You will agree with me that Pension Plans are complex, specially Annuity products like LIC Jeevan Akshay VI. But I can promise that after reading this post you will be in a better position to take decision. We will cover:

- What is Annuity? And types of annuity options in India.

- LIC Jeevan Akshay Plan Features

- LIC Pension Plan Chart

- Disadvantage of LIC Annuity Plan

- Should you consider LIC Jeevan Akshay VI?

But why it’s important for us to understand Pension Plans?

What is Annuity Plan?

Annuity is one of the options available to regular income seekers. With a mandate of providing a fixed income to members for life or the terms selected, life insurance companies offer annuity products to meet the desired need.

Any individual who is retired or nearing retirement does not have time to accumulate. With ready surplus available to invest or getiing huge gratuity, the need is to have regular income right from the next month or in a year’s time. Apart from savings scheme like Senior Citizen Saving Scheme (SCSS) or Post Office Monthly Income Scheme (POMIS), immediate annuity from life insurance companies is also available.

Annuity in India

Apart from LIC, which sell 95% of annuity products, pvt insurers like ICICI Pru Life, Tata AIG, Max New York and now Kotak Life insurance has immediate annuity products.

Recently, LIC started online selling of Jeevan Akshay VI, an immediate annuity product. This was a strong move from public insurer and may be followed by pvt players going forward..

Let’s review the product and see whether it is able to meet the income need of higher age population which is quite large in India.

What is Immediate Annuity?

In immediate annuity, by paying a lumpsum amount you purchase a stated income stream for life or a specified term from an insurance company as per the option you select. The income payment starts from the next periodic interval from the month you purchase it.

Read – Investment Options for Senior Citizens

LIC Jeevan Akshay VI

LIC has entered online insurance space but surprisingly with an Annuity Product; which as a category is not very popular in India. They have not launched a new plan but selling their LIC Jeevan Akshay VI with some rebate on it. Other existing LIC Penison plans are LIC New Jeevan Nidhi & Pradhan Mantri Vaya Vandana Yojana

Who can buy Jeevan Akshay Policy?

Any person with minimum age of 30 years and maximum 85 years can purchase the product online. This can be considered attractive feature as it is not restricted to only higher age individuals and someone having a good surplus at young age can opt for the product to earn a steady income.

Premium

The premium is to be paid in a single installment and the minimum payment is Rs 1.5 lakh for online buy. There is no maximum limit in LIC Jeevan Akshay.

Payment Option

Annuity is paid monthly, quarterly, half early or annually. The first installment of annuity is payable after one month, three months, six months or one year from the date of purchase of annuity depending on the mode chosen is monthly, quarterly, half yearly or yearly respectively.

Annuity options

LIC offers seven annuity options under Jeevan akshay VI product:

- Annuity payable for life at a uniform rate.

- Annuity payable for 5, 10, 15 or 20 years certain and thereafter as long as the annuitant is alive.

- Annuity for life with return of purchase price on death of the annuitant.

- Annuity payable for life increasing at a simple rate of 3% p.a.

- Annuity for life with a provision of 50% of the annuity payable to spouse during his/her lifetime on death of the annuitant.

- Annuity for life with a provision of 100% of the annuity payable to spouse during his/her lifetime on death of the annuitant.

- Annuity for life with a provision of 100% of the annuity payable to spouse during his/ her life time on death of annuitant. The purchase price will be returned on the death of last survivor.

The policyholder can choose any of the option based on his requirements. However, once the option is selected it cannot be altered.

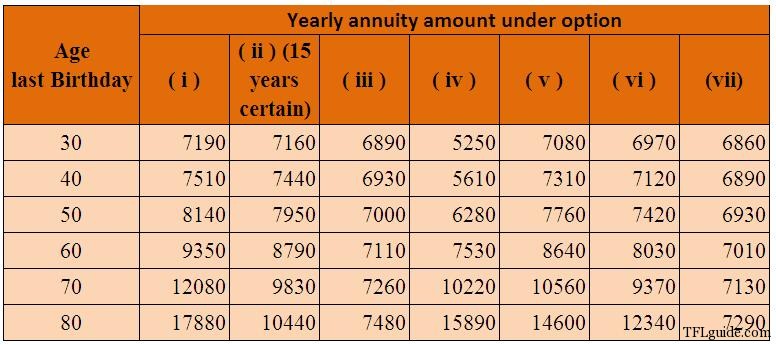

Annuity Rates of LIC Jeevan Akshay Plan

This is the most important factor as it decides whether annuity you receive will be sufficient to meet your requirements. As per LIC website the following is the annuity rates offered in Jeevan Akshay VI

LIC Annuity Calculation – Amount of annuity payable at yearly intervals which can be purchased for Rs. 1 lakh under different options is as under:

Jeevan Akshay Online Purchase

There is a special incentive offered to online buyers in addition to what is offered in offline product. The basic annuity rate is more by 1% when you buy Jeevan Akshay VI online. Be frank that’s huge difference considering Jeevan Akshay 6 Agent commission is low in comparison to other traditional products like LIC Jeevan Ankur or even ULIPs like LIC Wealth Plus.

LIC Jeevan Akshay annuity Taxable

Annuities are added to your income and taxed as per your income tax slab.

Jeevan Akshay Interest Rate – What you Earn?

LIC Jeevan Akshay VI annuity rates vary under various options. Any option where the purchase price is not to be returned offers higher annuity in comparison to where there is joint annuity or purchase amount is returned to nominee. Also the higher is the age of the member higher will be the annuity received.

Given below are annuity rates in Jeevan Akshay VI which shows more annuity is offered then you buy it at higher age which emanates from the fact that company have less period to pay.

| Age in Years | Annuity rates (%) |

| 40 | 6.93 |

| 45 | 6.96 |

| 50 | 7.00 |

| 55 | 7.05 |

| 60 | 7.11 |

| 65 | 7.18 |

| 70 | 7.26 |

| 75 | 7.36 |

| 80 |

The annuity rates are for option with return of purchase prices (Source Jeevan Akshay Chart: moneylife)

Jeevan Akshay Vs Fixed Deposits

It’s really touch to compare annuity with a pure fixed deposit or a post office scheme. Taxation wise right now both are taxable but LIC annuity plan or for that matter any annuity is a complex product.

Disadvantage of Annuity Products

The annuity rates have come down substantially with years. LIC who was the sole player in this market has reduced rates in Jeevan Akshay VI from what it offered previously. When you look at first instant then annuity rates of 7% is surely something to talk about. However, if your annuity amount is taxable then the returns lower down substantially and fall behind other investment option available. Someone who is at age of 60 and falls in 30% tax slab the returns from annuity will be approx 4-5%. This does not beat even the inflation. Also, annuities are fixed for the term while your income requirement keeps on increasing due to inflation. Although this product offer an option of 3% increase in annuity but inflation is more than double. So after a certain period the income from annuity may not meet even your basic needs if you have relied heavily on it.

Must Read – Is 1 Crore enough to retire?

Should you consider LIC Jeevan Akshay VI?

There have been regulatory changes in pension sector which has forced companies to rethink on pension products. Most of the private players do not market these due to tough environment. One of the primary reason is the absence of long term debt instruments where insurance companies can lock in rates to reduce interest rate risk and offer life-long annuity to people. The research has been also lacking in this sector due to which even LIC did not revised annuity rates for very long time. However, after IRDA specifying that annuity space would be from the same insurance company who sells the pension product, SBI Life Insurance and Star Union DaiChi have launched immediate annuity products where rates are higher than LIC Jeevan Akshay. Expect more insurance players coming out with better rates or it may force even LIC to revise its rates. Hence, it will be good to compare other products and investment options along with your increasing requirement before you make any decision. Inflation and longevity risk are two devils which can spoil your retirement years if not considered.

Review of LIC Jeevan Akshay VI is done by Jitendra PS Solanki, CERTIFIED FINANCIAL PLANNERCM he focuses on special needs planning

If you have any questions related to LIC annuity plan or any other pension plans – feel free to ask.

What is the second option ? can you clarify me?

(Annuity payable for 5, 10, 15 or 20 years certain and thereafter as long as the annuitant is alive.)

Second question is – Is the anuity rate will change in future or it is guranteed?

Manjunath,

In the option annuity is fixed for the term decided. Even if annuitant dies during the term the company will pay keep paying the annuity till the term.Post this period annuity is paid only till annuitant is alive.

Annuities are assured for the life.

It is fixed through out life

Good one. If am not wrong we dont have inflation indexed annuities in India with the exception of govt pension where DA offered twice a year is linked to inflation. It may not be a bad idea to annuiatize about 40% of pension (say guarantee food on the table alone for life) and actively invest the rest and then progressively ladder the annuity as one becomes unable to manage money actively.

Two aspects of personal finance post retirement is clear: It requires active management, likely more than what one did during employment.

Professional help is crucial at this stage.

As an emerging area of specialization only a few CFPs would have experience in advising retirees over extended periods of time, say 10 years. Looking for this experience may be important.

Pattu,

Jeevan Akshay offers an option of 3% rise in annuity every year.Star Union Daichi offers 5% rise in annuity every year.But then annuity rates in both these options are too low. So the problem remains that we do not have annuity at present which can be linked to inflation.My guess is that the annuity market is going to improve in the future.

Annuities today are more of supplement where you can have some basic needs covered through them and rest you have to look at other wiser options.Yes you are right in the aspect that today you have to do an active management by combining various options in your retirement.

Nice review jitendra.

Sometimes i wonder that when 10 year govt sec papers are at more than 8% , bank fixed deposit rates are at more than 9% , then how can someone advise a retiree to invest in such kind of product where the rates are in the range of 7%-7.5%. In this high inflated economy , even 9% is not looking enough , how would one survive on 7%.

I totally agree with pattu saying

“Two aspects of personal finance post retirement is clear: It requires active management, likely more than what one did during employment.

Professional help is crucial at this stage.”

This is the worst possible investment option. A bank FD is much better. Current rate is over 9% and on death, the nominee gets the principle amount and can then choose to continue. Interest can be credited Qrtrly / yrly etc. In LIC if you want the principle money back you have to accept a lower rate of return what kind of crap is that??? How can this be an investment option for a retiree?

This is absolutely right, these annuity plans are basically a well marketed joke

The nationalized bank deduct TDS more than 10000rs intrest. The ratio of intrest is 7% also there. If we invest 100000 rs than 8000rs will be deduct automatically. For that i have to fill up 15G .is it effective?.

Manikaran,

Thanks.

Yes, managing income post retirement is a crucial aspect where you requires active management. Annuities fails in many aspect for meeting retirement needs. But considering that insurance companies have taken a step in coming out with these products i am hoping that the rates will improve going forward.

Enjoyed reading and learning about annuity products. But I don’t think these are an attractive option at all. Bank FDs are much better option.

This product needs more flexibility and much better returns in order to get some serious investors. Companies should look at inflation indexed annuities like Pattu mentioned.

how do you calculate rate of return when you consider the option of no return of purchase price (like option {i})

my mother turns 80 next month. if i buy an annuity with 200000 , then she gets 3000/- per month approx. as long as she lives. if i invest the 200000 in a bank @ 9% , i can provide her with just 1500/- per month.

is this calculation correct ?

Ravi,

Annuities rates are higher when the age is more like your mother.This is due to the fact that companies assumes a longevity and the liability of paying till life is less that age. So at age 80 the rates can beat FD rates due to this reason.Hence, buying an annuity for your mother at this age may prove more beneficial.

Let me first pray for a long life for your mother.

If you want more monthly pension, add some more money and take an FD for 10 years from ICICI bank. They pay 10% so for 3 lacs, you can give your mother Rs2,500/- per month. and the sum remains with you, which on expiry of mother, will be inherited to you as taxfree asset from your mother.

Did you liked this idea?

This is infact a better idea. I like it.

Please note that in option (i), there is no return of capital.

FD has return of capital.

Your calculation of 3000 pm and 1500 pm is correct.

But to calculate yield, you need end date, which in case of option (i) is not available. Unless, you want to assume longevity up to say age 85 or 90.

No, calculation is wrong. 200000 as FD with interest rate of 9% p.a. it should be 15000 / month.

Jitender

I did not quite understand ravi’s calculatuon for mother gettign 3000 pm on 200000 annuity buy?? I have similar situation with mother so thinking to go for?

sunilk – the annuity amount for 100000 is 17880 for a person of 80 years. this is under option (i)

so for 200000 , the annuity will be 17880 x 2 = 36760/- per year

36760 / 12 ~ 3000/- per month

Sunil,

The look at the annuity table in the article where Rs 17880 is the yearly pension for Rs 2 lakh.Now double it for Rs 2 lakh and it will give you the figure what Ravi has calculated.That’s the monthly pension his mother will receive for life and when she dies nothing is returned.

Ravi,

as Jitendra correctly mentioned , in this case you don’t get any amount on the death of your mother unlike the bank FD which returns your principal at maturity. So, financially speaking,to recover the amount of Rs2L invested today in LIC jeevan akshay your mother should be alive till 87 years, (assumed discount rate of 7.5%) –excuse me for being so blunt,please. Maybe better to invest in a good diversified equity MF and do a systematic withdrawal of Rs3000 p.m.

I believe the author has missed out on mentioning benefits of investing larger amounts. For example, for 40 year old investing 1 Cr under option (iii), annuity rate increases from 6.93% to 7.33%.

Now for those comparing it with FD, please understand that FD has a limited tenure, maximum 10 yrs. Renewal of FD after 10yrs will not be at same rate.

Annuity rate is fixed for life. For someone aged 40, we are looking at possibly 40 years of annuity period. Which other instrument can offer guarantee for 40 yrs ? NONE.

It has its limitations, but does not mean its useless !

Bhushan,

I think in the article nowhere it is mentioned that Annuity is a useless product. It has its advantages and disadvantages.On Rs 1 crore as you are mentioning, the annuity which a 40 year old will receive is surely going to be taxable.Now if he falls in highest tax slab, the post tax returns on 7.33% falls to approx 5% on a simple mathematics.And this annuity is fixed i.e. does not increase with inflation. So after 10 years your annuity income fall short of your requirements which has increased due to inflation.

If annuity has been tax free or there has been products which were inflation indexed then surely the annuity products would have been considerable.But in today’s scenario relying on these fully for your income requirement for life may not be a viable option.As i said in article it can be looked as supplement with other products if you have the needed surplus.

I hope this clears your doubt.

Pricing annuity products is a big challenge globally because of the longetivity risk.We have an added problem in India due to absence of long term debt products so reinvestment risk is faced by the Insurance Companies.Further IRDA investment regulations does not give any scope for risk taking by Fund Managers so as to generate higher return.Funds has to be invested in Govt Securities and AA rated instruments.So the Companies can generate say 9% ,out of which expenses of 2% gone.So returns are around 7%.

Even Bank FD can not beat inflation.But the depositors bears the reinvestment risk where as in Annuity the Companies bears it.This is a plus for annuity buyers.By active management through debt instruments,u can save 2%i.e expenses charged by Companies.If you still want better, take the help of a Professional Financial Planner.

You are right Prakash. Its the absence of long maturity debt products and some stringent regulations which force companies to price the products so higher.

So one has to look at mix of products to meet the requirement today.Hopefully the market will evolve and we will see more such products with better rates with SBI Life and private players joining the race and IRDA shifting the annuity burden from LIC to other players.

What many people do not know is that LIC’s first Jeevan Akshay came with an ASSURED return of 12%, the FD rates in those days were around 14-15%, you read it right 15%, if anyone would have taken the argument of FD v/s Annuity then, he would never have put any money in Jeevan Akshay and when the Bank interest rates went to 5% in 2003-2005, it was these people who bought it then, who were smiling all the way to the bank, BTW they are still receiving 12 % today, as it is assured for life with return of purchase price to the nominee.

So an annuity is life time product, PLEASE do not compare it with bank FD’s for eternity, part of you money should be in a product like this, part should be in Bank FD’s and similar products as they also have the liquidity aspect, you should NEVER put all your money in a single product especially one where premature withdrawal is not allowed

Hi,

New to this website .. Couple of questions

1. I have LIC Endowment policy which is 5+ years old and premium amount is around 35k which recently i cam to know its not worth of investment. Should i convert this policy to ‘Paid UP’ or surrender it?

2. I have other LIC ULIP policy which is also 5+ years, should I surrender it off?

Planning to buy ‘TERM POLICY” please suggest which is better off.

With Regards,

Hemanth

Dear hemant hemant sir has already written the arcticle on this u should read this http://www.tflguide.com/2010/02/exit-strategies-for-mis-sold-insurance-policies.html.for term insurance u can opt for any plan from companies like lic anmol jeevan,amulya jeevan apart from this online term plans are very cheap like icici pru I care,hdfc life click to protect.hope this ll help u.

My age is 31. I want to invest 30,00,000 in Jeevan Akshay VI immediate annuity (option 4) with increase of 3% every year. According to the new online plan including the higher incentives, If i go for this online policy, how much exactly will i get initially monthly?

Dear sarvan

Going by the annuity table, you will receive approx Rs 1.57 lakh annually.Haven’t considered the rebate of 1% here.

I am 38 and want to transfer my UK pension fund to LIC’s Jeevan Akshay 6 (option 7). Is this permitted under current rules? For a fund of about 50 lacs, what benefits am I looking at? thank you.

From my understanding, if by transfer you mean – some transfer from UK authorities to LIC, it cant be done. You would have to encash UK pension fund and make lump sum payment to LIC. Please note that pension would be paid in INR only. It will be added to your income, and therefore would be taxable. Pension should be about 3,65,750 pa.

Hi Syd,

To transfer UK pension fund to India, you need a policy that is qualified under QROPS (google it). Now, there are many in the market but when you approach those providers in India, they are simply not aware. I literally had to show them on the internet that it could be done. The only provider that is actively aware and is in fact seeking such funds was ING Life insurance New Best Years policy and they did the transfer for me in under 2 months.

Granted that ING New Best years is quite expensive (its effectively a pension policy with a vesting date and then annuity, charges about 3-4% in AMC, charges etc) but at the time I was looking, I met all the leading insurers who were listed under QROPS and ING was the only one that knew actively how to do it.

I want lic plan to get rs 6000 per month my dob4-4-1970

Hi Mukesh,

Talk to some agent or check LIC site.

Syd, Bhushan.

I believe transfer of UK pension to LIC can be done through QROPS of UK. Please refer to

So coming abck to Syd’s question, could you provide more information as I also wish to do the same. Thank you.

Not at all attractive…. Why can’t they put the amount in Fixed Deposit and earn at least 9% interest monthly ?

When you talk about transfer of your UK fund, you have to go through QROPS system and there is no option of closing the UK pension fund and investing it in anything you like. So, you only have limited options under UK HRMS schemes to transfer.

Hey Mr. Hemant,

Where did you find the info that SBI Life offers better returns than JA VI?? From what i see from their site is not true. SBI life says for 60 yr old person the annuity for life is 6761 whereas your table shows it as 9350. Do you have any inherent problem with LIC that you almost always write negative about it?

I really don’t understand !!!

Unfortunately there is no mention about income tax benefits one gets if you purchase Jeevan Akshay VI policy. Suppose I purchase a ploicy of Rs `1 Lakh can take this 1 Lakh as it is for my income tax benefits. That is,. can I get Rs 30000 benefit if I am in 30 % tax bracet ?

Dear Mr. Kalyanaraman,

There is no tax benefit on purchased amount.

I just turned sixty. If I invest Rs. 500000/- in Jeevan Akshay VI what amount will I get if I opt for monthly returns, and when I conk off will the principal be paid to my nominee? Also what are the tax implications???

Thank you,

Adlai

Dear Mr. Adlai,

You can refer to the table from the article which give you rates for different options.

The annuity you will receive will be added to your income and taxed accordingly.

I have taken HDFC unit liked pension plan. Maturity Time due , I have to invest in 67% in annuity. Pl advise best annuity scheme with their monthly return. My age is about 63 years. My one time investment is 1,50,000/-.

Dear Mr.Singh,

Apart from Jeevan Akshay, Star Union Daichi life Insurance has comparable returns. You can consider either of these.

sir I want to buy this lic policy my monthly income is 7500 only i want to invest some money and increase my monthly income

Dear Solanki,

I want to get Rs 30,000 pension ,please advise where & how much should I invest to get a monthly pension of this amount with 3% increase every year .I am 56 years of age & non resident Indian planing to return.I intend to get a pension from 2014 .Thanks

Dear Solanki,

Appreciate if you could advise me on the following

1) I am a NRI looking forward to coming back .I want to get Rs 30,000 monthly pension ,starting 2014 .

Please advise me what are the most risk free schemes I can invest in to get that amount & I am looking for a 3% increase yearly .I understand that Jeevan akshay is good what about other schemes available.

Thanks

Dear Kiron,

Its essential that your money also grows in the long term to sustain the income you desire.For this some amount of equity exposure will be good. You can consider debt mutual funds along with having some amount invested in equity through balanced mutual funds. Alternatively, Monthly income plans in debt funds have some equity exposure and they give periodic dividends. However, the dividends is not assured but there are god schemes who have been consistent.

Regards

Hello Sir,

i m 27 year old i want to invest 2,00,000 in jeevan akshay vi online policy

& i want monthy income immidiately after investment

Please confirm how much i return

Best Regards

Shiv kumar

Hi Shiv,

Minimum age for the product is 30 years. Longer the payout for the company lower the returns. So at your age you may have the lowest returns. evaluate other alternatives too where you can also have the growth of your investment also such as SWP in debt mutual funds.

Hi,

I like thank you for details

Could you please clarify the below details

1. What is difference between Fixed deposit and LIC Jeevan Akshay VI – Immediate Annuity Plan if I need monthly payments

2. Which one will get higher returns(Fized deposit with monthly interest and Jeevan Akshay VI – Immediate Annuity Plan)

3. Is the return tax free for Jeevan Akshay VI – Immediate Annuity Plan

4. How long will I get pension with this LIC scheme?

5. After my death how much amount my nominess will get? its same lupsum amount I paid initially?

Thanks in advance for your support 🙂

Hi Neethu,

1. From the point of taxability both are taxable by adding to your income. But a Fixed Deposit is for a specific tenure and you generally don’t have a monthly payout. Annuity is a series of payment , can be monthly also, and have a lifetime option. The other difference is the payout rare which is based on age of person in case of annuities.So at higher age you have higher payout. FD is a fixed interest option for every individual.

2.As i said Annuity returns vary with age. So you need to check rates at your age and then evaluate options.

3.No annuities are taxable.

4.You have multiple options from which you can choose.

5. If you have opted for then nominee will get lumpsum. You have options of annuity to spouse after death or only annuity to you for lifetime.Again the rates will vary as per the options.

I hope this clarifies your doubts.

An agent explained me that Max Life Partner Plus Insurance Policy is best ever policy, can any one please guide me , that shall I go for it or not. My age is 36 years. Premium is 72,300 per year.

Thanks in advance.

Sram,

The pension plans have not been a wiser option considering the high cost associated and after IRDA changes even companies have not been interested enough. There is no best ever policy and unless you earn a decent returns on your accumulation you won’t be able to accumulate a good corpus. Mutual funds would be more wiser option or accumulating money for your retirement income.

Return on investment in LIC Jeevan Akshay is not attractive as in banks. Particularly for bank employees. As of now I am getting 10.85 % on FD invested by me(9.35 % +1 %[For ex staff]+0.50 % for Senior citizens) with entire amount returnable on maturity( years). In LIC 7.01 %, that is a difference of 3.84 % which works out to nearly Rs 4,480.00 per month on a FD of Rs 14 lakhs)

In my opinion, any investment less than 9 % tax free return is of no use to Senior citizens, particularly for those who do not have any pension scheme.

Dear Mr. Shankar,

Yes Prima Facie FD is yielding you higher returns. But every investment has its own characteristics. FD returns will lower down with fall in interest rates and it is not a lifetime income. Then you will have to consider other options. On other hand Annuity income is lower but is a lifetime income. However, both are taxable and so someone with taxable income will have to consider more options. Its difficult to meet all needs with a single investment avenue. One has to consider combination of options to ensure the longevity risk can be taken care.

I am 54 year old.

I want Rs. 20,000 per month. I am not in tax bracket. So how much & where to invest ? which is the best option.

Your guidence will be very helpful to me in investment.

Thanking you.

Mr.Dinesh,

It will be difficult to count any single option for generating this income. The amount of corpus you need to invest should be based on a calculation which take inflation into consideration and a time horizon. It may be easy to identify in the Annuity product (It may be 25-30 lakh for this income) as the amount is same for lifetime cause there is no inflation indexation. But ideally there should be a mix of options with some giving your investment a growth while few earn you a fixed income.

Dear Mr. Singh,

Thanks for the explanation and calculations. I have a question.

Can we combine options on this policy? I would like to combine option 3 and 7. Is it possible?

Dear Mr. Vaibhav,

You cannot buy annuity with two options in the same product.

I am year old.

I want to invest Rs. 1,00,000/- one time for pension. i am working private secotr and i am not in tax bracket.

Your guidence will be very helpful to me in investment.

Thanking you.

Dear expert,

I am planning to buy a JA IV for my mother.she is 58 years.I want her to get 6000 a month.She dooesnt fall under tax bracket.Can you tell me how much should i invest to get the same.

Khan,

You may need Rs 8-10 lakh for meeting this income need. Actual amount will be based on the option you choose.

Sir,I had taken ICICI Pru Life Time Super Pension Plan in the month March 2007

for 10 years term.I had paid 3 premiums of 100000/-each. My policy is in force.

I have to intrest in 67% in annuity.Please advise best annuity scheme with their

max monthly return & which option will be more suitable.My DOB is 05/11/1942

My total investment is 300000/-.

Your guidance will be very helpful to me in investment.

Please send your comments via e-mail ([email protected])

I am already Annuity Plan member.Whether this year I have to submit “LIFE CERTIFICATE?”Hope to receive answer. Thanks

Mr.Kamrakar,

You can get this information from the company you have bought annuity.

my father age is 65 and he is not employee and not having income and i am presently doing private job and i have 1lac rupees can this plan benefit for my father

Kiran,

The plan can give a monthly income to your father. The amount of income you can get from the table. But you need to take into consideration that the income will be same throughout and if your father income needs increases in future due to inflation, this may fall short. Look at other alternatives and hen decide.

Open a post office Monthly scheme where he will get Rs 700/- per month with principal back. Another is eAnnuity of SBI where for 10 yrs he will get Rs 1265.15 per month.

My wife age is 38 yrs, i would like to invest 10 lakhs, how much she gets in 60 years old onwards? Please advice

Ravi,

The amount of pension your spouse will receive will be based on how much the investible surplus grows. Since there is almost 22 year when she reach that age, you need to invest this surplus wisely. On reaching the age you will then have to evaluate options for generating the required income. This can be mixed of variable or fixed instruments based on what options are available during that period.

As a thumb rule remember PO MIS gives Rs 700/- per month for Rs.1,00,000 deposit(Rs.8400 per yr). All pension plans are near this only. And you get ur principal on death.

I would like to know that how much amount is required to purchase this pension plan under option VII in order to get annuity Rs 40000/- per month.

Soibam,

For this much annuity you will require approx Rs 70-80 lakh. The actual amount will be based on the age of pension holder as the annuity varies accordingly.

Dear sir, i’m shyam kumar, 31 years old. if i invest 2 lacks in Jeevan Akshay VI, how much amount i will get, if i opt for annuity pay. could you please provide details. please suggest best suitable plan for my age. my annual earnings are 5 LPA

Shyam,

At your age you may not get a very good amount since annuity rates are lower at younger age. The surplus you have should be utilized for your goals effectively for which you will have to identify them first. You should take the help of a financial planner to work on your requirement.

Dear sir

I’m 33 years right now, I am thinking of investing upto2 lakhs in this plan.

But I’m unsure if this plan will benefit me as a retirement plan. I would like a plan where I get yearly or monthly returns after 20 or 30 years Please advise me if LIC has any particular policies which would suit my requirements. I’m a bit wary of private companies.

Vanessa,

The requirement you have illustrated would have been met by pension plans. But unfortunately they are not an ideal product to invest due to many disadvantages. A wiser approach will be to accumulate corpus for your retirement through mutual funds and when you reach the target goal you can consider options for generating the income you need.

Hi Jitendra,

For a retired individual, who intends to invest a sum of Rs 20lakhs. Which is a better option-

1. Fixed Deposit

2. Immidiate annunity plans like Jeevan Akshay.

For a period of 10 years which would give higer returns, considering the taxation aspect as well.

Sourabh,

In both these investment the return you receive is taxable. However, in a fixed deposit senior citizens are offered an additional interest. Which will be more beneficial will depend on what rate you receive in fixed deposit. In current scenario the interest rate in fixed deposit for senior citizens is good enough. But FD may not give you monthly payout.

So look at the rates offered in FD and then you can compare easily which is yielding you more.

Hi Jitendra,

I am presently 49 years and in 30% tax payer slab. My wife is house-wife and do not have any income. Can I buy Jevan Akshay VI with option 7, for amount of 60 L against her name? Should any tax applicable to her? If I purchase on line policy, will we get 7930 (6930 + online 1% rebate) x 60L = 475800 per year. (39650 per month) We have one son of age 16 years. Should he get all amount of 60L after our death.

Please provide your guidence

Thanks in advance

Uday C

Hi Uday,

LIC offers two incentives:

1. If it is online purchase, there is 1% addition, which you are aware of, but have misunderstood it.

The pension amount increases by 1%. LIC says you will get 1% pension extra if you buy pension online. Now note that this 1% is not on total purchase price but on already calculated pension.

Example. If someone buys a pension from LIC OF INDIA buy investing Rs 1 cr and he get Rs 7,50,000 per annum pension,now if someone buys pension online he will get Rs 7,50,000+7500 (1% extra) =Rs 7,57,500.

So the benefit of online vs offline is not as huge as you imagine it to be. Further, note it and understand carefully that, in case of online purchase, you / your family member has to personally co-ordinate with LIC in case of changes. It will happen twice in case of option 7 i.e. death of 1st person and then death of 2nd person.

2. Further, if purchase price is more than 2.5 Lacs, then annuity rates are higher. The chart rate of 6930 is with out this addition. So you are bound to get even higher, because your purchase price is 60Lacs.

However, you have ignored one fact that service tax of 3.09% is applicable on entire purchase price of 60 Lacs.

About your other queries:

Yes, you can buy pension in name of your wife. LIC does NOT deduct any TDS. So it is up to you to manage the taxation. Below permissible limits, the pension will go tax free if your wife does not have any other income. Beyond the limit, it is taxable as per tax slab.

Yes, after death of both parents, your son will get 60Lacs. This however, will be tax free. Service tax paid at time of purchase is NOT returned.

Hope I have answered all your queries. Feel free to ask more.

Can One Surrender LIC akshay plan ?? If yes how much does one get back of there principal amount ???

Varun,

Annuity plans cannot be surrendered and so there is no surrender value.

Sir,I had taken ICICI Pru Life Time Super Pension Plan in the month March 2007

for 10 years term.I had paid 3 premiums of 100000/-each. My policy is in force.

My total investment is 300000/-I have to invest 67% in annuity.Please advise best annuity scheme with their max monthly return & which option will be more suitable

.I can invest annuity in savings scheme like Senior Citizen Saving Scheme (SCSS) or Post Office Monthly Income Scheme (POMIS), My DOB is 05-12-1942

Your guidance will be very helpful to me in investment.

Sir,I had taken ICICI Pru Life Time Super Pension Plan in the month March 2007

for 10 years term.I had paid 3 premiums of 100000/-each. My policy is in force.

My total investment is 300000/-I have to invest 67% in annuity.Please advise best annuity scheme with their max monthly return & which option will be more suitable

.I can invest annuity in savings scheme like Senior Citizen Saving Scheme (SCSS) or Post Office Monthly Income Scheme (POMIS), My DOB is 05-12-1942

Your guidance will be very helpful to me in investment.

Parmanand,

SCSS and POMIS are not annuity scheme but only for a fixed term. Post the term you have to again reinvest the amount. The only risk now is that interest rates may not be the same. For annuity either a product like LIC Immediate Annuity or even the scheme you are invested are available. But the rates are good only after age of 70. If you opt for then annuity only to you option will give you higher amount. You can work out investing in multiple options to get the maximum out of your corpus. You will have to take a decision based on what interest rates you will be receiving on the day your term gets completed.

hello sir my name harish i invest arount 10 lac which plan i am investment pls suggest and which age i am purchase annunity and higher rate

The above review of Jeevan Akshay VI immediate annuity plan seems to be outdated. Are these annuity rates applicable today in September 2015?

Mahavir,

You can check the company website where annuity rates are clearly mentioned.

Dear Sir

I am 49 years old. I want to take Jeevan Akshay 6 policy. I want invest Rs.500000/-. opted for case 7.

According to LIC Calculator monthly annuity works out to Rs. 2929/-. I would like to know whether it is net payment to me or any deductions will be there from LIC.. pl clarify.

Further if I take policy through online, as per LIC document I am supposed to get annuity Rs.2929 + 1% (29.29) = Rs.. 2958.29/- OR I get annuity of Rs.2929/- only for premium of Rs. 495000/- Kindly explain in detail.

Thanks

Manjunatha C

I HAVE ICICI PRUDENTIAL LIFE INSURANCE POLICY LIFETIME SUPER PENSION.

I HAVE PAID TOTAL PREMIUM AMOUNT Rs 300000/- MATURITY DATE IS 13/03/2017.

I MAY GET ABOUT RS 600000/-AT THE TIME OF MATURITY.

1/3RD AMOUNT WILL BE GIVEN TO ACCOUNT HOLDER IMMMIDIATELY AND REMAINING 2/3RD AMOUNT WILL BE INVESTED IN ANNUITY.

MY DOB IS 05/11/1942.I WANT TO KNOW WHICH IS BEST SCHEME FOR ME & WHICH COMPANY WILL BE BETTER

SUCH AS NPS, LIC,ICICI,HDFC, AVIVA INDIA LTD., ETC.

PLEASE INFORM HOW MUCH APPROXIMATE AMOUNT I WILL GET AS A PENSION CONSIDERING AT PRESENT RATE

WAITING FOR YOUR FAVOURABLE REPLY. THANKING YOU

REGARDS,

PARMANAND JETHANI

I HAVE ICICI PRUDENTIAL LIFE INSURANCE POLICY LIFETIME SUPER PENSION.

I HAVE PAID TOTAL PREMIUM AMOUNT Rs 300000/- MATURITY DATE IS 13/03/2017.

I MAY GET ABOUT RS 750000/-AT THE TIME OF MATURITY.

1/3RD AMOUNT WILL BE GIVEN TO ACCOUNT HOLDER IMMMIDIATELY AND REMAINING 2/3RD AMOUNT WILL BE INVESTED IN ANNUITY.

MY DOB IS 05/11/1942.I WANT TO KNOW WHICH IS BEST SCHEME FOR ME & WHICH COMPANY WILL BE BETTER

SUCH AS NPS, LIC,ICICI,HDFC, AVIVA INDIA LTD., ETC.

PLEASE INFORM HOW MUCH APPROXIMATE AMOUNT I WILL GET AS A PENSION.

THANKING YOU

REGARDS,

PARMANAND JETHANI

I HAVE ICICI PRUDENTIAL LIFE INSURANCE POLICY LIFETIME SUPER PENSION.

I HAVE PAID TOTAL PREMIUM AMOUNT Rs 300000/- MATURITY DATE IS 13/03/2017.

I MAY GET ABOUT RS 600000/-AT THE TIME OF MATURITY.

1/3RD AMOUNT WILL BE GIVEN TO ACCOUNT HOLDER IMMMIDIATELY AND REMAINING 2/3RD AMOUNT WILL BE INVESTED IN ANNUITY.

MY DOB IS 05/11/1942.I WANT TO KNOW WHICH IS BEST SCHEME FOR ME & WHICH COMPANY WILL BE BETTER

SUCH AS NPS, LIC,ICICI,HDFC, AVIVA INDIA LTD., ETC.

PLEASE INFORM HOW MUCH APPROXIMATE AMOUNT I WILL GET AS A PENSION AT THE PRESENT RATE.

THANKING YOU

REGARDS,

PARMANAND JETHANI

It is highly unlikely that you will get 6 Lacs from ICICI if you have paid 3 Lacs. Why dont you check on current Fund value or surrender value. You will get a realistic idea (read as real shock).

when annuity rates are revised of Jeevan Akshay VI immediate annuity plan .Please inform revised rates if these are changed.

Thanking you.

Regards,

Parmanand Jethwani

Hello,

I want Rs 10,000/- a month (pension) DOB March’ 1969′. Please kindly explain both the Jeevan Akshay policies i.e. Without nominee(here I don’t get my money back) and with nominee.

Another question is if I get Rs. 10000/- pension for the first year, how much would be on second and third year I would get?

Jayesh

In Jeevan Akshya 6, pension does not change every year. It remains constant. So 10k per month will remain as it is through out your life.

You need to invest 15 lacs without nominee to get approx 10k per month.

You need to invest 17.5 lacs with nominee to get approx 10k per month.

Nominee means return of purchase price in above example.

I am going to retire on 30th April next year and have three questions…

1) In annuity Plans i and ii, is the purchase price returnable?

3) If not, I would prefer to consider Plan iii.

4) Do I have to pay service tax while buying the Annuity? If yes, what’s the rate?

5) While paying the annuity, does LIC deduct Income Tax at source?

Grateful if you kinely let me know.

Thanks & regards

Tanmoy Lahiri

Dear sir,

Plz read carefully,Because service tax for 200000 is 7500 they will not tell this details and u can not have option to take back amount in further …..because i have taken policy for my mother and now they telling for 2 laks,7250 is service tax so my total amount is now 193000. Be careful sir when u are taking this policy…………..

I am working overseas, I want to buy LIC Jeevan Akhsay VI policy, Can annuity will be credited to my NRE account. I can pay my contribution from my NRE account.

Jeevan Akshay VI also charges 14% service tax . So if you want to purchase or invest 10Lakhs , the service tax is 140000. So in total you need 1140000 /- to get policy for 1000000/-

Is it a typo ? Should not be more than 2% I guess.

Annuity for NRE will be credited to NRE if the single premium comes out of NRE account. Also no tax liability until you maintain your NRI status. I just booked it.

This is a good product for someone who has a plan to complement his retirement funds through a steady income. If you are young and don’t need immediate annuity for consumption, take the annuity into a high yielding product until you need to . This compensates for the risk and also the inflation bit in the short term by then you can build another corpus for your golden years.

Works best for a NRI like a 40 year old. Option 7 is the best the way I see it for a married person with kids. No service tax, no income tax and go online to get 1 percent rebate. Also add the benefit of extra rate if the amount is higher.

Look at also the comfort of credit into your account without worrying about any market volatility or reinvestment risk. Sovereign guarantee even if a financial crisis hits that prolongs for 5 years. Trust me we are going to see a financial landscape that is unprecedented.

@Ramesh, can you share your email id, I need to take your advice on the points you have mentioned.

How may number of Plan ( Jeevan Akshay) one can buy?

Suppose Now I want to buy one plan for 2.5 Lacs and in coming can I buy more plans in same name?

Yes Sarfuddin – that’s possible. As such there’s no limit.

Dear Sir,

I had a fixed deposit in Canara Bank account. A marketing Manager from the same bank advised me to deposit in Aviva Insurance where I will get more than 12% in 2006. So I agreed and deposited for 5 years. I thought it will help me to purchase a house. After 5 years, I got 1/3% and balance 2/3% went annuity which I deposited with LIC. I did not wanted this annuity, still Aviva Insurance cheated me and told me it is compulsory annuity. What a non sense. Annuity should be only if we agree because it is our hard earned money. Can I file case against Aviva Insurance for sending my money to annuity? I have already purchased many LIC policies for me and my family. Now I want money urgently, can I get this money out? What is this annuity plan? It should be only for those who deposit in annuity wilfully, in case he/she does not want annuity then it should be allowed to cancel immediately. Please advise me should I file a case, if I do not get my money on time? Please tell me, should I file a case against Aviva Insurance or LIC? Thank you.

Rajesh,

That’s the structure of pension plans in India. Only 1/3rd you can commute at vesting age and rest needs to be purchased at Annuity. Yes if the product has been missold to you can always file a complaint with the Relevant authority. But annuity once starts you do not have option to withdraw or cancel it.

Dear Rajesh,

How did you fill the form provided by Aviva people? You filled the form for an single premium plan leading to purchase of annuity at vesting. One must very careful in doing such financial transactions.

Further, its almost impossible to withdraw your money once invested, because you have signed and agreed to all the terms given by Aviva, I don’t see any fault by LIC of India here.

Whne the purchase price (Capital) is returned to nominee, is the amount taxable in the hands of the Nominee ? Since it can be large amount, the Nominee will face a large tax liability in the year of receipt !

Hi,

It’s not taxable right now.. not sure when wealth tax be introduced.

sir

i want to invest 500000 in this policy under F clause my age is 36 years,

i want to know that it Fixed interest rate for life time or change in future.

suppose i get 36000 per year so it will countine for life time or in future it may be decrease to 10000 per year, if it is guarteed return plan when it is in clause of policy. please send me link or image of that clause in lic website.

Hi Dilip,

I will not suggest Annuity at the age of 36 – even at the age of 60, one should think 10 times before buying an annuity.

Dear Dilip,

The rates offered in Jeevan Akshay Immediate Annuity plan are guaranteed, they are not going to reduce once it is executed on your bond for Rs.5 Lakhs.

Hi,

I’m NRI, Age 45, can buy LIC Jeevan Akshay VI Policy in online?

is there any taxable in NRI status? If relocate to India any changes/taxes applicable? If taxable how much tax will deduct?

If buy on wife name as no income/house wife, is there any differences?

Any differences between online vs offline/agent purchase this policy.

Preferable option 7.

Please advise… thanks in advance.

Regards,

Rambabu

Hi Rambabu,

Yes it will be taxable in both the cases – tax depends on your slab.

No benifit in transferring to wife.. clubbing provision will apply.https://www.retirewise.in/understanding-clubbing-of-income-blunders-people-make/

Online will give you bit higher annuity.

I am 61 yrs old, willing to invest 20 lakhs in LIC jivan akshay 6, Option 7, for a guaranteed income, alternatively is looking for HDFC prudent/ Balanced fund.What is advisable ? I don’t get any pension from my employer.Can I divide amt.Between these two options, pl.advise at early time.on my mail.

Hi Mr Mohan,

You can consider that buy my suggestion is get in touch with a Financial Planner in your are.. he can see the bigger picture & than make suggestions.

You should also read https://www.retirewise.in/systematic-withdrawal-plan/

Hi,

if i invest 25Lakhs in LIC Jeevan Akshay VI, how much amount will get yearly and how much tax i need to pay?

i need to pay tax/gst/service on priciple amount 25Lakhs? iam NRI and already paid income tax for this amount in overseas.

So Please clarify how much amount i should pay for 25L investment and how much amount i will receive after tax deduction?

By the by my age is 46 and Plan option is no.7

Please suggest… thanks

I am 33+. Want to invest 1000000 in on line Jeevan Akshay vi policy with immediate annuity. If I opt for vii how much I will get per month?

In the table u provided, it shows 6930.00 for 1 lakh opt vii. For online purchase u mentioned 1% additional rate will be provided. Will it be then 7930.00 or something else?

Hi Shantanu,

I will suggest to get in touch with LIC for exact quotes.

My mother who is 69 years old, she wants to invest Rs. 5.0 Lakhs in Jeevan Akshay-VI, can you guide us which option she select?? pls reply.

Hi Chetan,

Normally people are going for “Annuity for life with return of purchase price on death of the annuitant” – you can talk to LIC agent

I am 58 yrs + lady . In my office I could not opt pension . Thus I want to invest 15 lac in jeevan Akhyay VI. Is it a good investment? Is this amt added to my income right now? If i want to take annuity after 60 yrs , then what will be the scenario?

Is there any other investment plan for myself/

My Birth ( 1.1.1953 ) age 64 yrs & Wife ( 16.7.1958 ) age 59 yrs wants to invest 15 Lacs for monthly or Quarterly interest in my saving account. Wife is House wife & I am working & filling return for Income Tax . Already invested 15 Lacs in Bank @8.30% for Sr Citizen scheme . Please advice where to invest further.

Best thing about annuity is that one has a fiscal discipline, in the sense that the principal cannot be accessed easily and therefore, no scope for wanton spends while earning a salary like figure every month albeit a lesser sum. FDs require a lot of maturity not to be had at, since one is vulnerable to various kinds of pressures as one gets older. Best is to have an intelligent mix of both

Can you please clarify whether Lic pension plans are backed by sovereign guarantee of Govt of India. If the answer is yes, then all things being equal, it makes sense to invest in Lic rather than bank fixed deposits. Reason is not far fetched as only Rs one lakh is guaranteed in the banks thru Deposit insurance. Should the bank go bust, you are on your own and doomed….

Does Jeevan Akshay plan enjoy sovereign guarantee by Govt of India?

In all times , LIC and SBI investments are quite best , when compared to others.

Guaranteed monthly returns with Return of Capital to nominees is the best option.

In these days of more cheaters, relying on Government institutions are healthy.

Comments are closed.