Mutual Fund is a new baby for most Indians – I keep getting lots of mutual fund questions through Comments on posts, Ask Us, or Business newspapers where I regularly write query sections. I have selected the most important & most frequently asked questions (faq) out of that. You can also ask questions in the comment section.

You can also get a “Secret Investment Guide” from the end of this post.

Mutual Fund Questions

- Is a mutual fund with a low NAV better?

- The difference in the performance of a Dividend or Growth Plan?

- What are the tax benefits in mutual funds?

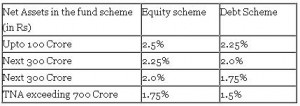

- What are the charges in mutual funds?

- Is it a good time to invest in mutual funds?

- Should I invest in Infrastructure funds?

- Equity Vs Real Estate – which one is better?

- Mutual Funds or Direct Equity – who is the winner?

Low NAV Vs High NAV Mutual Funds

Question: Is it worth to go for a SIP in a fund where the NAV price is very high. Say HDFC Equity where NAV is around Rs 200?

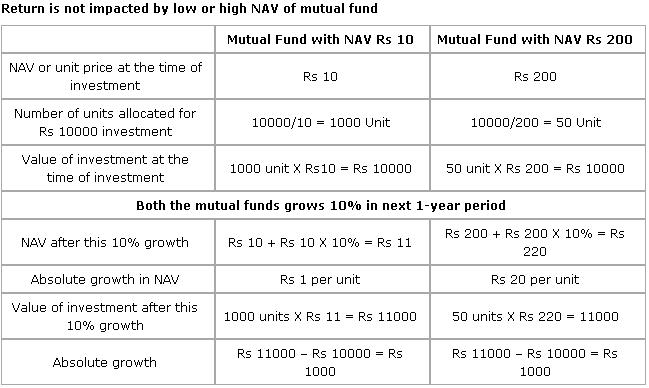

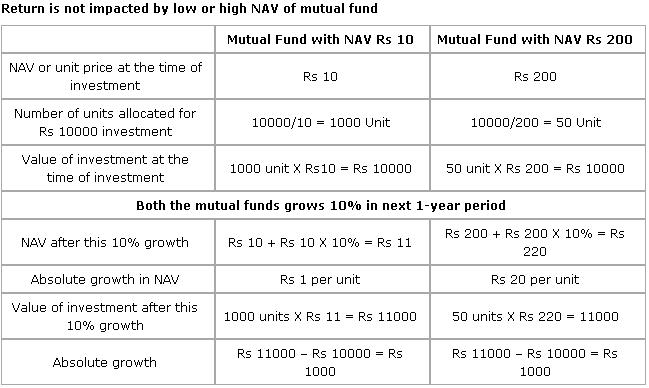

Answer: You should not consider NAV as a deciding factor while investing in Mutual Funds. It is a myth that it’s good to invest in Mutual Fund with low NAV mutual funds because you will get more units and that means more returns. Let me clarify high or low has nothing to do with the future performance of the fund – NAV keeps changing due to the performance of the fund and that depends on markets & fund manager performance.

The only good thing with a higher NAV fund is that it is having some past track record to show. Low NAV is a gimmick used by agents to introduce you to new funds where their commission is higher. Say NO to NFO.

Must Check – Insurance for Diabetics

Check calculation of high an

Dividend or Growth

Dividend or Growth

Question: I want to invest in Reliance Mutual Fund, but as I am seeing the NAV, there is a huge gap in Growth and Dividend NAV. Which is better to invest in?

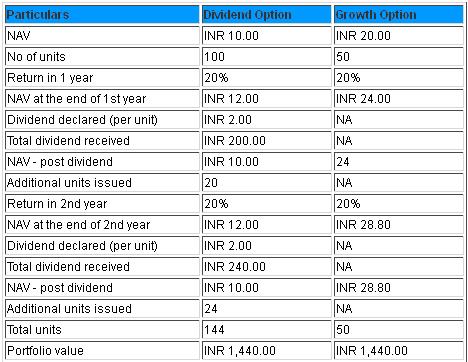

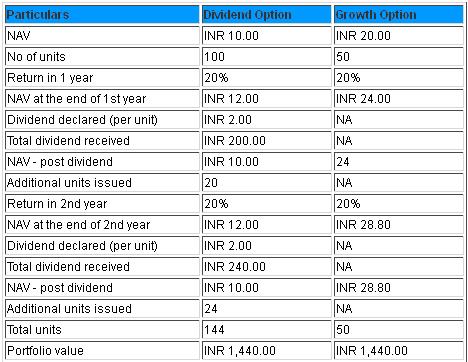

Answer: Most mutual fund schemes come in three options – dividend, dividend reinvestment, and growth. Undergrowth option, you get the units at the time of buying and you have a same number of units till the end. The NAV keeps changing according to performance. The fact that under the dividend option the fund keeps on declaring regular dividends so NAV reduces with such dividends. In dividend reinvestment, you get additional units on ex-dividend NAV. However, the truth is that it does not make a dime of difference which option you choose, from the pure investment yield point of view. There is a caveat, though – Investors should opt for that option that minimizes their tax liability.

Let’s take an example to understand this. Suppose an investor decides to invest INR 1000 in both, Dividend Re-invest and Growth option of the fund.

Must Check –Benefits of long-term orientation in Life & Investing

Check the calculation of dividend & growth plans.

Tax benefits in Mutual Funds

Tax benefits in Mutual Funds

Question: What are the tax benefits I can get while investing through mutual funds? Are there any special funds where I can invest to avail tax benefits?

Answer: Tax benefits in Mutual Funds keep changing from time to time. According to current laws, a few of the tax benefits are No long term gain tax on the sale of equity mutual fund(the long term here means 1 year plus), Tax-free dividend, No dividend distribution tax in case of equity mutual fund, Benefit of indexation in case of debt mutual fund & Lower long term gain tax in comparison to any other interest-bearing product. You can also invest in Equity Linked Tax Saving Schemes of mutual fund to take benefit under section 80 C. ELSS schemes have a locking period of 3 years & as the name suggest it invest in equity shares.

Must Read –Economic Bubble

Mutual Fund Charges

Question: How the mutual fund charges its annual maintenance fee from the investor? Does it reflect in the NAV we get against the amount investor pays? How can an investor calculate it from the statement it receives? Other than this any other charges?

Good time to invest in Mutual Funds

Question: I would like to invest Rs 2 Lakh for Long Term. Will you suggest investing it right now or should I wait for correction.

Answer: Far more money has been lost by investors in preparing for corrections, or anticipating corrections than has been lost in the corrections themselves. You should understand that timing of the market is not possible even by experts. In the long term, equity has consistently outperformed all other asset classes and works well against rising inflation. Equities are volatile in the short run but have the potential to create immense and stable wealth in long run. In the last 30 years, if one has invested for any 20 year period, the worst returns are 13.35% which is double what you get in an Endowment policy & the average return of equity in the same period is 16.72% which is double than any other debt investment. But if you don’t feel that you have such patience better invest through 1 year Systematic Transfer Plan.

Read – Secret of High return Investment

One more on timing the market

Question: I was running a SIP of Reliance Vision for Rs. 1500/- per month it ended the last September…I invested Rs. 36000/-in 2 years… the present value is Rs. 49,000/-. It touched Rs. 54,000/- a few months back also but I didn’t withdraw the money. But now as the markets are going down, I think I have taken a wrong move by not taking the money out.

Answer: Equity gives you two types of return, one is speculative and another is fundamental growth. 95% of the investors in shares or mutual funds are here for speculative gain that is gain from the short-term price movement. They start TIMING THE MARKET rather than giving TIME IN THE MARKET. This approach for short-term gains is the real cause of loss. Investment, in the long run, is not only rewarding but also beats inflation by a good margin and creates wealth. If you keep such a close track on your investment it is going to be very tough for you to achieve your goals through equity investment.

Infrastructure Funds

Infrastructure Funds

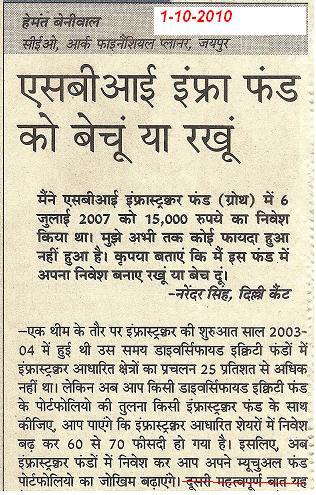

Question: Should I invest in Infrastructure Funds – as it is believed that India needs good infrastructure & that will be reflected in the performance of the stocks.

Answer: Infrastructure funds as a theme was started in 2003-04 at that time exposure of infrastructure-based sector was not more than 25% in diversified equity funds. But now compare the portfolio of diversified equity fund with any infrastructure funds and you will find that exposure in infrastructure-related stocks has gone up to 60-70% of the overall portfolio. So now investing in infra funds means increasing the risk of your mutual fund portfolio. Infrastructure covers a lot of things like banking, power, energy, engineering, construction, cement, metal, etc. One more thing people need to realize that any diversified equity fund can buy into any sector or theme if the fund manager sees potential. Buying theme funds should be decided only when the theme has something unique to offer, which other funds are either not offering or offering in a limited way.

Equity Vs Real Estate

Question: Which will give better returns in the long term – equity or real estate?

Answer: Both equity & real estate are growth asset classes and will always beat inflation in long term by a substantial margin. Both real estate & equity markets are driven by the growth of the economy & businesses. In the long term, equities give a better return than real estate but investors have earned better returns in real estate. The reason is in real estate people invest for long term maybe 10-20 years so it saves there undue expenses, tax & bring out greed & fear emotions from investment. But inequity we do it the other way & that’s the reason investors feel properties give better returns. Also remember there are many shortcomings with real estate as well like the size of the investment, leveraging, black money, title problem, encroachment, liquidity issue, maintenance charges, etc.

Mutual Funds Vs Direct Equity

Question: I want to invest 2 lakh in the share market for 10 years please suggest to me the best shares in infra, power, bank, FMCG?

Answer: There is one good thing & one bad thing about your question. The good thing is you want to invest for the long term in equity but the bad thing is you want to invest directly in equity rather than going through Mutual Fund Route. The biggest problem with direct equity is that a very small number of people can do it right. And people who can do it right don’t ask for suggestions or tips – they just research & make their investments. But most of the people just feel they’re right, till they get really screwed big time when the market makes a turn. I am having a big confusion that why people think they can beat mutual fund managers? Direct equity demands too much attention & at times it’s too addictive. And when you can’t control yourself, it can ruin your portfolio and wipe out your savings.

Bonus Question – Suggest Low Rish High Return Mutual Funds

Answer – Hmmm

Hope you learned something from this post. In case if you have any mutual fund questions – feel free to add them in the comment section.

You can also check these pages:

Hi Hemant,

Thanks for such a nice article. I have shared this with all my close friends.

My query is, I have purchased a sip in RELIANCE EQUITY OPPURTUNITIES FUND 2000 pm….. kindly tell me abt this fund and how it will be in future….

Thanks Gaurav for sharing the article.

Regarding your question – Reliance Equity Opportunities is a diversified equity fund with multi-cap focus. Multicap means fund is not biased toward large cap or mid cap – but it is free to invest in any type of stocks. These are bit aggressive funds as fund manager talks calls depending on the future market outlook. This fund has given good returns in last 3 year & substantially higher than it’s peers. You can continue your investment in this fund but if you are thinking about further investment you should choose 1 large cap & other mid cap fund.

Hi Hemant

Thanks for taking time to share the valuable information.

Hi Hemant ,

If i have SIP portfolio of 4-5 mutual funds which have very good track record ,then my queries are

1. How frequent should i review my portfolio

2. what should be avg annual return that i should expect from fund of each category , like largecap , midcap , multicap , secotrial

3. If after 1-2 years, in a review i find out that one of the fund is not performing upto the average (not sure which average should set as base ) , then should i switch to other fund from same sector or should i wait for it to perform

All the funds are from very good fund houses and have decent record in past

Hi Rohan,

It’s good to see that lot of people are taking interest in SIPs & asking questions regarding the same. Regarding your 1st query – you can review your portfolio on quarterly or half yearly basis but if you are following asset allocation you should try to rebalance it not before 6 months. Telling average return in future depends on many thing so quoting exact figures is like gazing crystal ball which is not possible but still you can expect 12-15% cagr returns from equity mutual funds if you horizon is 10 years. Mid caps can deliver bit better returns than large caps but also have some extra risk. If one of the funds is not performing for 2-3 years you should check the reason why this is happening – is there a change in fund management team, there thought process, any changes in overall objective, what about other funds in the same category. Also see what was the reason that you bought that particular fund – once you have done all this take a well thought decision.

My mutual fund agent is absconding from last 1 year. So I contacted some other agent through reference of my friend but he tried to sell me ulips. Can you please help how can I switch my funds & start new sips.

Hi Balraj,

Simple reason is there is no entry load on mutual funds – means less earnings for mutual fund advisors.

You can directly reach asset management company.

Most funds charge an exit load if units are redeemed before a specific period. Is this exit loads also applicable if we withdraw the dividends reinvested from the same scheme before this period?

Hi Ramesh,

Yes it will be applies as dividend reinvest is considered as a purchase. (so exit load & taxation will be done as a new purchase)

Hi

I want to understand in todays scenario if the investors horizon is for 2 years which would benefit him more an investment in MIP or investment in GOLD Savings Fund.

Hi Tanmay,

This is a dream question that people ask me daily – which is the asset class that will perform best in near future? And I only have one answer I can’t predict it. 🙁

I am 33 years old and had invest in lot of LIC and also in ULIP plan of State bank of india and now I wants to start SIP of around 5000 to 1000o per month please advice should i go for one SIP or invest in different SIP

Hi Gaurav,

As I have already mentioned to few readers that people should have proper diversified portfolio same applies to you.

Hi Hemant,

Can you please provide me the details of upcoming FMP’s for period of 1yr. i like to invest in FMP’s .which FMP is best?

Thanks

Hi Vijay,

We don’t keep list of this – you should contact your mutual fund advisor.

Dear Hemant,

I am a regular investor in Birla Sun Life tax relief 96 growth fund and invest monthly Rs 10000 since last one and half years. Now my question is , how it this mutual fund doing? Should I hold it for long ie say 2 more years or should I look for some other mutual funds with better returns. Is it advisable to continue for long? Can you please advise. Also which are the best funds with long term planning say for 5-10 years.

Can you also give me your opinion on Benchmark S&P CNX 500 Fund – Growth Plan as I am also having a monthly SIP ( Rs 2500 ). Is it ok for long term investment with this mutual fund.

Hi Mr Trivedi,

Birla tax relief is OK kind of fund – even it would have been best performing fund – still I would have suggested you that you don’t have a proper portfolio.

My suggestion is you should divide this amount in 3-4 funds – you can add HDFC tax saver or fidelity tax saver.

Benchmark S&P CNX 500 Fund is an index fund & that too a very diversified index – may be bit less risky but I don’t expect it outperforming managed funds.

This is indeed a very helpful portal to access great information on financial planning. I am planning to get into SIP with HDFC for the following 2 finds

1) HDFC top 200

2) HDFC Prudence Fund

I am planning a SIP of 1000 and 3000 INR respectively initially, this is apart from my other financial savings.

I have read the fund performance reports of the 2 funds, given the knowledge you possess could you please tell me if its worthy the effort ?

Hi Shripad,

Both funds are good but I will suggest you to divide your funds in 2 mutual fund companies – you can also invest in fidelity equity fund.

Hi Hemant,

I agree that both the HDFC funds – Prudence and Top 200 (and even Equity) are managed by the same manager. But if the funds are the best performing funds in their respective categories, does it not make sense to continue with them rather than get a relatively low-performer from the same category? All these funds from HDFC have been very consistent in their performance and i see no reason that they won’t continue to do so. Your thoughts please!

Hi Sumeet

Recently I had shortlisted some top performing funds of different categories.I found that there are some fund houses which have around four high performing funds.Under the circumstances one is tempted to have more than one fund from the same fund house in the portfolio.But the advisers generally do not favour having more funds from the same fund house.

I agree Anil that advisers do not favor having funds from the same fund house in the portfolio. But that’s exactly my question. As an example, if HDFC Prudence is the best performing fund in the balanced category, should one avoid it simply because one already has HDFC Top 200 or HDFC Equity?So do i diversify at the cost of reducing returns?I think it is not easy to answer that.

Hi Sumeet

There is so much of difference of opinion among the advisers as for as investment in mutual funds is concerned that it leaves the investors confused.To give you an example recently I read the opinion of two advisers in two different magazines regarding investment in Reliance Growth Fund. One adviser was of the opinion that one should immediately come out of this fund in view of its deteriorating performance whereas other said that in view of its past history one should remain invested in this fund.

As for as HDFC Mutual Fund is concerned it has perhaps the highest number of highly performing schemes. I think there is no option for the investor but to take his own call in such situations.

Hello sir, inspired by your site, started gaining knowledge abt mutual funds and willing to invest in equity funds. Ihave 2 goals right now, 1st is to accumulate 5 to 6 lacs inperiod of 5 yrs from now. 2nd goal is to accumulate 15 lacs in 10 yrs. Please suggest funds and the strategy. Whether to go for large cap, mid small cap or multi cap? Why mid and small cap funds offer high returns as compared to large cap? I learned abt diversification and it suggests me(citing example) not to include HDFC top 200 and HDFC equity in one portfolio bcoz their stocks are very similar. Am i right?

Hi Siddharth,

Great Going 🙂

Regarding your question – Why mid and small cap funds offer high returns as compared to large cap?

Small companies have more scope for growth – as we can’t expect reliance to double it’s profit every year but some small companies can do it – in long term this reflects in stock prices.

Hemant – Wonderful article and very well articulated.

Thanks Arun for appreciating our effort. 🙂

Thanks for clearing that concept! Sir, It would be great if you suggest some funds and diversifying strategy regarding my two goals, i mentioned!

Dear Hemant

Hemant-Great article .Please let me know the fair comparison between ulips of INDIAFIRSTLIFE INSURACE COMPANY LTD and mutual fund,expecially mutual fund..

Thanks Hemant once again for such a nice post.

I know it is impossible to time the market.Last year when the sensex was around 20500 I made lumpsum investments in HDFC Equity Fund,HDFC Top 200 Fund,Birla Sunlife Frontline Equity Fund and UTI Opportunities Fund.My returns from these funds are still negative.On the other hand I am getting decent returns from my investments in Kotak Mutual Fund and ICICI Prrudential Fund where I am investing through monthly SIPs for the last three years.The lesson which I have learnt is that long term monthly SIPs even in average funds are much better than lumpsum investments even in the best performing funds.

Hemant,

Great article, cleared some doubts that I had on MF.

Keep up the good work.

Rakesh

Thanx.

Respected Sir,

I am investing in SIPs as follows.

1.Reliance Gold Saving Fund – Rs.500/-per month

2.ICICI Prudencial Focused Bluechip Equity Fund – Re.Growth – Rs.1000/-per month

3.HDFC Equity fund – Growth – Rs.1000/- per month. Are these good funds for me? I want to invest some more funds. Please suggest me some good funds to invest. Thank you.

Dear Mahesh

Your selection of funds is good.For additional investment select the large cap funds from the list of funds for SIP given by Hemant.

Thank you Hemant for this wonderful article. It was absolutely great. The answer for the last question Mutual Funds Vs Direct Equity was too good. And you said it truly , investing in equity becomes addictive. it is better to invest in good MF for a long term .

Thank again for a wonderful article.

Welcome Velu

Dear sir,

really great article for young generation investors. Could you throw some light on sectoral funds like pharma, banking. Are these too risky to invest? How to go about them? Please suggest!

Hi Prakash,

Read this

https://www.retirewise.in/2011/05/sector-fund.html

hello sir,

my husband is investing Rs.25000p.m. in 5-6 funds like HDFC top200, BSL frontline, DSPBR top100, Reliance growth, HDFC midcap opp. for last 2 yrs. through SIP. my husband is saying that he will redeem these funds when sensex will touch 21000 mark or more as the NAVs will be higher and keep on investing through sips. may be it will take 3 yrs or 5 yrs or 1 yr. and put that redeemed money in either any debt fund like PO mis or FDs or STP. but i want to stay invested for 10-12 yrs. and when i’ll need that money i’ll redeem it to achieve our goal. so i’m confused whether to listen to him or try to convince him. please suggest!

Hi Chandrani

It does not appear to me that sensex is going to touch 21000 in near future.This is blessing in disguise for you and will allow your husband to remain invested in these good funds for a longer period of time.

I wanted to have a very straight and profeesional opinion about investing in Sundram Equity Plus NFO. I understand that it is advisable to invest in NFOs but sundaram is a good fund house and have a standing in the market. Your Opinion please to invest or not?

Hi Ali,

Who told you that it is advisable to invest in NFOs? I think this should be your agent who gets more commission when you invest in NFOs. NFO is the worst way to participate in Mutual Funds you don’t know about the track record of fund & NFOs with new themes are launched when there is fancy in the market. If you are investing from couple of years you should know what happened to IT funds that came in 2000 or Infra related funds that arrived in 2007. So in case of Sundaram Equity Plus they are trying to push gold which is fancy now a day. My suggestion is you should not invest in it & if you want to buy gold you can directly go for gold ETF or Gold Mutual Funds.

Hello Hemant Ji,

I’ve browsed through all of your articles & other sites but haven’t found out how tax is calculated on Mutual Fund returns.

I’ve just started to invest in Mutual Funds through SIP. My fund are :-

ICICI Focused Bluechip Eqty. – 5,000/-

ICICI Discovery Fund – 3,000/-

ICICI Dynamic Plan – 3,000/-

HDFC Equity – 5,000/-

I’d like to invest for long time (for atleast 10 years).

So how my tax is going to be calculated. Is it going to calculated yearly or when I stop the SIPs or how?

Hi Vinod,

Before answering your question let me tell you that are you very big fan of ICICI Mutual Fund? Almost 70% of your money is going in a single fund house which makes your portfolio very risky. I think either you are dealing ICICI Bank/direct for investments or your agent is having some special interest in ICICI SIPs. Check what’s the case because it will definitely going to have big impact on your investment planning. Now coming to your question as you said you are going to invest for 10 years & will redeem after that. In mutual fund tax is applied when you redeem that amount & if it equity fund & redeemed after 1 years the whole gain is tax free. So in your case investment done in first 9 years will qualify for long term capital gain but the investments done in 10th year will come under short term capital gain & you have to pay 15% on the gains. My answer is according to current tax laws but they can change after DTC.

Mutual funds give 18% returns conservatively if I consider a 5 year or 10 year view

Myth or mis-selling 🙁

Hi Sir,

I have taken below 4 SIPs

1. HDFC TOP 200 — 2000 Rs per month

2. Fidelity Equity — 2000 Rs per month

3. DSP Small & Mid Cap — 1000 Rs Per month

4. Reliance Gold Saving — 1000 Rs per month

Could you please suggest me if my portfolio is equally diversified.

Thanks,

Amit Kumar Gupta

Hi Amit,

It’s a good portfolio – keep holding.

I had left a comment earlier which seems to have been lost.My question is regarding rating of Mutual Fund Houses and Equity Mutual Funds.Recently many personal finance magazines have given ratings to fund houses as well as equity schemes.However the ratings given by different sources are different.This is mainly because no common yardstick is used in rating.Each source uses a different methodology of ratings.Hence I would request you to write an article on the methodology to be used by the investors before investing to arrive at the correct combination of the fund house and the equity scheme.

Hi Anil,

This is really a tough one – different type of ratings from different sources are creating a big time confusion in investor’s mind. Some are using quantitative techniques other are using qualitative. Some are using different time horizons – so one is talking about 3 years other is talking about 5 years. Even in qualitative criteria are different someone giving preference to alpha & sharp ratio and some others are talking about sortino. To add confusion asset management companies are promoting it where they are leading. I think even I am increasing confusion by writing all this. I think there are 2 solutions for investors – one they should develop their own research which is easy to say but hard to do or two stick to one of the resource which you trust most.

I will try to write something on this.

Hi Hemant

Thanks for your response.I have observed that even the expert advisors have a herd mentality.Most of them restrict themselves to their favourite fund houses.Even the authors who write about funds and fund houses give higher ratings to their favourite funds and fund houses and adopt a strange methodology which the investors can not understand.The resources which I use for research are Value Research, Mint and OLM.I hope these are OK.

Hello Hemant

Today I got a mailer from HDFC Mutual Fund regarding Flex STP.It says that it automatically increases the amount of investment in a falling market and decreases it in rising market.Some time back I had read in a Personal Finance Magazine that a similar concept is available in the case of SIP also.The idea behind this concept is to increase the returns by decreasing the cost of investment.The concept looks good but how it actually works in practice is not clear to me.Can you please throw some light on it?

Hi Anil,

These products are based on value averaging concept – which is a good concept & sometimes looks even better than rupee cost averaging(SIP). First value averaging is not used in best shape in India – value averaging says when market is going down add more amount & when market is going up there should be provision to redeem amount. Adding more units is available in many systems but no one talks about redeeming amount. Second in case of a sharp fall you need to add lot of money – say you are running a 4 thousand per month SIP & next month they may ask you to add Rs 15000 which is not practical for everyone. Value averaging is also not helpful in secular bull runs. So when we will see the calculations on paper it may look amazing but I think SIP with combination of asset allocation will be a better option.

Hi Hemant

Thanks for your response.Recently I read cover story of a leading Wealth Creation Magazine about SIPs.So far I had believed that one should invest 70 to 80 % of the investment in SIPs in Large and Midcap Funds.But in this article the author gives the breakup as 40 % in Large Cap Funds, 20 % in Flexi Cap funds, 20 % in Mid Cap Funds, 10 % in Value style Funds and 10 % in Infrastructure Funds.This has left me totally confused. I would like to have your take on it.

Dear Hemant,

I have started with 3 SIP’s with Rs 1000/-

Birla sunlife tax relief 96

Fidelity tax advantage

Reliance gold saving fund

Please tell me whether my portfolio has good fund.

Can you please suggest me which fund should i invest now i have two fund name but m confuse:

Reliance tax saver

Fidelity india growth fund

i will be investing it via SIP with Rs 1000\- and it will be long term…

Please assists me need ur help on this…

Regards

Mihir Vora

Hi Mihir,

It’s good that you have a diversified portfolio & you are investing in it through SIPs. And for tax planning you are investing in ELSS funds – more or less everything looks fine. But your confusion has confused me. Why you are comparing an ELSS fund with a normal diversified equity fund – both have different investment purpose. My suggestion is if you want to add new fund for tax saving purpose go for HDFC Tax Saver otherwise you can choose between DSP Top 100 and HDFC Top 200 Fund.

Hi Mihir

You seem to have special fascination for tax saving funds.Long term investment in equity funds is for wealth creation and not tax saving.For long term equity mutual fund investment select large cap funds from the list of funds given by Hemant for SIP.

Hello Hemant ji,

I have a doubt regarding MFs, I took an ICICI pru blue chip through SIP( 5000) monthly . I have an account in hdfc bank .Last month the money deducted from my saving . I can see the mf in my bank detail. But this months what i noticed that the money ( 5000) which should go to ICICI pru , but has deposited back to my account, that means this month , i have not given any money to this sip. When I asked my bank cs , she told that you must inquire with ICICI bank. I called the ICICI bank cs , she is saying that I have not any account in this bank, and since I took this sip through hdfc bank so I need to put my question there. I am really confused whether my money is going to ICICI prue through sip or not , if it is going then why they returned back this month installment .please help.

Hi Sangeeta

Sometimes after starting the SIP, fund house detects some problem in your SIP application or payment mode and reject the SIP.I think you should visit the office of your fund house ICICI Prudential Mutual Fund or the registrars CAMS to find out the problem with your SIP application and make the necessary correction or give a new SIP application to resume the SIP.Banks can not help you in this matter as they are responsible only for making the payments to the fund house from your account as per the mandate given by you.

Thanks Kapil for prompt reply, I will definitely do that , thanks again.

Hi Hemant

While considering investment in mutual funds we frequently come across the term diversification.However there seems to be no clarity on this aspect of investing.For some diversification means selection of different fund houses.For others it means investing in different types of funds.For some investing in three or four funds is enough for diversification.For others eight to ten funds are required for proper diversification.Terms under and over diversification are also frequently used.Can you please throw some light on this aspect of investment in mutual funds.

DEAR SIR,

CAN YOU PL. PROVIDE ME THE NAMES OF SOME MUTUAL FUND SCHEMS WHICH INVESTS IN PRECIOUS METALS ( DOMESTIC & OVERSEAS) , I HAVE ERAD SOMETIME BACK ABT.ONE SUCH SCHEME BUT NAME I DO NOT REMEMBER NOW.

Regards

Naresh Desai

982Valsad

Hi Naresh,

Never leave your number on public forums.

There are few funds that invest in international precious metal companies like – DSPBR world Gold, AIG World Gold & Birla – global precious metals.

Hi,

I have invested inNFO of following funds:-

1. religare business leaders fund-5000/-

2. religare PSU fund–10000/-

3. reliance gold saving fund–5000/-

am planing to invest in SIP of reliance gold saving fundplease advise me its good or not and also advise how i can switch from one fund to another in same family.

Hi Pramod,

Before switching anything switch your Mr Financial Advisor & if you want to say it was your decision to invest in these funds – my suggestion is start learning basics of investing. If we talk about your existing portfolio you already have a 25% exposure in gold so there is no need to add SIP in this fund. You have one thematic fund Religare PSU – such funds should only be part of once portfolio if you already have a strong portfolio with core funds. You have another large cap fund from Religare but again it is a poor performer. My suggestion will be replace these Religare funds with HDFC Top 200 & Fidelity Equity Funds and also start your planned SIP in them. Keep holding Reliance Gold savings fund but don’t increase your exposure in it.

Hi Admin,

Request you to kindly review the below SIPs of mine and provide your feedback/suggestions.

Policies Amount SIP Mode

Franklin India Bluechip, 2000 Monthly

BSL dividend yield, 1000 Monthly

BSL frontline equity, 1000 Monthly

HDFC Tax Saver, 2000 Monthly

HDFC Equity-Growth, 1000 Monthly

HDFC TOP 200, 1000 Monthly

Thanks,

Vijendra Singh

Age: 27 Years

Mumbai

Hi Vijendra

Your portfolio has already been reviewed.

Hi Hemant,

I had some time with 1 of Agent from Aegon Religare, i asked which is best Ulips or Mutual funds, suddenly he started explaining that MF’s are not good at this time and 1 should not go for that…and said Ulips are good at moment from there company, explained the schemes which have higher premium’s yrly, i know why he is telling abt high premium schemes bcoz he get good commission from that till the policy exists. he also explained abt the Money back and Pension schemes…. but the point i like to tell is……….we should have minimum knowledge before meeting agents…if nt they simply make fools……….

i have taken term insurance from Aegon he started telling me big stories……..but i did not fall under this trap………..that for giving me some knowledge Hemant..i had full debate with him asked many Q, but he could not answered. bcoz he has to make money for him……………

Thanks Hemant……………for giving me knowledge on investments………….

1. SBI tax gain SIP 1000/- 10yrs

2. HDFC Equity SIP 1000/- 10yrs

3. HDFC TopFund SIP 1000/- 10yrs

4. PPF Monthly 2000/- 15yrs

5. Savings account monthly 2000/- life time

6. LIC for my wife yrly 9600/- 20yrs

7. Term insurance 20yrs 20lacs, with riders ADD/Ci each 5lacs—total 7500 pa.

please go thro my portfolio and suggest me on this ,

Thanks Hemant

What do you advice for a peron of 55 years of age with practically financilly sound and want to invest an amount (30,000) in mutual funds for a period of 5-8 years. My main concern is is it advisable to invest in equity mutual funds at this age.

Hi M Ali

If a person is in sound health there is no issue in investing in equity mutual funds at 55 years of age.

Thanks!

Hi, Hemant.

Following are my monthly investments:

HDFC Top 200 (G)- Rs 3500.00 per month SIP

HDFC Equity(G) – Rs. 3000.00 per month SIP

Reliance Banking Fund (G) – Rs.3000.00 SIP

Reliance Growth fund(G) – Rs 1500.00 SIP

Reliance Regula saving fund(G) – Rs. 3000.00 SIP

HSBC Equity fund (G) – Rs. 1000.00 SIP

ICICI Prudential Life Time – Rs 1500.00 per month

PPF – 25000.00 per month

I have been investing in SIPs for last 4 to 5 years.Fund selection is entirely on experience gained by online briefs or books. Donno the direction of my investment.I have a life cover of 35 lakhs taken care of.Request you to kindly review my investment and provide your feedback/suggestions.

Thanx

Hi Prakash,

PPF Rs 25000 or Rs 2500

Will suggest you to hire some financial advisor in your area.

Its 25000.00 in DSOP ie Defence services provident fund. Do i need to relocate some funds and are my SIP funds worth investing….

Hi Prakash,

I have written something special for defense personnel – hope you will like it

https://www.retirewise.in/2010/12/financial-planning-for-defense-personnel.html

Dear Hemantji! Thanks for all the efforts. I have a few queries. It would be nice if you can throw some light.

Recently started two Rs.1000 SIPs in HDFC Top 200 & HDFC Equity. Just went through all the comments, & understood they both are almost identical. Hope to discontinue any one. Which one would you suggest?

Also I went directly to the HDFC AMC office & inquired about DIRECT investment. The Representative there said I could invest either DIRECT or through an Agent. The She introduced me to an Agent sitting there & said that he will not charge anything from me. So I agreed. He filled ARN No. in the form. My query is what is the Agent’s interest in all this. I know he gets some trail commission from AMC, which would be pocketed by the AMC itself if done DIRECT. Does he have any other interest? Actually I want to know if I invest direct, would it be more beneficial to me or it will be same?

Other two things I want to know is about Parking Surplus Funds & Flexibility options in SIP Installments. I have Rs. 1 lac in Surplus in SB A/C which is earning 4%. Where should I invest this Surplus – in some Liquid or Debt Fund from where it can be credited to the SIP A/C. For this to happen does both Liquid Fund & SIP should be with same AMC. Kindly suggest a few Funds too in this regard & also what would be Tax implication in case of this type of STP.

Sorry for the long post. Thanks & keep educating.

Hi Amit

Both HDFC TOP 200 and HDFC Equity are good funds.HDFC Top 200 is large and Midcap and HDFC Equity is multicap.Which one to have depends on other funds in the portfolio.

It does not matter whether you invest directly or through an agent so long as you are not paying anything extra.

For suggesting funds for your portfolio it is advisable to take the services of a financial planner.

Reg which option is better — Dividend payout, re-invest or growth–if investment tenure less than 2years ,maybe Payout better — the dividend amount you can put in some fixed income investment like PPF. With Div re-invest and growth options, there is a chance that if NAV is down at the moment you want to encash, you might get less. However, if investment tenure more than 2yrs, growth option best, I think. Your views please.

regds

Hi Shreedhar

Investment in equity mutual funds is done to meet the long term goals.Hence the horizon of investment is minimum of five years.For this purpose growth option is the best.Investment of less than two years comes under short term. For the short term investment in equity mutual funds is not desirable as it is very risky.

Hi..

Can you tell me whether its better to invest in MF in lump sum amount or through SIPs?

IT IS ALWAYS BETTER TO INVEST VIA SIP ROUTE SINCE IT HELPS INAVERAGING

BUT COMBINATION OF BOTH SIP & LUMPSUM WILL ALSO YIELD BETTER RETURNS SINCE LUMPSUM CAN EB INVESTED IN EITHER MIP OR DEBT FUNDS & SIP TO BE INVESTED IN DIVERSIFIED EUITY FUNDS . THIS WILL HELP IN MITIGATING RISK ALSO.

HEMANT IS IT CORRECT ?

Hi Ruta

SIP is the best route for investment in mutual funds to meet your long term goals.The greatest advantage is that once you start a SIP you can remain invested for a long time without bothering about the short term ups and downs of the market.The greatest disadvantage of lump sum investment is that you become a hostage of market timing.While it will be foolish to invest lump sum when the sensex is at around 22000,it makes sense to invest at a level of around 17000.You can always invest some lump sum whenever there is a sharp correction in the market.Probably this is the best time to make some lump sum investment.

Hello,

I am here for some advises from expert here. I have some amount ( 80,000) which I got by cancelling fixed deposit as it was gaining only 7 %. I would like to have your views , where to invest this amount ? Should I invest it again in bank FDs as the interest rates are high or should I invest it in lump sum to MFs as the sensex is down now . ( NB: already have a rd of 2000/monthly in bank for 2 yrs and 4 lakhs in Kisaan vikas)

2. Also please guide me some MFs for lump sum investment.

I have chosen the below funds to invest through SIPs / lump sum .

a. HDFC top 200 equity ( 3000)

b. ICICI prudence focused blue chip( 3000)

c. DSP black rock mid cap (2000)

d. Birla sun life ( which one ??? confused)( 2000) I want to have a diversified portfolio as hubby has already lost 7 lakhs in intra day trading 🙁

I am thinking to invest for 10 to 13 yrs with expect ion of gaining 13 to 15 %

3. One more question , I am investing through MF distributor , do I need to pay any commission to him ? shall I directly invest through my bank or should I personally invest through each fund house . Why investing in MFs is so confusing?

My mfs distributor told me that Investing through distributor , is better idea as I do not need to pay any charge for fund management , is he true?

Please guide.

Looking forward to hear from the experts.

regards

Sangeeta

Hi Sangeeta

Sorry to learn that your husband has lost so much in trading.I would like to inform you that investing in mutual funds is much better than trading but still subject to market risks.Before you start investing you must have some risk appetite.Normally you should expect a return of around 12%.The core of your portfolio should have large cap and large and midcap funds.Satellite of the portfolio can have multicap and mid and small cap funds.I think you mean Birla Sunlife Frontline Equity which is quite good.The funds you have selected are quite good.You can add one multicap fund if you want.

Once you have decided on the funds for your portfolio there is no need to invest through a distributor.You can always go to the offices of the concerned fund house and can get assistance from there in filling up application forms.

Hi Sangeeta,

Just read your message – sorry to hear that you people lost Rs 7 Lakh in trading.

Don’t feel offended by what I am going to write now – I don’t want to lose a good learner like you.

See at one place you have lost a big money & on another place you have a hitch to pay financial advisor. This is a very common approach by people & it is called “Penny wise – Pound Foolish”. A good financial advisor would have saved you these Rs 7 Lakh & many more – people need to understand this. Being financial literate never means that you don’t need to hire financial advisor. Hiring a right financial advisor is a time consuming process but may be one of the most important thing in your financial life.

One more thing few people think that finding few good performing funds is Nirvana but how you will control your behavior. Then they will say we are very patient about our investments – we are investing since 2005 & we never sell in fear. (even in 2008 when market was down more than 50%) And they are very sure that they will not do this in their lifetime – so my question is which one was your equation in 2008:

1. Your income was 10 Lakh & your equity portfolio size 5 Lakh. Or

2. Your income was 10 Lakh & your equity portfolio size was 1 Crore.

If your answer is 2nd you may not need investment advice from anyone. THINK

Thanks much Hemant ji and Anil ji, for your prompt reply. Yes I am also thinking to hire a financial adviser , but again not able to choose a good and certified adviser who can advise neutrally. Also I have a small baby to take care so really cant go office to office for purchasing funds, so buying funds from distributor seems good idea for me if I will not have to pay him .

thanks again .

You are welcome Sangeeta.

Dear Hemant,

I have been going through your posts and they have been most helpful. In 2006-2007 I got very much interested in investments and made a portfolio. Subsequently market crashed and then I got busy with work, and somehow I just didn’t keep up.

But now again I want to get into good investment options. Here is my portfolio

Investment Portfolio

S. No Fund name Investment year Fund Type

1 Rel Savings Equity Plan(G) 2006 lumpsum

2 HDFC Capital Builder (G) 2006 lumpsum

3 Franklin Templeton Prima 2006 lumpsum

4 ICICI Pru Infrastructure (G) 2006 lumpsum

5 ICICI Pru Dynamic (G) 2006-2008 in installments

6 ICICI Pru Dynamic (G) 2006-2008 in installments

7 Sundaram Mid Cap 2007 lumpsum

8 SBI Magnum Global (G) 2007 lumpsum

9 DSP Meryll Lynch 2007 lumpsum

10 Rel Vision Retail Fund(G) 2007-till date SIP:Rs 1000/-/month

11 Rel Diversified Power 2007-till date SIP:Rs 1000/-/ month

12 SBI Contra Fund 2007-till date SIP:Rs 1000/-/ month

I request you to please advice me on the following

1. Is my mutual funds portfolio ok, should I continue with all or discontinue some of them and acquire new ones.

2. I want to take additional 3 to 5 SIPs. Planning on HDFC Top 200, DSPBR Top 100 Equity and some more. Could you please guide me.

3. Any other relevant advice,like any lump sum investment. In total I can spare about 40 to 50K for any lumpsum investment, exclusive of SIPs.

Will really appreciate your advice.

Regards

Shradha

Hi Shardha

Investments in equity mutual funds are done to meet your long term goals.When you started your investments did you have any goal in mind? It appears that you have randomly selected some funds and invested without constructing a portfolio. Normally a well designed portfolio should not have more than five to seven funds.SIP is the best mode of investment.Once you start investing you have to do it regularly and systematically.After you start investing you have to track your portfolio to ensure that you do not remain invested for long in a nonperforming fund.

It appears that you have not followed these principals of investing.You have selected too many funds.In most of the funds you have done lump sum investments.Since you have not tracked your portfolio it has many nonperforming funds in it.

To construct a proper portfolio please read the post – Best Mutual Fund For SIP.

Dear Anil,

Thanks for the prompt reply. Actually the investment was done as advised by an agent at that point of time, as we were totally new investors & hence quite clueless .

But now after reading your articles, I feel that I will be able to make a better portfolio this time and I will definitely track it.

Thanks again

Regards

Shradha

Dear Hemant

Thank you for a very informative article.

I am a salaried executive aged 22 years, recently started my job and wish to invest in mutual funds but have some queries.

What is the difference in investment thro SIP and lumpsum (when market is low, like now a days). Is there any risk? Can I combine both at any period of time in future (as per availability of surplus funds like bonus etc.).

Secondly about time horizon, can I opt to exit any time/remain for more time, during the tenure of my investment. Suppose I start a SIP for 5 years initially, can I redeem my funds say after 4 years and on the other side, can I opt to extend it for 1-2 years more, if I wish to continue the investment

About taxation, at one place you mentioned, “So in your case investment done in first 9 years will qualify for long term capital gain but the investments done in 10th year will come under short term capital gain & you have to pay 15% on the gains”. How one can distinguish or calculate income of 1-9 years and of 10th year separately. Is it the income or investment that is subject to LTCG/STCG.

Thanks

Saumya

Hi Saumya

It is good to know that you are planning to start investments in equity mutual funds just after starting your job.All mutual fund investments are subject to market risks.In the short term you may see a lot of volatility and returns from your investments may even be negative. But if you remain invested for a longer period of more than five years in equity mutual funds, there is a potential of creating wealth.

SIP is the best mode of investment as you don’t have to bother about market timing.In lump sum investments you become a hostage of market timing.Yes, you can do some lump sum investment when you see the market correcting substantially.You can combine both modes of investment.

You can select any tenure for your SIP and you can increase or decrease it as per your requirement.You can also redeem whenever you need money.You have to only see exit load and tax implications.In ELSS funds there is a lock in period of three years.

Sorry, one more question.

Is investment in mutual funds either by SIP or lumpsum qualifies for deduction under 80C.

Thank

Saumya

Hi Saumya

Only the investments done in tax saving ELSS funds qualify for deduction under 80C.This deduction will not be available from next year.

Hello,

Thanks for the wonderful article. It was very good and gave a lot of information about the MF. I am 26 now and investing in the below funds for the past 6 months. Can you please let me know whether my selection is good. I would like to continute this below SIP for 10 years.

1)HDFC 200 Equity – SIP 1000 per month

2)HDFC Equity – SIP 1000 per month

3) Sundaram Select Midcap – 500 per month

4) HDFC Mid-Cap Opportunities Fund – – 500 per month

Please check whether my selection is good and i can continue for 10years.

Cheers,

Karthikeyan

Hi Karthikeyan

Your fund selection is very good but the portfolio lacks proper diversification as you have selected three funds from the same fund house. Normally we should have not more than one fund from a fund house as having so many funds from the same fund house makes your portfolio risky.

Dear ANIL KUMAR,

Thanks for taking time and replying to my doubts. Could please expalin, What are the other funds that can be included in my portfolio(other Funds details) i can have 1 fund in a house and will stop the others(since i have more than one fund from a fund house ). You help is very much appreciated. Thanks a lot.

Cheers,

Karthikeyan

Hi Karthikeyan

Since you are young and just starting your investments in equity mutual funds you can afford to have aggressive portfolio. Please select one fund from each of the categories mentioned in the post.To start with have one largecap fund, one large and midcap fund, one multicap fund and one mid and small cap fund.You can retain any one fund of HDFC Mutual Fund and replace others from other fund house from the list given.

Thanks a lot Anil 🙂

You are welcome Karthikeyan.

Dear Hemant & Anil,

Further to my post on 26th August, I have gone through your articles and decided on the following funds for SIP per month

Large Cap:

1. DSPBR Top 100 (1000/-)

Large & Mid Cap:

2. Fidelity India Growth(1000/-)

3. HDFC Top 200(1500/-)

Mid & Small Cap

4. IDFC Premier Equity (1500/-)

Multi Cap

5. HDFC Equity (2000/-)

Also, I have three SIPs of 1000/- each going per month since 2007, in Rel Div Pow, Rel Vision and SBI Contra. I want to discontinue Rel Power and start Rel Equity Opp for Rs 1000/-. For now I want to continue the Rel Vision and SBI Contra atleast till market picks up and I get a better ROI. Therefore I will have a total of 8 SIPs with an investment of 10000/- per month. I am looking at long term.

Please advice if my thinking is correct and whether the portfolio looks ok

Thanks & Regards

Shradha

Hi Shardha

The funds selected by you for your portfolio are very good.However for a monthly investment of Rs 10000/- eight funds are too many and do not provide any benefit of diversification. This is only diversification of numbers and not of style. Moreover you should not have more than one fund from a fund house in your portfolio as it increases your risk.Hence I would suggest you to consolidate.You can merge your investment in HDFC Equity with HDFC Top 200 and Reliance Vision with Reliance Equity Opportunities.

Thank you so much Anil.

Regards

Shradha

You are welcome Shardha.

Dear Sir,

I would like to have your valuable opinion with respect to my current Mutual Fund / SIP Portfolio, as mentioned below.

My plan is to build a corpus of Rs. 1 Crore within a span of 10 years. Hence, please advise the amount to be added to the present contribution / selection of funds, in order to achieve this target. I am 43 years old, working in a private sector company.

Thanking you,

Name of the fund Opton Start Date SIP Amount per month Holding Units Avg Price in Rs. Value at Cost in Rs.

Mutual Fund

Reliance Banking Fund Growth 14.12.2010 332.2060 109.8292 36,485.92

Reliance Equity Opportunites Growth 14.12.2010 544.0920 37.1583 20,217.53

Reliance Regular Savings – Equity Growth 12.12.2008 884.2240 13.4845 11,923.32

SBI Magnum Sector Umbrella Contra Growth 12.12.2008 367.8190 29.1900 10,736.64

SIP

Reliance Growth Growth 26.11.2008 2,000.00 171.5650 373.0365 64,000.01

SBI Magnum Sector Umbrella Contra Growth 02.12.2008 2,000.00 1,373.2470 48.0613 66,000.04

HDFC Top 200 Growth 20.02.2010 2,000.00 188.8190 201.2516 38,000.13

Reliance Diversified Power Fund Growth 28.02.2010 1,000.00 402.3700 69.5873 27,999.84

Sundaram Select Midcap – Appreciaton Growth 14.12.2010 2,000.00 119.9530 150.0599 18,000.14

Regards,

Ram

Hi Ram

Presently you have SIPs in five funds with total amount of Rs 9000/- per month. Considering annual return of 12% this is very low to achieve your target in 10 years.It is difficult for me to advise you about the amount by which you must increase your investment as I have no information about your income, savings as well as the other investments and expenses like insurance etc.

Presently you are invested in five funds of Reliance Mutual Fund and two of these are sector funds.This makes your portfolio very risky.Moreover the performance of some of these funds is poor.

To construct a proper diversified portfolio I would suggest you to read the post – Best Mutual Fund For SIP.

Dear Sir,

Thank you for the prompt response.

We have gone through your post “Best Mutual Funds for SIP” and found it most useful, as it clearly explains the criteria for selection of Mutual Funds.

My wife and I would like to invest a further amount of Rs. 40,000/- per month (Rs. 10,000 each in 4 funds) in SIPs. Accordingly, we have shortlisted the following Mutual Funds for investment through the SIP mode:

Large Cap:

• DSPBR Top 100

OR

• ICICI Prudential Focused Bluechip Equity

Large & Mid Cap:

• HDFC Top 200

Mid & Small Cap:

• IDFC Premier Equity

OR

• Sundaram Select Midcap

Multi Cap:

• HDFC Equity

OR

• Reliance Equity Opportunities

We would appreciate your advice in order to proceed.

From the earlier portfolio presented to you, could you please suggest which funds we should exit from? We would be truly grateful for your opinion in this matter

Thanks once again.

Best regards,

Ram

Hi Ram

You can have the following funds in your portfolio.

1 ICICI Prudential Focused Bluechip Equity

2 HDFC Top 200

3IDFC Premier Equity

4 Reliance Equity Opportunities.

Have 60% allocation in core and 40% in satellite. Keep tracking the performance of your funds after starting your SIPs. The performance of the fund can be checked by comparing with its index, category average and peers.

You can consolidate by merging your SIPs in Reliance Growth and Reliance Diversified Power with Reliance Equity Opportunities.

If you do not need the money right now you can remain invested in the funds where you have done lump sum investments till the market turns.

Dear Sir,

Thanks for the prompt reply. We will go by your advice and invest accordingly as well as keep regular track on the performance of our funds.

Best regards,

Ram

You are welcome Ram.

Dear Mr. Hemant & Mr. Anil,

Great knowledge base created on Mutual Fund investment by you. I thank you for the same as it proves to be a great help for person like me who is a new entrant in world of mutual fund. I have started investing in MF since June-11 onwards and request you to review my portfolio:

1) UTI Dividend Yield Plan: Rs.3000 p.m. (dividend payout);

2) UTI Master Value Fund: Rs.1000 p.m. (dividend payout);

(I want to convert both the above funds to “growth option” after 1 year or even before)

3) HDFC Top 200: Rs.3000 p.m. (Growth);

I can invest further Rs.3000 p.m. (max Rs. 10000 pm). My MF investment time horizon is about 10 years. I want to create corpus for my child education, who is 8 years of age and is in 4th standard. My target corpus would be 30 to 40 lacs. Request your review on my existing portfolio and suggest changes (if any). Also suggest some funds for balance amount to be invested (Rs.3000 p.m.) looking to my set goal. My age is 36 Years. My average take home salary on monthly basis is Rs. 32000-

Dharmesh Bhagat

Vadodara, Gujarat.

Hi Dharmesh

It is good to know that you want to construct mutual fund portfolio for education of your kid.I would suggest you to read the post – Best Mutual Fund For SIP for this.It is advisable to have select only one fund from a fund house. For your additional investment you can select one large cap fund.

Hello Anil Kumar ji,

Thank you very much for your suggestion.

For large cap fund, I want to opt for ICICI Prudential Focused Bluechip Equity Fund (G) say Rs. 2000 or 3000 p.m. Is this fund okay ??

I am also investing in UTI Master Value Fund (Rs,1000 p.m.) which is small & mid cap fund. Is this fund okay??? should I increase my investment amount to Rs.2000 p.m.???

Dharmesh.

Hi Dharmesh

Both ICICI Prudential Focused Bluechip Equity and UTI Master Value are good funds. You can consider both these funds for investment. However please ensure that your portfolio does not have more than one fund from a fund house.

Dear Anil Kumarji,

Can you please technically explain the exact difference between “dividend payout”, “dividend re-investment” and “growth” option. If I am targetting 30-40 lac corpus in 10 years can that be attained thru “dividend payout” or “dividend re-investment” or “Growth” option would be the best!. Please suggest with some examples (if any).

Hi Dharmesh

If you are investing to meet your long term goals then growth option is the best. You should opt for dividend payout only if you want to use the money which you get by way of dividend payments. Please note that whenever you get some dividend payment, the NAV of the fund gets reduced to the extent of dividend payment. In dividend reinvestment the dividend declared by the fund is not paid to you but is reinvested to buy more units for you. Moreover from the next year the dividend payment is also going to be taxed. So it is best to stick to growth option only.

Dear Anil Kumarji,

Thanks for your prompt response. I have already shared with you my MF investment profile which has two fund under dividend payout mode. One UTI Dividend yield fund & UTI master value fund. I invest fund thru my close friend but some how he is not convinced to convert these two fund into “growth” option for me. He is suggesting to move for “re-investment of dividend”. I am argueing for “growth” option. I am confused and don’t know what to do!.

Hi Dharmesh

You have to consider tax implications from next year. Right now dividend reinvestment option is also fine.

Hello Anilkumar Ji,

Can you please suggest me some best perfoming tax saving ELSS funds. I have to invest 40,000 p.a. Would it be advisable to invest in ELSS as it has lockin period of 3 years from each alloted units i.e. effectively it becomes 6 years (for total 3 years span). I am investing about 50,000 per year in EPS / VPF. Housing loan is now paid. hence gap of Rs. 40,000 has arised. Please suggest.

Dharmesh

Hi Dharmesh

You can consider Canara Robeco Equity Tax Saver. From next year you will not get any rebate on ELSS Funds. Hence you should think of some other option.

Thank you anilkumarji….. for highlighting the discontinuation of tax exemption to me. What about National Pension Schemes (NPS) ??? Can you suggest some high return options!

Hi Dharmesh

You can consider NPS. When you consider high return options, saving tax only should not be your aim. A good portfolio of diversified equity mutual funds only can give you decent returns.

Thank you Anilkumarji….

One more doubt I want to get cleared….

Mutual fund units are now available in demat form also. If I open a demat account with a private DP like Sharekhan or say Jhaveri Securities and start SIP through them i.e. the DP would pick the money every month from my bank account and buy MF units from stock exchange and credit the same to my demat account….. would this be a safe and secured method??? I mean, going forward MF may also compulsorily get in to demat mode only….. What would be your advice sir……

Hi Dharmesh

As far as investment in equity mutual funds is concerned it is best to keep the things as simple as possible. Construct a good portfolio and invest systematically every month via SIP route.

There is no advantage of investing in mutual funds via demat account.

I am hearing for the past ten years that investment in mutual funds is going to be made only through demat account. This has not happened and it is not going to happen in near future.

Hi Anil,

My question is which is best among HDFC top 200 ie Large & Mid Cap:

or HDFC equity ie Multi Cap. Can i have two funds from the same house. and otherone is that how i can judge whether the fund is not performing well just in 1 yrs of span as you said in former article. what are the decisive factor or criterion on which i can make judgement. as i am investing from 1.6 yrs in SBI magnum tax gain(g). but the return till now is not upto the mark in fact it is depressing (even in market high) it is not as par. hence i want discontinued this fund. If i withdrew sbi fund then is there would be any exit load. or will i get lumpsom amount just in single hand. i hear that in sip each installment should have 3 yrs span.

Please give your beneficial suggestion.

Hi Prakash

Please read the post – Best Mtual Fund For SIP for selection of funds. Normally you should have only one fund from a fund house in your portfolio for proper diversification and to reduce the risk. After you have constructed the portfolio you must track the performance by comparing it with its index, average of the category and its peers.If you find that a particular fund consistently performs poorly based on this criteria then you should take corrective action.Moreover many rating agencies give star rating to funds.If you find that a fund begins to lose star ratings then it is the time to exit the fund.

Yes the lock in period for ELSS funds is three years. This means that you have to remain invested in the fund for three years to claim tax benefits.This does not mean that you must contine with your SIP for thee years.Morover you will not get any tax benefits from such funds from next year.Hence you can stop your SIP now.You will be able to withdraw your money only after you complete three years.

I want to invest in Quantum Mutual fund with SIP mode. Is it profitable Investment in a long term.

Hi Suresh

You have only given the name of the fund house and not the scheme in which you want to invest.Moreover, while investing all the funds in the portfolio have to be considered.One fund is not to be considered in isolation.

Hello Hemant,

My Investment Plan:

1) Investments in Mutual Funds: I have decided to invest Rs.6000 monthly through SIP’s and have prepared the following portfolio after some research.

1) ICICI Pru Focused Bluechip ( Rs. 1000 )

2) HDFC TOP 200 ( Rs. 1000 )

3) IDFC Premier Equity ( Rs. 2000 )

4) IDFC Smal & Mid-Cap Equity ( Rs. 1000 )

5) HDFC Equity( Rs. 1000 )

I have already started with IDFC Premier Equity, IDFC Mid & Small Cap and HDFC TOP 200 this month. The other three I will start after being sure that I am going on the right path. So my question to you is, whether my selection of funds is right or does it require any change. Also, I was not sure whether to have HDFC Equity or should I replace it either with HDFC Mid-Cap Opportunities or with DSP BR Micro Cap Fund.

Horizon: My horizon is long term (15 years) and since I don’t have too many responsibilities at this moment I am willing to take more risks in anticipation of greater returns.

2) Tax Saving & Insurance (Aim to take benefit under section 80(C) tax benefit of upto Rs. 100000)

(i) PPF Account: Rs. 70,000 annually ( Should I stay with this or should I take Jeevan Anand for next 25 years)

(ii) I have taken Jeevan Shree and am paying Rs.25000/ annum

3) Saving : I have also started a Recurring Deposit of Rs.10,000 per month for 1 year and the deposit will be used to fulfill the slot of Rs.100000 investment as lump-sum planned for each year. This strategy I wish to continue for years to come.

Kindly advise if I have designed the investment structure right and would like to know the possibilities of optimizing it further.

Thank you

Hi Anu

For an investment of Rs 6000/- per month you do not need five funds. Three will be fine.Moreover, you should not have more than one fund from a fund house. You can consolidate by selecting only one fund from HDFC Fund House and IDFC Fund House.

Having recurring deposit to accumulate Rs 100000/- for lump sum investment does not make any sense. Systematic investment is the better mode.It will be better if you increase your SIP amount to Rs 16000/- per month.

Is mutual fund best vehicle for Investment of Retail investor ( equity Only)?

Hi Sham

Yes , investment in equity mutual funds via SIP route is the best mode of investment.

Hello Sir,

I Am very new to the Mutual funds and stuff, I don’t have too many responsibilities at this moment and can take risks where i would expect good returns in 3-5 years before marriage, these amount would be useful to my parents.

1) HDFC TOP 200 ( Rs. 1500 )

2) IDFC Smal & Mid-Cap Equity ( Rs. 1500 )

3) HDFC Equity( Rs. 1500 )

4) UTI Dividend yield Growth (Rs 1500)

5) Reliance Gold Saving Fund Growth Plan (Rs 4000)

So please look at the below mentioned funds which i have opted for and provide you valuable suggestions.

Thanks

Neha

Hi Neha

All funds in your portfolio are very good. However your exposure to gold is on the higher side. Normally it should not be more than 10%. This makes your portfolio very risky. Since you are young and prepared to take risk it should be fine. Hopefully your investment in gold may turn out to be good at the time of your marriage. Best of luck.

Respected Hemantji

I am 45yr old and in govt service I alredy invest in these fund through sip

1.Rs 2000/ in HDFC TOP 200.

2.Rs.1000/ in HDFC MID CAP OPP.FUND

3.Rs.1000/ in ICICI PRU FOCUSED BLUCHIP EQUITY FUND

4.Rs.1000/ in TATA DIVIDEND YIELD FUND

5.Rs.1000/ in TATA EQUITY P/E FUND

I want to discontinued in Tata dividend yield fund and tata equity p/e fund and start sip in RELIANCE EQUITY OPPORTUNITIES FUND Rs. 2000/ and rs 500 in Reliance gold saving fund. Pl. comment on my portfolio and give me any other advise my time horizen is 10 to 15 year when I will retire from service.

Thanks

Hi,

Some of the funds in your portfolio are consistent performers like the HDFC Top200, HDFC equity, UTI dividend yield.keep youeself invested in these fundds and in future try to increase your allocation to these funds.

As you are new to MFs, I suggest you to start with large caps only.

You can include Frenklin Bluchip, IDFC premier equity, BSL frontline and other similars.

In starting keep away to the secotrials funds.

Hope it helps.

Thanks

Hi

I am 22 years old and just started with a job. I plan to invest 5K per month in mutual funds. Infact, I already opened an account and made initial investments in different schemes today itself. I chose following funds:

1.) HDFC TOP 200 (1K PER MONTH) > LARGE CAP FUND

2.) HDFC EQUITY (1K PER MONTH) > MULTI-CAP FUND

3.) HDFC PRUDENCE(1K PER MONTH) > BALANCED FUND

4.) HDFC MONTHLY INCOME-LONG TERM(1K PER MONTH) > DEBT ORIENTED FUND

Now, my questions are:

1.) Is my portfolio right?

2.) 1k which is not shown above is lying pending to invest in gold. Since I donot have demat account, I cannot buy gold etf. I was planning to invest in reliance gold fund but after reading one of your articles, I have put an idea on hold. Kindly suggest me on how to make investment in gold then???:O

3.) Now comes the main question. In order to set up SIP with fundsindia, I am facing some problem since they dont have tie up with my bank for auto debit (something like that). But I didnot want SIP in first place. I rather plan to invest myself in a disciplined way every month after watching market. Now the question is : Does it make any difference whether I invest in hdfc top 200 via SIP or myself invest every month(flexible in this case). I mean, by investing manually every month, am I missing some of the advantages of SIP like compounding returns, lesser maintenance charges by mutual fund house to SIP customers or anything like that..:O

4.) Also, I need to have tax rebate. What are the best investment options for tax savings with decent returns?? Initially, I wanted to add hdfc tax saver as well but lock in period of 3 years made me stay away from that.

Kindly reply to these issues of mine. Shall be very thankful to you.

Hi Monjo 3311

This has already been answered.

Hi

Can you please copy paste the answers for the 4 ques asked because it woud be difficult for a novice investor like me to go through each already answered questions to find my answer. Thanx

Hi Monjo 3311

Only yesterday you had asked the same questions on some other post. Obviously you have copied and pasted these on this post. You should know where these questions were asked. Whenever I am able to locate I will let you know.

Hi Monjo3311

Please read the comments in the post -Best Mutual Fund For SIP to get your answer.

Dear Hemant and Anil

Very happy to see your guidance changing the way people are making their investment decisions.

I am 28 and want to start by investing 12.5 k per month in the below mentioned funds. Please correct them and reallocate them if you see any issues. Feel free to add or remove to make the portfolio correct. I want to continue investing for another 10 years through SIP.

HDFC Top 200 (Rs. 2500)

Fidelity Tax Advantage (G) OR Fidelity Equity Fund (G) —- (Rs. 2500)

HDFC Equity (G) — (Rs. 2500)

Canara Robeco Equity Tax Saver — (Rs. 2500)

DSPBR Top 100 — (Rs. 2500)

Thanks

Hi Mir2507

You have selected two tax savers. From next year you are not going to get any income tax benefits from these funds. Moreover your money is going to be locked for three years.

You have selected two funds of HDFC mutual which is not the correct approach.

You can consider these funds :

1 ICICI Prudential Focused Bluechip Equity Fund.

2 Reliance Equity Opportunities Fund.

3 HDFC Midcap Opportunities Fund.

You can retain DSPBR Top 100.

You can invest in tax savers for six months if you want and then exit and divert the investment to equity funds of your portfolio.

Thanks Anil.

I will drop the tax savers and go with the below mentioned portfolio.

Just a small question. (2) and (3) are mostly into midcaps and is it advisable to have 50% exposure to midcaps ? Will it do good to add another large cap and take the portfolio to 5 mutual funds ? Please clarify.

1 ICICI Prudential Focused Bluechip Equity Fund

2 Reliance Equity Oppor – RP (G)

3 HDFC Midcap Opportunities Fund

4 DSPBR Top 100

5 —-(fidelity equity or another plan of your choice)—-

also in (2) there are two plans retail and institutional. I have selected retail and growth. Is it correct ?

Thanks

Hi Mir2507

Four funds will be fine. There is no need to add any other fund. Reliance equity opportunities fund is a multicap fund and not small cap fund. It is not necessary to invest equally in all the funds. You can invest more in large cap funds and less in multicap and mid and small cap fund. The exact allocation will depend on your risk appetite. Retail and growth option are fine.

Thanks Anil

Finally decided with the below combination. (13 k/ month)

1 ICICI Prudential Focused Bluechip Equity Fund – 3500 Rs/month

2 Reliance Equity Oppor – RP (G) – 3000 Rs/month

3 HDFC Midcap Opportunities Fund – 30000 Rs/month

4 DSPBR Top 100 – 3500 Rs/month

As mentioned again and again in this thread will revisit the portfolio once a year.

Hi Mir2507

Your portfolio is perfect. Best of luck.

Hello,

I have started an SIP in four of the MFunds and tax savings also ON FEB2011, Kindly let me know if my selection is good, and I will keep this sip continue minimum 7 years.

HDFC TOP 200 G – 5000/-

FIDELITY EQUITY FUND G – 2000/-

RELIANCE RSF BALANCED G – 1000/-

DSPBR MICRO CAP FUND G – 1000/-

HDFC TAX SAVER G – 4000/-

FIDELITY TAX ADV G – 2500/-

Hi AJ

Your portfolio lacks proper diversification across fund houses. You should not have more than one fund from a fund house.

I understood the difference b/w growth and re-investment option.I am doing SIP’s in UTI dividend re-investment plan.I want to know how will it affect my tax?I was mis-guided by the UTI person that dividend option is better than growth.Today i understood the difference.So please let me know about the taxes sir.

hi sir,

i invested Rs.50000 in equity mutual fund about 2 months back.But now i noticed thar the total fund value has gane below the investment and now it stants to Rs.48000.I’m not happy with the situation.What should i do now?Please reply me as soon as possible.

Hi Padmavati,

Your portfolio is only down by 4% & your are worried.

Do only one thing – LEARN.

Hi Padmavathi

Is this your only investment in mutual funds? What was the purpose of this investment? Have you invested lump sum?

I understood the difference b/w growth and re-investment option.I am doing SIP’s in UTI dividend re-investment plan.I want to know how will it affect my tax?I was mis-guided by the UTI person that dividend option is better than growth.Today i understood the difference.So please let me know about the taxes sir.

Hi Kirti

If you are so much concerned about the taxes then why don’t you go for growth option?

Actually the problem is that I have already started my SIP’s and now the person from UTI said I cant change my plan from re-investment to growth.

Please help me out.Can I change my plan?If yes, how?

thanks in advance

Hi Kirti

Yes you can change your option without any problem. A transaction slip is attached to your account statement which gives you various options. You have to just tick on the growth option and deposit the slip at KARVY or UTI office. Don’t forget to to take acknowledgement.

Hi

You explained very well in question about “Dividend or Growth”

And conclude with the words “However, the truth is that it does not make a dime of difference which option you choose, from the pure investment yield point of view.”

But you end with “There is a caveat, though – Investors should opt for that option that minimizes their tax liability.”

Is the tax treatment for these 3 types are different? Will you please be kind enough to explain the same using some example?

Thanks

Umesh

Hi Umesh,

Read this

https://www.retirewise.in/2011/12/mutual-fund-taxation-in-india.html

Hi

You explained very well in question about “Dividend or Growth”

And conclude with the words “However, the truth is that it does not make a dime of difference which option you choose, from the pure investment yield point of view.”

But you end with “There is a caveat, though – Investors should opt for that option that minimizes their tax liability.”

Is the tax treatment for these 3 types are different? Will you please be kind enough to explain the same using some example? An investor always welcomes

the option that minimize ones liability.

Thanks

Umesh

Already replied.

Hi,

I have today gone through an article in moneycontrol website about mutual fund investments. It says that the MF industry in India is approaching a standstill. The returns accumulated in the last 10years were lost in during the ongoing slowdown / fall in equity market as there are no enough talents to manage the funds properly.

I thought of knowing your comments on the above website and article…

I think this article is not completely true, what i know mutual fund managers are more equipped with tools and information than what they had 10 years back. Even the returns from some of the fund houses are 20-25 fold in the same 10 years time the article is suggesting. Infact i found there are very good fund managers available with many fund house having different view points and have proven their perspective as well. Probabaly prashant jain (HDFC) would be on highest ranks as he handle 4 largest funds of industry simultaneously. Also fund managers of DSPBR, IDFC , ICICI, Franklin are great return earner.

Hi Padmanabhan

Investments in equity mutual funds are subject to market risks. The returns given by a mutual fund are not only dependent on the talents of fund managers. The fund house also has a role to play. In good fund houses systems are in place so that the role of an individual fund manager is considerably reduced. If the market crashes even a good fund house and a star fund manager can not do any thing as they are not magicians.

Dear Hemant Ji..