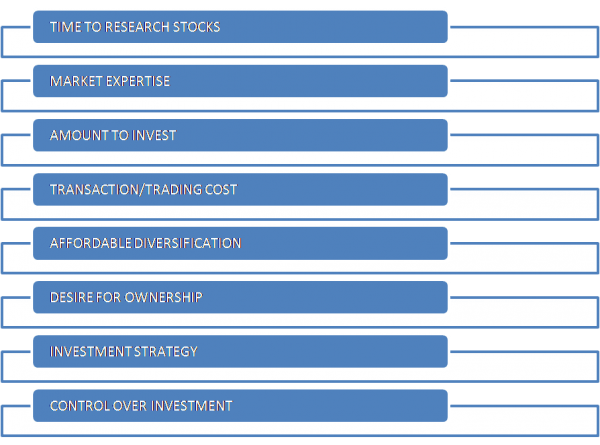

Below are various factors which a person should consider before making his decision to invest.

-

- Time to research stocks: Studying the share markets is a full time activity and requires a lot of time and energy on part of the investor. And it is just not confines to share market but also includes analyzing economic numbers and macro-economic factors like government policy changes, currency trends etc.. If an investor is ready to dedicate adequate time in studying these markets and can continuously monitor his investments, he can go for investing in direct stocks. If a person does not have time to select and monitor his stocks, he can invest through mutual funds. In mutual funds, the investor leaves this task to the fund managers who are professionals in their field and manage the investment on behalf of the investors.

- Market Expertise: A person requires adequate skills and expertise in managing the investments. The skill lies not in having information about the market alone but in the ability to analyze the information. So, if a person is holding a stock in auto ancillary sector, must be able to analyze the trend if the Automobile Association announces that “Q3 sales drop in passenger segment” and “Maruti is developing petrol engine with more than 22 km mileage”. The information comes in the crudest form as these may not refer to studying a particular company or sector but it encompasses the study of the micro and macro factors affecting the economy as a whole. In mutual funds, the fund managers have quality access to research material and have adequate skills and experience in managing the fund to the best of their discretion.

- Amount to invest: The cost and time involved in research study for selecting stocks is not justifiable for small amount of investments. For eg to invest Rs 5000 a month in Nifty stocks, are you going to go through financial data of all the fifty companies? Thus, for small investors mutual funds are a better option. Small investors can invest through SIP (Systematic Investment Plan) route in mutual funds which helps them in investing small amount regularly on monthly/quarterly basis. The investor gets the benefit of rupee cost averaging which is not available in case of stocks.

- Expenses and Transaction/Trading Cost: The main charge involved in mutual funds is the annual expense ratio (fees charged as percentage of total investments) whereas the charges involved in stocks are demat, brokerage and transaction charges. A person has to be prudent in studying the costs involved. As mutual funds involve high trading volumes, the transaction cost is comparatively lower than that of an individual investor who has lower trading volumes. Further, if an individual investor trades frequently, he will be paying significant brokerage commission + Capital Gain on every transaction.

- Affordable diversification: The units of a mutual fund scheme provide the investor exposure to a range of stocks held in the portfolio of the scheme. Thus even for a small amount of Rs 5000 in a particular mutual fund scheme, the investor enjoys a diversified portfolio as schemes have 30-60 stocks in the portfolio. In case of stocks, for the same amount of Rs 5000, the investor can purchase limited number of different stocks. In order to achieve the same level of diversification as in a mutual fund scheme, a person needs to invest huge amount.

- Desire for ownership: If a person wants ownership in a company, he should purchase the stock of the company directly. Equity share is part of shareholding so howsoever small it is you become the owner and like an owner, you have to discharge your duties and have the right to share loss or profit. In case of mutual funds, as the stocks are held indirectly by the investors, they don’t get the ownership right. Thus in case of purchase of stocks, the investor is entitled to various benefits, like attending the shareholders meeting, voting right etc.

- Investment Strategy: Mutual Funds provide various investment strategies to investors like SIP (Systematic Investment Plan), STP (Systematic Transfer Plan), SWP (Systematic Withdrawal Plan). Also portfolios are managed as per various strategies like growth, value, contra etc.. These investment strategies are not available in case of individual stocks. Further some mutual funds provide various other options and facilities like dividend reinvestment, trigger facility (shifting or redeeming investment based on happening of a certain event in future, like Sensex rising 10% up etc..) again not available in case of purchase of stocks.

- Control Over Investments: If a person prefers to have control over his investments, he should invest directly in stocks. In case of mutual funds, the decision to buy, sell and hold stocks is delegated to the fund manager and the investor has no control over his investments. So even though if you have hunch that markets may fall, you cannot do anything. Or if you hate companies manufacturing liquor, you may not be able to tell you liking to the fund manager.

I raised Mutual Funds Vs Stocks on LinkedIn & got few interesting comments on both sides – check here

Read – 3 Principles & 3 Practices to generate Superior Lifetime Returns

Thus both mutual funds and direct equity have their own pros and cons. Investment in stocks is recommended only to those investors are a great stock picker and have developed expertise in securities market. For beginners in equity market and those who don’t have adequate time to monitor their investment, should invest in equity market through mutual funds as mutual funds provide various benefits which are summarized below:

- Professional management

- Portfolio diversification

- Economies of scale

- Liquidity

- Tax benefit

- Convenient options

What is your take on this? It will be great if you can share your experience – Mutual Funds vs Direct Equity. Do share in comments section.

For Normal Working Citizens — Mutual Fund is the best which has regulatory responsibilities too. To invest in the Right MF, also needs knowledge , where a good Honest Financial Planning services can be availed.

Hi Hemant,

In my opinion, untrained investors should do SIP in 3-4 good quality (not necessarily last year’s top ranked) mutual funds, diversified across AMCs and managers, and then sit tight for many many years, irrespective of market condition. Do not look at NAV every other day, and keep faith in your choice.

Thanks,

Kuntal.

Kuntal,

Yes your views are right. But for a good portfolio diversification is important and it will not be wise to repeat the exposure. So 3-4 SIPs should also be invested across various categories.

Hi Hemant,

Nice article….Explained in a simple way. I think everyone should understand Stock market before investing in either mutual funds / direct equity. Its always good to understand the underlying mechanism of stock market operation before investing thier hard earned money.

Reading all your artciles regularly will definitely help everyone to develop good & much needed knowledge and then they themselves can take a decision whether to invest on MFs or direct equity.

Thank you once again for one more wonderful article.

Regards, Vinay

Thanks Vinay.

Do share the article with your network.

Mutual Funds are supposed to be the BEST vehicle for small and untrained investors. But the practices followed by the AMCs in India leaves a lot to be decided as they are very much skewed in favour of large investors only. Even the normal and genuine things are followed by AMCs only when forced by regulators and then why blame that equity culture is not picking up in India?

Hi Hemant,

Not sure in cost vise which one out of these two is best is it MF or Stock either while purchasing/maintaining an account/ while selling.

As now days most of the purchase are done through online banking. To purchase MF one has to maintain special investment account with the bank and the charges for the same is around Rs200 per quarter not completely sure about this as it will vary with each bank. And if you have the more information on average charges levied by banks then please share. Also there is a management fees deducted every year from the profit of MF share for providing the fund maintains services by MF.

And to maintain a Demat account to purchase stocks with the bank charges are around Rs1000 PA and additional transaction charges will again varies with different banks.

What do you think which one of this have minimal cost?

Thank You,

Ravi

Easiest way to reduce costs for mfs is to invest directly. Is not too much of a hassle and you do not need a demat.

Hi Hemant,

This is very Interesting topic and after comparing i find investing in Shares directly as a better option but before sharing why i like that let me share that shares can be purchased now through Systematic Equity Plan as SIP in MF ( This feature is currently in ICICI Direct)on a monthly basis.

Why Shares are Better

1 Own choice of Shares: I like to own shares of MCX and want to retain it for long but no MF has stake in it.

2 Regular Dividend and Bonus payout ( I cant track the dividend or Bonus Issues for MF)

3 Very Low Cost: In Shares you only have to pay the transaction cost only during buy and sell and since the transaction cost is coming down this comes at very cheap rate vs Increasing cost of MF with each year irrespective of performance.

4 MF are not risk free too- Every MF had good holding of Satyam at the time of its fiasco and had put a good dent in NAV due to that.

Thanks and Regards

Chinmay

Hi Chinmay,

Hemant has written a very nice article on ‘Why SIP in Direct Equity makes no sense”. That apart, one can invest in direct equity if he/she has proper technical knowhow.

Thanks,

Kuntal.

ICICI Direct is a very expensive brokerage for small investor

ICICI Direct is a very expensive brokerage for a small investor

Hi Chinmay,

SIP in direct equities/stocks is a biggest myth

https://www.retirewise.in/2012/02/sip-investment.html

I have never invested in direct equity. For me mutual funds are the best option.But for investing in mutual funds also one needs periodic monitoring.For regular investment SIP is best.For periodic lumpsum investment one has to be careful and market condition has to be taken into consideration.

I think Equity SIPs are one of the best option on comparing with Direct equity or MF

Hi Sanil,

Could you please explain yourself? Equity SIP can either be direct equity or MF. So what are you talking about?

Thanks,

Kuntal.

I am software engineer.I am doing trading from past 3 years.

With personal experiance I can say SIP in Mutuvalfund is better option than direct equity.My mutuval fund investment has given more returns than shares, PPF, fixed deposit, insurance and silver/gold.

@hemant and TFl your doing great job. I recomended this website to my friends too .

Anand,

Thanks.

Mutual fund is definitely a better option than stocks. However now there are so many mutual funds that picking the good or appropriate mutual fund is no easy job. The small time investor is still running a huge risk. Everybody talks about the “India growth story” but how are you sure its going to happen? You will say I am being pessimistic but anything is possible in a country like ours with completely skewed policies. If you do not believe that India will do better then you should not be investing here at all!!

Dr.Paul,

Opportunities are there where there is scope of growth. If we go down in history then equities in a more long term has delivered reasonable returns over and above inflation. The mismatch arises when we match wrongly our requirement and expectation. For e.g. for short term gains we move towards volatile assets classes expecting the same returns as in the long term. In my view have the right allocation as per your investment horizon and risk apetite and make your investment simple. With respect to selection of MF schemes, there is lot of assistance available now which you can choose from. If you wish to do it yourself take certain parameters and refine the list.

Dear Sir,

Is NPS is good or not? What are the possibilities in future of this pension scheme. Please advise me for investing money. Should we purchase NPS or other pension plans?

thanx.

Kailash,

You can read about NPS here:

https://www.retirewise.in/2010/06/new-pension-scheme.html

There have been changes made since them which you can get from PFRDA website.

Hemanth Ji, last couple of years you were posted best/recommended mutual funds per yearly basis, but I could’t see your posting for this year. what are the best mutual funds for 2014? Please share the link if you already posted. Thanks.

Hi Experts,

Which one is better Category to invest in Mutual Fund through SIP – Banking OR Technology ? I will be investing 1K for minimum 6 years….

Dayal,

Read this to know more on creating an investment portfolio:

https://www.retirewise.in/2013/09/core-satellite-fund-portfolio-investment-approach.html

Hello Vikas ji,

I’ve managed to create a portfolio and below are is the summary of my monthly investments :

1)PPF 5000 pm

2)2 Tax saving Funds thru SIP 1000+1500 pm

3)Mediclaim 800 pm

4)ICICI Export and other services 1500 pm.

i hope the portfolio is diversified and will help me in achieving my goals like my retirement(Currently 34 yrs) and Child Marriage .

Is there anything else i need to do ….

Kindly guide..

Hi Hemant,

In my view there is no 1 correct answer. If the AAM aadmi in this example does not have any background or expertise in stock picking skills, then it is best to leave this to a fund manager.

Having said that there are a bunch of Buffett and Munger fans who have the time and skill to structure a good portfolio. They may be able to better MF returns. Risk factors are ofcourse slightly higher here. Its easier said than done though.

In my view for the latter category it could be a blend of both MF and Direct equity.

Cheers!

Hello Hemant,

I am an avid reader of your blog. I had some questions which i have listed below. If you can assist it would be great.

I have some holdings in below funds

1. BSF 95 Series Regular Plan.

2. Birla Sunlife Frontline Equity.

I have a couple of questions –

1. Why should an investor park money in all the categories i.e. Small, Mid and Large Cap?

2. I plan to start an SIP with 10K amount, can you please advise some suitable funds?

Thanks & Regards,

Ankit.

Comments are closed.