Got a question on ASK US “Please let me know your take on the LIC Samridhi Plus, whether one should go for it. Any other option which will be better than the LIC Samridhi Plus. Is Guaranteed Highest NAV usually preferred or not?” and I simply replied “My answer is NO”. So let us understand why I said NO to this scheme.

First check – What is LIC Samridhi Plus (Table No. 804)

Let’s me share a presentation on features & benefits of LIC Samridhi Plus & later you can check 5 reasons why you should not invest in this yojana.

Must Check- New LIC Jeevan Akshay VI a Crazy Guaranteed Annuity Plan

LIC Samridhi Plus Features & Benefits

ULIP plan 804 –

5 Reasons why you should not buy LIC Samridhi Plus

1 Because LIC Samridhi Plus is an Insurance Scheme

Oh! What went wrong everyone knows this is insurance policy from LIC.

We have always said that one of the biggest mistake people do is mixing insurance & investment. If your need is just insurance, that is, you just want to build up a cushion against the risk over your life this policy is not for you. If you are aiming that you get good returns that market is offering over a long period of horizon, again… but this policy is not for you.

Check – LIC Jeevan Arogya Review – Should you buy it?

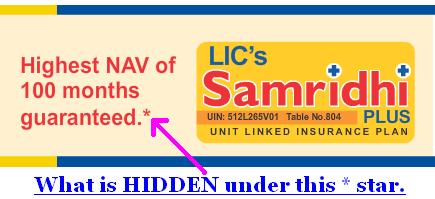

2 Because LIC Samradhi Plus is a Highest Guarantee NAV Scheme

First people confuse Highest NAV with Highest return. Second highest guarantee NAV does not mean that the amount in your investment account is guaranteed. (Because expenses are charged by redeeming units)

Also Read: Psychology of an Indian when it comes to Life Insurance

Let’s understand what is highest guaranteed NAV is?

“Most of them use an investing strategy called dynamic hedging or constant proportion portfolio insurance (CPPI). Under this, the fund manager will constantly reallocate money between debt and equity classes to assure the previous highest NAV.

In year one, your investment will be split between debt and equity in such a manner that you get an assured NAV of Rs10 at the end of 10 years. Over the year, if the equity market goes down, your capital stays put as you have bonds. But if the market goes up, you will see the NAV rising. So, let’s say, we are at an NAV of Rs15 after a year and the market sinks 15%. The fund manager will sell equity and buy bonds to secure the highest NAV till then.” Source Livemint

Must Read – Story of a Life Insurance Advisor

If you can notice it works against principal of equity investing. Rule says invest in equity while market is down but fund do just opposite of it.

3 Because similar scheme like LIC Samridhi Plus have poorly performed

Last year LIC launched similar scheme even with more pomp & show by the name LIC Wealth Plus. Its NAV is right now below 10 and mind you expenses are deducted by reducing units & not from NAV. In the same period SENSEX has delivered return of 15% & even Monthly Income Plans have delivered good Returns.

Also read what we wrote at the time of LIC Wealth Plus Launch.

Check – Review: LIC New Term Plans – Amulya Jeevan II & Anmol Jeevan II

4 Because LIC Samridhi Plus is playing Gimmick with Accidental Benefit

I read it in Economic Times “Accident benefit option is also available under this plan that will be equal to the life cover up to a maximum of Rs 50 lakh, subject to certain conditions.”

Why they always add condition & * with simple things.

It’s not free – they are charging for it.

Accident Benefit charge – It is the cost of Accident Benefit rider (if opted for) and will be levied every month at the rate of ` 0.50 per thousand Accident Benefit Sum Assured per policy year.

Must Check – LIC New Jeevan Nidhi Review – Pension with Tension

5 Because LIC Samridhi Plus is Expensive

Let’s compare LIC Samradhi Plus regular premium expenses with equity diversified Mutual Fund.

- Premium Allocation Charges: 6% in first year & 4.5% thereafter. (Mutual Fund NO Entry Load)

- Fund Management Charges: .9% every year. (Mutual Funds average charges 2% but you have variety of funds available to choose from & you don’t have compulsion to stick to a fund)

- Guarantee Charges: .4% every year. (Guarantee is a gimmick still they are charging for it)

- Mortality Charges: This is the cost of life insurance cover which is age specific and will be taken every month. The life insurance cover is the difference between Sum Assured under Basic plan and the Fund Value after deduction of all other charges. (Even if you buy term plan you have to pay mortality charges)

- Policy Administration charge in LIC Samridhi Plus `30/- per month during the first policy year and ` 30/- per month escalating at 3% p.a. thereafter, throughout the term of the policy shall be levied. If we convert Policy Administration charges in yearly Rs 30 x 12 = 360. Now if we see it in percentage terms it is 2.4% every year if premium is Rs 15000 yearly. I am never able to understand this charge. (In few other ULIPs I checked this charge sometime goes as high as 5-7% every year)

Right to revise charges in LIC Smradhi Plus (Source – LIC website): The Corporation reserves the right to revise all or any of the above charges except the Premium Allocation charge, Mortality charge and Accident Benefit charge. The modification in charges will be done with prospective effect with the prior approval of IRDA.

Although the charges are reviewable, they will be subject to the following maximum limit: Policy Administration Charge – `60/- per month during the first policy year and ` 60/- per month escalating at 3% p.a. thereafter, throughout the term of the policy. Fund Management Charge: The Maximum for Fund will be 1.30% p.a. of Fund Value. Guarantee Charge shall not exceed 0.60% p.a. of the Fund Value.

So charges can be hiked & they are not hiding it.

My View on LIC Samridhi Plus

If I were a film critic my rating would have been some what like “waste of time (& money also)” or “must avoid”.

The thing that pains is a responsible company whom billions trust with their money, when it comes to last days of year and it knows that this is the time most people will complete their tax savings and every year launches a product just to boost it sales and forgets the investor’s benefit(Read: Exit strategies for mis sold insurance polices). Remind me of a sher (poetry):

“EK HI ULLU KAFI HAI BARBADE GULISTAN KARNE KO,

ANJAME GULISTHAA KYA HOGA JAB HAR SHAKH PE ULLU BAITHA HO.”

Would you like to share your views or ask any question?

Hi Hemant

That was an excellent article. Keep up the Good Work!

Thanks Loney – Must Share it with your friends.

Hi Hemant,

It was a great work.you completely described the details of the samridhi plus.congrats

it helped me a lot

Could you please let us know the plan icici prude life’s new one

pinnacle super

i think it is also having insurance plan.but some switching option is their.could you please give a details about this plan

Best regards

Roby George

Hi Roby,

My suggestion is don’t confuse your financial life – don’t mix insurance with investment.

Hi Hemant,

could you suggest me some good investment skims

Hi Mihir,

Start Investing in Mutual Fund SIPs.

HI HEMANT

A eye-opener again.

keep up the good work.

Hi Paritosh,

Thanks for appreciation. 🙂

Dear Hemant,

Very much agree with u.

To take insurance for 10 yrs means wastage of insurance only.

Hi Paresh,

You rightly said what’s the use of having insurance for just 10 years.

But do people really understand importance of Insurance 🙁

Well said!

The sad thing is that I have known a person who has no dependents who has been sold a ULIP.

Why would anyone without dependents buy an insurance product. Such is the magnitude of mis-selling that it is indeed heartening to see such good forums and blogs aimed at creating that awareness among investors.

Hey Loney,

Good you shared this example – I wrote similar thing in earlier article “Strategies for Young Investors”.

How about Bharti Axa Life True Wealth plan, can i invest in it. Current NAV is 8.97. Please suggest!

Thanks

Hi Vishal,

I just want to say that you LUCKY because you have not invested in this policy.

Hi Hemant,

Myself is not so lucky :(. I invested 40,000 pa for this Bharti axa True Wealth, yet to get policy documents though. Issue date likely to be 28-29th Nov,2011. Should I get out of this within free-look period. Please advise.

Thanks in advance.

Indradeep

Hi Indradeep,

You are damn lucky – you still have sometime to use free-look period. My suggestion you should go through this article (also check all the links in the article) – then take a final call

https://www.retirewise.in/2010/12/psychology-indian-life-insurance.html

Hi Hemant,

I have submitted reoke of my policy within Free-Look period and Bharti AXA may have started to process it. The agent, who sold it and his manager are pursuing me hard to retain this policy. They are repeatedly asking to duly consider it and says this is the best product in market, even they are saying if I subscribe this policy, after an year or two I will ask other people to purchase this policy too. For the time being I asked them I will be taking a decision after one or two days.

But after going thru your suggestion and links, I see little merit in this policy. Will it be a mistake to withdraw from the policy? Need your suggestion.

Thanks,

Indradeep

Hi Indradeep,

You can withdraw this – definitely its not going to be a mistake but a wise decision.

Hi Hemant,

Thanks for ur reply and ur insightful article. During the free look period agents again tried to persuade me but I remained adamant and few days back I got message from Bharti AXA that they have dispatched the cheque deducting stamp duty and other charges.

Looking back at my investment portfolio, I find various policies like Bima Plus, Bima Gold, Jeevan Anand, Jeevan Varsha etc. which were started by my father,now retired, and currently being carried by me. All of them are 2-3 years old. Will it be wise to carry on investing in these policies?

Thanks,

Indradeep

Hi Hemant,

Your views are always interesting and upto the point. I want to know your views on LIC Market Plus-1 policy as it does not have any risk cover and is purely based on investment although there are some allocation charges. So what is your take on LIC Market Plus-1 policy?

Dear Manoj,

LIC Market Plus-1 is a unit linked deferred pension plan which is closed now.

In a pension plan, if you take the full maturity at vesting age or before, the total amount is taxable.

Although charges on this policy are on a lower side in comparison to other ULPP in the industry, it will not be enough to meet your retirement goal.

Better to sit with a Financial Planner and match all your investment with your goals and then take a decision.

@Manoj

I second with thoughts of Jitendra.

dear Hemant . . . .u have rightly said that the responsible co. like LIC should not launch this type of plan

Hi Hemang,

Now I think they are IRRESPONSIBLE.

Nicely compiled information!

Got very little time but I think more time would not have changed my views. 🙂

Hi Hemant,

Your views are always interesting and upto the point. I want to know your views on LIC’s pension policy single primium. i forgot the name of the policy. my agent told me about this like how it works & how i get the fix interest annualy . should i go for it.

Hi Himanshu,

Pension plans are actually TENSION plans – don’t invest.

Appreciate your clear and straight-forward review which is easy to understand and act upon. Well done Hemant!!

Thanks Jaswinder.

This time I thought of keeping it straight-forward as it is open & shut case.

Hemant

In morning I read “LIC Sold 75000 policies of LIC Samradhi plus in first 10 days. Amount mobilised 300 Crore” 🙁

Hi Vipin,

Thanks for sharing this. This is magic of LIC or herd mentality at its best.

If you agree with my views must share this article with your friends – we can save few more financial lives.

i believe SMRIDHI PLUS is actually adding(PLUS) SMRIDHI to LIC’s already gargantuan CORPUS 😉

Hi Hemanth

Last week my agent sold me this policy. After reading your article I have realized that it was my big mistake.

Please advice what should I do now.

@Naveen,

Every policy will have a free look-in period of atleast 15 days. So, you can cancel your policy within this time without paying heavy charges.

@Hemant,

Thanks to you for letting us all know the details and helping us to avoid falling into such traps.

Thanks Santosh for Helping Naveen

Readers can also read – How to exit mis-sold insurance policies

https://www.retirewise.in/2010/02/exit-strategies-for-mis-sold-insurance-policies.html

You have rightly said that the insurance should not be mixed with investment. So one should take “term insurance” only as per his/her requirements. For investments, there are various other options like Mutual funds, equity market, Debts, etc. to chose from.

TFL readers are getting smart or only smart people are coming to TFL. 🙂

HI HEMANT

Will you plz advice ‘How should one plan for retirement purpose from the age of 30 years.’

Hi Paritosh,

Buy unit linked pension plan LOL 😉 (please don’t follow this)

See retirement is the most important goal for everyone – it is not easy to share this thing in just a comment.

You can go through these videos – you may find them helpful.

https://www.retirewise.in/2010/11/financial-planning-retirement-planning-guide.html

Hi Hemant. Thanks for the valuable info given here. I am an LIC agent myself but have been advising people against buying ULIPs. I have burnt my own hands buying ULIPs. Only after I became an agent I understood how I was at a loss. Though the idea is great as in it takes the headache out of paying seperately for insurance and investment purpose, the way it works is flawed. One wud rather invest in MFs for growth and term plans for risk cover and have peace of mind.

Thanks Sanket,

That’s the difference between advisor & agent. Agent is always ready with a new policy if he see some opportunity to sell but advisor advices according to the need. Hats off to you as you shared your story.

One of my friend told me that his uncle is LIC agent & sold almost 30 policies of LIC Samridhi Plus but don’t know how this will work – even don’t know what is equity & debt. 🙁

LOYALTY ADDITION IS NOT GUARANTEED BY L I C. AGENTS ARE GIVING ASSUMPTION OF 10% P.A. AT THE TIME OF MONEY PLUS PLAN SAME FUNDA PUBLISHED BY AGENTS AND OFFICERS OF LIC FOR THEIR OWN INCENTIVES.

NOW MONEY PLUS IS GOING IN MINUS.AGENTS AND OFFICERS EARNED HUGE COMMISSION AND INVESTORS ARE LOOSING THEIR HARD EARN MONEY.

DON’T TRUST JEEVAN SARAL AS GOOD INVESTMENT.

ALL INSURANCES ARE GIVING ONLY 3to5% return. NOT MORE THAN THAT.GO FOR LONG TERM RECURRING IN BANKS.

Hi Satish,

Money Plus is ULIP – if someone understands this product he should be aware that returns will be impacted due to market performance.

But truth is 90% of people think lic will give returns from it’s pocket. 🙁

I was about to invest in it but thought of exploring on the net. Then I came across your review on Smridhhi. Now I am totally blank with my investment plan. Please guide me which is the best option for reaping good investment returns in 5 years.

Hi Anita,

Read this

https://www.retirewise.in/2010/06/long-term-and-short-term-investments.html

Thanks alot. Iam saved from falling in trap of Samridhi plus.The charges being levied are exorbitant.

Hi Neha,

Must share it with your friends we can send few more financial lives. This plan is closing on 24th May.

It is sickening to note that the premier insurance institution of the country is continuously coming with such schemes, regularly before the close of every financial year. A lot of effort is required to spread the financial literacy – to make people understand the difference between insurance and investment. I appreciate and support your earnest and sincere efforts in this direction. Keep up the good work.

Thanks Elaya for sharing your views.

You should read Yogi’s take on this. A complete opposite of yours.

Hi Manish,

I read that & I am not able to understand why they wrote so.

They have also written in the end “will have to be cautious about is the feature of the guarantee of highest NAV. This is more or less a misleading term.” But their explanation of this fund(how it will work) is far from truth.

One more thing – I remember there was 1 MF structured scheme based on CPPI model which returned only principal amount to investor after 3 years. (Maturity was in 2006 or 2007)

Hi,

I was think for some child plan then i tried to explore more but didn’t find any good option. In between i just started reading TFL and then i decided to get Term plan and do start investing in mutual funds or PPF. For term plan i read the article on Jao investor. Article was awesome but not able to decide for which term plan i should go. Btw i already have one term plan which covers 10 lacs but i need more of 25 lakhs because i am married and have child too. Can you please suggest me which term will be a suitable.

Thanks,

Sanjay

Hi Sanjay,

On coming Tuesday I am going to add “How to choose term plan” – may be you find it useful.

HEMANT,

In India INSURANCE is not taken, it is sold. All officers are enjoying huge salary

and incentives. but policy holder is not getting good returns, instead of controlling

their management expenses they are pointing toward share index.

Still I am having MONEY PLUS brochures issued by L I C through their AGENTS.

showing high returns. Now a days agents are selling JEEVAN SARAL, showing pay Rs. 5000/-p.m.and earn Rs. 1CRORE after 30 yrs.

Hemant is it possible. Some agents says it is guaranteed. BUT officers are not taking action against this. Only for their incentives and promotion.

Hi Satish,

What you are saying is true – I don’t know why LIC or IRDA are not taking any action.

We wrote about this at the time of LIC Wealth Plus & also shared the one-pagers.

Dear Hemant,

a very informative article. Infact after going through several such articles I am going for a term insurance plan. Thank you for the information

Hi Palash,

I am really feeling good that you are going to buy a term plan.

Hi Hemanth

I am looking at investing Rs1000 – Rs 2000 / month in SIP or mutual funds. Please let me know which SIP’s is performing well over a period of time

Thanks,

Ranjith.

Hi Rajith,

You should read this

https://www.retirewise.in/2011/02/systematic-investment-plan-mutual-fund-sip-best.html

you can also check comments.

Appreciate this article. You saved me from getting into worry ful of investment portfolio. I am young invester and just learning. I really wonder why people get into such rediculous funds which have so many complicated charges…

Hi Krishna,

Simple reason is “People want to earn money but don’t want to learn money”.

The investment strategy of any guaranteed product is CPPI, in which a low floor is maintained and the upside movement is capped.The floor is mostly the initial contribution.In fact this strategy will yield very low return. But when the scheme is marketed, the USP of Highest NAV is not explained properly and gullible buyers think it is the highest Sensex/Nifty level over the years.Most pathetic aspect of the product is a guarantee charge for delivering the low return!!!

Well Said Prakash.

Hi,

Hemant , Thanks for your comments on Samrudhi Plan, after understanding your view i have dropped to buy it. Now can you tell me which plan i can take for investment in LIC ? i can invest 2000 per month

Waiting for your reply.

Bhaskar

Hi Bhaskar,

Insurance is not investment

https://www.retirewise.in/2010/04/what-is-insurance-investment-or-expense.html

My suggestion is go for MF SIP.

Hi Hemant,

what is your opinion about the newly launched product by Birla Sunlife know as”Foresight”.

Is it also similar to Samriddhi? Should we avoid buying this product?

Please advise.

Regards, Kalyan

Hi Kalyan,

If you are happy with 5-6% returns you can try it – if not Avoid.

Hemant,

3 years back, an LIC agent sold me a combination of 7 marriage endowment/educational annuity policies (T.No.90) with a ‘guaranteed’ returns for my kids benifit from year 16 to 22. I pay an annual premium of about 25,000.

After reading on this review, in hindsight, this looks like a big mistake when I could have gone for some MF invetment. Since I have already paid the preomium for 3 years, is it advisable to exit and what are the pitfalls?

Yes Jayadeep

If you have realized that it was your wrong decision – there is no use of throwing good money to save bad money.

You can make your policies paid-up.

Hi Hemant

Ur article is really an eye opener, I was also planning to invest in Samridhi Plus.

wl be seeking ur advice for investing small amounts in Mutual fund on regular interval during fy2011-12.

if I will invest Rs 10000 per quarter for 100 months, how much minimum amount I will get when maturity will come

Hi Sagar,

You can make your calculations here

https://www.retirewise.in/2011/02/systematic-investment-plan-mutual-fund-sip-best.html

Hi Hemant,

i am also amongst the group of people who were about to invest in LIC sammriddhi plus policy. But after reading your view, i have realised that insurance and investments should not be mixed.

But what is your take on money back policies esp from LIC…….and any term insurance you reccomend…??

Regards,

Ravi Lamba

Hi Ravi,

Money Back are not worth putting your hard earned money.

For term plan read this

https://www.retirewise.in/2011/03/best-term-insurance-plan-india.html

Hi Hemant,

My father is retired now and he want to invest sum amount so that he can get good monthly return on it. I need your suggestion.

Hi Das,

You can check MIPs & post office MIS or senior citizen scheme.

Hi Hemant,

First i need to thank u for making every one clear about the difference between and the insurance and investment and for replying each and evry one queries. My name is chowsan and for the last one month i read so many articles regarding investment and insurance. But your reviews on products is good and easily understandable.

I am also searching for a good investment policies which gives good returns not only good but highest returns, so kindly suggest me which plans should take for investment

Hi Chowsan,

Read this for getting highest returns

https://www.retirewise.in/2009/12/returns-cannot-be-your-goals-in-investing.html

thanks for providing such vital information regarding samridhi plus. I was going to invest in this policy being lured by an agent but after your articles on wealth plus and samridhi plus my eyes were opened and now I will not mix investment and insurance. since you told that it is a a policy based on debt and equity and NAV is a different game funda. Why IRDA not issues strict warning to the publicity made by companies ? why the reputed companies like LIC take stringent action against their DO and Manager for misleading the innocent people who just rely on the name of company?

Hi Ajay,

Nice question but I think only IRDA & LIC can reply.

HI……

WHICH FUND WILL GIVE ME A MINIMUM 11% RETARN YEARLY

IN LIC.

my dear friend

you have rightly told with logic and it can save them who mix the insuance and investment plan

sunil

Thanks Sunil 🙂

Its not only with lic all insurance company ulip policy have same funda either u invest in lic or any insurance company dont make any diffrence, its all the same unless u have a master in fooling.

Can I guess – you are an LIC agent.

Try to give comparison with your suggetion only critics dont make any sence to educate people. It will be only u put other against one. So when you say its not right one then, which one is right to choose

I don’t think every time one need to compare things – if something is bad it’s bad.

hi sir

uti super investment plan offers free term insurance of 15 lakhs what are their hidden charges if any. are they good plan or some birla sunlife this type of plan . or any term plan with return of premium is good.

Hi Anand,

If I am not wrong UTI is not having this plan – they have different plan which provides some insurance benefit.

But my suggestion is keeping insurance & investment separate.

Very nice analysis and useful article.

May I know please – location/URL to read good plans for Investment (only) & Pension as well.

Many thanks in advance.

Regards,

Sanjay Sharma

Hi Sanjay,

You should try this link.

https://www.retirewise.in/2010/12/best-personal-finance-articles.html

Hi hemant,

Thanks for sharing this informative article as i was about to invest in samridhi plus.

In 2009 i invested Rs. 30000 yearly in ICICI life stage assure policy for 10 years policy term… was that a good decision (i really doubted on this )

Also pls tell me between LIC Jeevan saral and SBI money back which one is better.

Hi Abhishek,

Your doubt is real – it was not a good decision.

Now don’t repeat earlier mistake of mixing insurance with investment.

Hi Hemant ,

Thanks for your comments on Samridhi PLUS Plan.

Now could you please tell me a suitable plan currently available in market which is good for investment(long term investment as well as short term investment).

Hi Jai,

This article will be helpful for you

https://www.retirewise.in/2010/06/long-term-and-short-term-investments.html

Hi Hemant,

Thanks for the insight. I was looking forward to buy this policy, hence, was searching some review to add to my confidence. Guess I was right to do so. You have saved me lot of trouble mentally and financially.

I would like to share some points as I have worked in a Bank for such insurance, ULIPs nad saving accounts etc.

-> I was a fresher in those days and did not have much knowledge in financial products.. but I always liked to understand the products that I sold to my clients as at an initial stage my family and relatives were my “Natural Market” (as you correctly mentioned). However, I was always given half facts about the products and I believed them. Fortunately I realised it soon enough that a Golden Road does not lead you to the Treasure (As in most of the cases). There it came to my notice that many agents or the Sales person do not even know their products well not to mention the advantages and disadvantages of the product they are selling. They have been told to believe the product is excellent and they need to sell so they can also earn good Incentives/Commission.

My understanding here is that not only we as an Investor needs to be educated the importance of handling their own life long savings but also, young people like me needs to start taking initiatives to examine the products before selling them to the potential clients or their relatives.

If the mis-selling has to stop agents need to understand that they are playing with their Family’s/ Relatives/ Friends savings directly or indirectly.

Hemant, I am in my 24th year and I am looking for a good growth plan with moderate returns and no hidden costs. I know I can get it in Equities but as you mentioned in SIP’s I can have a more diversified portfolio where I can Hedge my risk if one particular security did not perform well. Could you please advise me in which SIP I need to Invest to earn highest returns possible?

Thanks and regards,

Priyesh Kothari

HI Priyesh,

Fully agree with your views – both investors & advisors have to learn & understand their responsibility.

It’s good that you understand all this at 24. 🙂

Hi Hemant,

This is my first investment and reading the above article, i think i did a mistake. I have invested a sum of 30,000 as a single premium on 2nd of March.

My question:

Does it help in saving income tax?

Can anything be done to compensate the loss?

where should i invest in future as i am new to this line?

Thanks in advance.

Hi Hemant,

This is my first investment and reading the above article, i think i did a mistake. I have invested a sum of 30,000 as a single premium on 2nd of March.

My question:

Does it help in saving income tax?

Can anything be done to compensate the loss?

where should i invest in future as i am new to this line?

Thanks in advance.

Hi Manuj,

It’s bit late but I think it should be a big lesson for you – try to learn as much as you can so that no one can take you for a ride.

No, you will not get tax benefit. You should start SIP & also open PPF account.

Thanks Hemant

Hi Hemant,

Thanks 🙂 You save my money

Today only i was planning to buy this but now i wont.

Thanks again……:)

Hemant- I m looking to buy child plan for my daughter which one do you suggest me.

Hi Hemant,

Thanks 🙂 You save my money

Today only i was planning to buy this but now i wont.

Thanks again……:)

Hemant- I m looking to buy child plan for my daughter which one do you suggest me.

Hi Pritish,

Avoid buying child polices – they are very expensive. Keep it simple – buy term insurance for risk & start Mutual Fund SIP for investment.

Hello Hemant,

Could you please help me with any good MF SIP scheme in which I can Invest… I am 24 years old and want to make short term and long term SIPs… what all things do I have to consider in terms of SIPs performance and all so that I can invest?

Hi Priyesh,

For short term(assuming horizon less than 1 year) as such their is no need to have a SIP – you can open folio in any ultra short term fund & keep adding the extra money that you have.

For long term you should look for diversified equity funds – go for HDFC top 200 & Dsp br equity.

One of my friend has invested in HDFC200 and he got good returns and its fairly priced too what horizon should I be aiming at 10 to 15 yrs or more? and for short term perspective is there any particular Sector that I need to aim…. IT doesnot seem to be doing too well… how about Infrastructure, oil&Gas, Steel/Metals or Automoblies?

Hi Priyesh,

Don’t go for sectorial funds invest in diversified equity funds. HDFC top 200 is a good fund to start with.

Thanks Hemant,

I will get back to youu with the technicals of the fund after analysing it fromm the mutual fund India website…

Will be back soon on this

I want to buy policy for my child, which can benefit in future for her education and marriage. kindly suggest.

Hi Nitin,

Don’t be fooled by emotional attyachar. Don’t use insurance polices for investment.

hello Hemant,

thanks a lot for your info on samridhi. please suggest some insurance policy for my daughter which helps for her education.

If I have to do one time investment to lump sum amount which plan is good please suggest.

thanks again,

Divakar

Hi Divakar,

If you have read the whole article – in the first point itself I have clarified that insurance is not for investment.

@All readers – can we think beyond policies 🙁

Hi Hemant,

Thanks a lot for all info…my agent was desperately asking me to invest money in this policy…

I need your advice on money plus – ulip policy…when that policy launched my agent told me that you need to invest 10k for 3 yrs that is 30k per yr and you ll get 50k at the end of 5 yr…aftr completing premium for 3 yrs, he said as market is down, you do one thing continue paying premium till 2 more year so paid premium for another year that is now 40k is invested under that policy but in current date he is saying that market is in very bad condition & so you break down your money plus policy & transfer that amount under summrudhi plus but when I asked him what is the total amount I ll get if I finish the money plus then his answer was strange…it ll be less then 40k…actually loss for me

So now I am in confuse mode…should I continue that policy or break and take the amount back what ll be in current stage i.e. less than 40k …need your advice.pls reply soon cos i have opened two same policies 🙁

Hi Nadini,

You can exit money plus – as you have realised that it was a costly mistake or mis- sold by agent. But again he is trying to mis-sell you by saying “withdraw it & invest in samridhi plus”. Your agent is thinking only about his commission.

What do you mean by this “i have opened two same policies” – have you already bought 2 more insurance policies. If it’s in freelook period; return your policy.

Hi, Hemant,

Its a great article and a good eye opener. Thanks a million. please keep posting more and more….

Thanks Navin – Keep visiting TFL & sharing it with your friends.

hi hemant,

I read u r artical n highly impressed from u but i am confused i have one profit plus policy from last four years n now my agent told me surrender that policy n convert that money in samrudhi plus so please suggest me that i convert that profit plus policy or not. please reply me as early as possible.

Thanks & Regards

from

krishna

Hi Krishna,

This is the hottest mis-selling trick – discontinue old policy & start new one. As in first 3 years commission is high – he already earned that in your first policy & now he want to earn more with a newer policy.

Hi, Hemant,

Thanks for sharing this informative article as i was about to invest in samridhi plus.

After going through ur article I’am confused, what to do as I have lost my husband before 6 months and i have two childrens, whatever insurance money we got, some

i have invested in MIS, and also FD, but now I want to do something for my childrens who are aged 10 Yrs & 5 Yrs for their future. Please guide me how to plan myself whether to invest or take policy.

Hi Hema,

Hope you got reply through mail.

hi Friends,

please tell me where and how to invest money for absolute returns in 10 to 15 years. I am planning for my kid.

Hi Srinivas,

Make combo of PPF + SIP.

Sir,

LIC Samridhi Plus may 5 lacks invest karo to maturity value kitna milega.

Hi Abhijit,

No Idea 🙁

Hi Hemant,

Which is the best way to invest if I want a retirement corpus of say 2 Cr when I am 60? I am 39 now. Should I put all in one SIP, or spread it across?

And can you also suggest a good medical plan, over and above Mediclaim, which can maybe address medical expenses when we are not hospitalized? Will be useful to have when we are older.. 🙂

Hi Priya,

Don’t invest in single fund – make a proper fund portfolio. (also invest in debt)

For medical needs you can create a separate medical corpus rather than depending on some plan. (I am talking about over & above medical insurance)

Hi Hemant,

How about the LIC’s Health Plus policy?

Hi MP,

You should take normal health insurance policy through some general insurance company.

Hi Hemanth,

Thanks for providing valuable information.Really I dropped to taking this plan.

Could you pelase let me know about Bhrathi AXA…

The plan is 10 yrs and will get the return from 7th yr onwards and 5% of the intrest will get once in 5 yers.

But,I am not aware the policy name…

I am planning to invest 2000/- PM for my kid name,Please suggest any ploicy name

Hi Sridhar,

I think you are talking about Bharti Axa life True Wealth. Oh! again wealth – samridhi 🙁

Answer is same – for investment purpose think beyond insurance policies.

Hello Hemant !!

Firstly being a mother of 3 daughters , i have the anxiety and worry and confusing about the insurance and investment policy in the market . Cant decide which to choose for benefit and a peace of mind , secure policy guaranteeing me with a sure return on time , without the interference and market up and down instability ……

At the age of 40 …… with life and death , i just want to be at peace concerning my children’s educations .

looking fwd to hear frm you soon . plz reply personal on my email address as i happened to per chance open this page abt LIC …..

mariam…….@……ill be waiting for ur reply

Thanking you ,

Mariam .

Hi Mariam,

If you are just looking for safety of instrument better go for PPF or FDs rather than such insurance policies.

Hi Hemant,

Your article is very very nice.

Can you show some focus on newly launched “Lic-Nomura mutual fund”

Many thanks

Hi Reema,

It’s not a new launch – Nomura has purchased some stake in LIC.

Performance of funds from this fund house is very inconsistent.

Hi Hemant,

Thanks for info.

Can you suggest some good mf…also can u show sm focus on fixed deposit in bank..is it good to invest money in fd n can i take the benifit of that for tax.

Many thanks

Reema

Hi Reema,

Every asset class is having different role in your portfolio. Where FDs provide you stability – Equities provide you growth. If we talk about investments in relation to goals – FDs can be used for any of your short term goal say upto 5 years & Equities can be used for long term goals. Now coming back to your question – yes tax benefit of section 80 C can be taken on FDs with maturity of 5 years or more. But always remember that interest from FD is included in your income & taxed according to your slab. As you asked for some mutual funds; it looks you are going to be first time investor – my suggestion is start with some small amount through SIP in DSP BR Top 100 & Fidelity Equity Fund.

Hi Hemant,

Thanks a lot for info 🙂

Yes..this is my first time…yet b4 i never invested in MF so taking your views…can u show sm focus on “my suggestion is start with some small amount through SIP in DSP BR Top 100 & Fidelity Equity Fund.”..i searched on net for “DSP BR Top 100” but i got many result…so like exactly which i need to choose…and one more question…where can i invest money in mf…do i need to approach my LIC agent for the same cos many times he has asked me for some other mf or is there any alternate way…

Many thanks for ur all valuable advices…

Reema

Hi Reema,

Both the funds are good & you can take help of your LIC agent in investing.

Hi Hemant,

i have a LIC’s Wealth plus policy. i m investing 20000 per year in this policy for 3 years just 1 installment is left. should i surrender the same or wait till maturity? Also i m planing to invest in Mutual Fund, which fund is best to start MF investment? im in 28th now and want returns atleast 30 to 40 lacks in my 50th.

Also i m planing to secure myself by insurance. kotak mahindra provides 25 lacks life cover till 30 years by 550 rs installment by every month. should i take it?

Please quide me for above quiries.

Thanks & regards,

Kishor

Hi Kishor,

I am trying to solve your queries in full detail – hope it will be helpful for others.

LIC wealth Plus was launched on February 9, 2010 states that LIC will guarantee the highest NAV to the investor in the first 7 years and product will mature after 8 years. It nowhere guarantees the return. But it was perceived by investors as highest return guarantee & that’s a mistake. It was also grossly mis-sold by agent by showing pamphlets that “Lumpsum Rs. 1 lac invested today will become Rs.3,45,693/- or give Rs 25000 for 3 years & get Rs.2,14,690/- after 8 years.”. Current NAV of this scheme is Rs 10.12 which means a return of 1% on NAV but if I adjust expenses out of that you are in deep red. My suggestion is there is no need to pay even 3rd premium – LIC has kept this provision in this policy. Talk to your agent.

Regarding your term plan query – It’s a very good decision to take term plan it’s provides financial security to family member in case of some mis-happening to bread winner. Kotak term plans are very cheap in comparison to other life insurance companies & even claim settlement ratio is good. It looks that you are a smoker because for non smokers they have a special plan whose premium is even less – in your age it will be close to 350 per month. My suggestion is go for yearly premium as in term plan if you miss out a premium – you miss out a policy & existing benefits attached with that.

You can start mutual fund investment in Fidelity Equity Fund & HDFC Top 200 Fund.

Hemnt,

This is the first time I m going through ur reviews..Very interesting and useful as well… I bought “HDFC Young Star” around 5 year back and paying 25K yearly premium. I think that is also similar type of plan..Pls advise me how is that and is it good to continue as well?

Pankaj G.

Hi Pankaj,

Child plans are the most expensive insurance policies – my suggestion will be to surrender it.

Samridhi plus better than all other Insurance companies ULIP plans??

Hi Shiva,

Do you have any logic behind this.

hi hemantji,

i have read all your article and they all are superb and an eye opener for everyone, I want to ask one question i took policy called kotak smart adv. in 2008(4 inst has been paid) 15000/each. and other one kotak super adv. both are ulip plans. i want to know how these plans are ? and should i continue this because if i do redemption then i would not get first installment of 15000 as they say(kotak) it will be given to you on maturity ie after 25yrs Please suggest

hemant ji,

your review is logical and very informative.

thanks

susanta, from bhubaneswar.

Your Welcome.

hi hemantji,

i have read all your article and they all are superb and an eye opener for everyone, I want to ask one question i took policy called kotak smart adv. in 2008(4 inst has been paid) 15000/each. and other one kotak super adv. both are ulip plans. i want to know how these plans are ? and should i continue this because if i do redemption then i would not get first installment of 15000 as they say(kotak) it will be given to you on maturity ie after 25yrs Please suggest

Hi

Thanks for the aricle, it is quite informative.

I have a query, I have been offered the Canara HSBC grow smart plan by my hsbc reationship manager.

Can u pls shed some light on it, I am looking for a investement plan and not intersted in insurance.

The guy said that there is around 5000rs/yr admin chargeand 1.35% fund charge + 8.5% premium allocation charge (which reducedd to 5!25 from 2nd till 10th yr)

Can you let me know if this is a good plan to iinvest in! My goal is to save something for retirement and my kids future, I am 36 now.

Than

Hello Hiten,

As Hemant n many other financial experts always say, never mix investment with insurance. They are not even close to meet our goals. insurance policies are very costly. As you yourself have mentioned about the allocation charges.

Since you are 36 years old, first of all buy a term insurance plan if you have not purchased yet. Please note that your term insurance should be at least 10 times of your annual salary. Term insurance is necessary because if something happens to you, your family will be secured financially. You can buy term plans online of ICICI I protect or Kotak which you will get at a cheaper cost and claim settlement ratio is also very good.

Now coming back to your investment, mutual fund SIP is the best form of investment for long term growth and considering inflation.there are no allocation charges in mutual funds. I am not sure how much you want to invest per month. But if you are looking to invest say Rs. 5000 /- per month then after 20 years with avg returns of around 15 % you will get around 65 lacks. Now you can use some amount for your kids education n marriage out of these 65 lacks and keep on investing for another 5 years till your retirement then you will be able to achieve your goals for retirement i.e around Rs. 1 crore. Now these are just assumptions. But if we invest for long term then sure we will achieve our goals. Keep on increasing your SIP’s when your salary increases.

You can invest your money in good mutual funds like HDFC Top 200, HDFC Equity fund, DSP BR small n mid cap fund, Reliannce Equity opportunities fund, IDFC Premier Equity etc.. For more details on selecting mutual funds, you can read this article of Hemant n Anil..

https://www.retirewise.in/2011/07/best-mutual-fund-for-sip.html

is sampoorna samriti lic better than hdfc top 200 mutual fund

Hi Friends,

Can any one suggest, good investment plan or any scheme for short term period of say 3 to 5 years.

Gaurang

Hi Gaurang,

Read this

https://www.retirewise.in/2010/06/long-term-and-short-term-investments.html

Hello,

I am trying to invest in kotak Ace investment plan

LINK. It works on the same procedure as LIC samridhi plan. total charges for this is 6% for 1st yr and later 3% fro the following years..They assure a return of 20%.Insurance is not an issue.. i think there will be no harm in investing if the we get a 20% annual return….

Or could u please suggest any comparable plan for about 30,000 annually for 5-8 years.

nitish

FYI, Kotak Ace doesnot guarantee any return on this plan.

please check i have not used the word GUARANTEE rather i said they ASSURE u,this does not mean they guarantee..

Ok! They donot assure you any return on this plan. The investment risk is born by the investor and there is no downside protection or assurance whatsoever.

@HEMANT

tnks a lot hemant for your suggestion…

today only one agent told me about LIC samrudhi plus plan. Acco to him there are charges only in the first yr thereafter NO CHARGES…now I will take a print of above article n show it 2 him…..tnks again bro for saving my money!!!!

can u pls tell me where 2 start investing?

Hey Yash,

What was your agent’s response when you shared this. 🙂

You can check this for inventments

https://www.retirewise.in/2010/06/long-term-and-short-term-investments.html

Hi,

This article was really nice. What is your views on Jeevan Anand policy? I purchased a policy of 5 lacs for a period of 21 years. The agent told me that I’ll receive near about 11-12 lacs. Is it correct ? Also, to double your money is Kisan vikas patra an effective tool?

Thanks

Hi Gautam,

will suggest you to read this

https://www.retirewise.in/2011/02/debt-return.html

Hi Hemant,

Many thanks for this article, I was about to invest in LIC Samriddhi Plus, but now I will refrain from it.

If in a year when the market has appreciated 20% or I consider even 15% lets say, then also LIC is giving around 5% … quite dismal.

Thanks again Hemant …

Must Share it with your friends – Rishi.

These negative comments are submitted by some DALAL (Chamcha) of Private Insurance Company. Otherwise its record of LIC in giving better return than Market allways..

No matter to fear..Invest in Samridhi Plus and enjoy the benefit of Highest NAV of 100 months guaranteed.

LOL 🙂

Hemant,

Pls advise the MFs which are doing good. I want to invest in MF. Any sugession ?

Pankaj G

Hi Pankaj,

Read this

https://www.retirewise.in/2011/02/systematic-investment-plan-mutual-fund-sip-best.html

Hi Hemant,

I want to take samridhi plus.Pleas give me some suggestion.my m. n. is

98713.thanks

Neerav

Hi Neerav,

Never share your mobile no on such forum – I said you should NOT buy this policy.

Please help me to spend money in right way

I am having small Printing shop

Can invest 15,000 per annum or 2000 per month

Hi Vikas,

Spend Money or Save Money??

Thanks I was just spending in this.

Hi Vikas,

You rightly said SPENDING.

Hemant,

Thanks for your advise. What is your view about Fixed Maturity Debt plans of mutual funds?

Hi Amit,

check this

https://www.retirewise.in/2010/03/fixed-deposit-vs-fixed-maturity-plan.html

hello Hement,

Today., on 24th I got a call for Samridhi plus from Lic employee & I was ready to purchase this policy. luckily I sercged web for this policy & found your article. that article open my eyes.Thanks a lot. you saved my money.

Hement I can invest upto 1 Lac a year. I want to purchase Term Insurance plan for me of around 50 lac. but LIC is not covereing pamanent hanicapped case in their Term Insurance plan. They only covers Natural & accedental death. also they are charging more than other company’s Term Insurance plan. Can you suggest which Term insurance plan covers pamanent handicapped/paralysed patients. From where should I purchase Term insurance plan?

And pl explain what is Mutual fund? which is safe & which is giving highest return now a days?

Thanks

Rahul

Hi Rahul,

For term plan

Read this

https://www.retirewise.in/2011/03/best-term-insurance-plan-india.html

My suggestion is keep your term plan & accidental policy seprate.

To understand Mutual Fund read this

https://www.retirewise.in/2010/08/understanding-mutual-fund.html

Dear Hemant Ji,

I need some suggesation from you.I want to invest 30000 to 40000 at a time in MF in long term like 12 to 15 years.My age ig 33.So could you please suggest me such a plan where i can get high return .

Thank you

Harekrishna

Hi Harekrishan,

Read this

https://www.retirewise.in/2011/02/systematic-investment-plan-mutual-fund-sip-best.html

Hi ,

All your comments are excellent and good for Investors. you are saying all child plans are expensive then what about HDFC child gift fund (Mutual Fund) . Shall i take this ? and what LIC insurance plans i have to take for my kid and wife. please suggest me .

bhaskar

dear sir,

i am 35 year old i want to open lics jeewan saral& invest rs 2000 per month in jeewan saral,for 10 year,my agent say after 10 year you earn rs 4.25 lack,so please guide me what can i do,

manoj,

The rate of return suggested by your agent is a shade over 10% and is unrealistic.

Hi Mr. Hemant,

I don’t know a thing about investments, but badly need to start one. I am a home maker (aged 38) and my son would be finishing school in another 5 years and also have a daughter who has just entered class 1. Could you please suggest good investment plans (pl. suggest names of the plans, can’t understand much from the posts and am not knowledgeable enough to make the right choice) for my son’s higher education as well as another one that would help me save for my daughter’s future. Request a quick reply (You may send the reply to my email, if you do not wish to make your suggestions pubic). Thanks.

Anuradha,

By ‘investing’ in an insurance policy, your ‘real’ rate of investment would only be negative, which means your money will depreciate in value with each passing year.

Hence ‘Think before you act’

Hello Hemanth,

I have invested around 2 lakhs in this samridhi plus three months back. Today after reading your article, I am feeling bad and scared. I have only one question for you. Am I in loss or am I getting less profit than other plans? now do I get atleast the money I invested… i m worried…a few wrds helps…

thanks,

Hello Bhanu,

I can understand your fear since I also went through the same problem. I invested 1 lakh lump sum in LIC market plus 1 policy 1 n half year back when sensex was at 16000..Now when the sensex is at around 18000, my value is still negative. So it means that LIC has been a poor performer in the last 5-6 in any nav market plan..Money plus, market plus, wealth plus n even samriddhi plus are just not good enough.. The real problem is with the fund management of LIC which is the reason why these policies are a failure.

Since you have invested such a large amount, I would actually like to encourage you to stay in this policy till the maturity bcoz the fund management can change n LIC starts performing better in the market n I think you will still get around 10 % returns. Hemant can explain in a better way..

Manoj

The negative returns from your policy is not because of the fund management but it is because of the charges that have been deducted to your ULIP account by the cancellation of units. In addition, since market plus is a policy where you can decide the allocation, you can expect 10% over long-term (10years) by investing about 80% in Equity and 20% in debt. But, with Bhanu’s case, the allocation is not with the policy holder. The allocation between Equity and Debt would be based on a mathematical model. So, to guarantee the highest NAV, the allocation to debt would be very high (more than 80% and might move to 100% if the market is volatile. The investment mandate of the policy states that 100% debt allocation is allowed. Hence I am very very sceptical about the returns to expect. With yields on bonds increasing, 6-10% return is more likely. Including the charges, the return goes down still.

Also, Almost all traditional insurance schemes, including those of LIC, give a return of about 4-6% only which is close to the returns that you get from your ordinary savings account. Hence i would keep my money in my savings account rather than going in for these ‘faultyly-innovated under-insurance’ products.

Hey Loney,

Thanks for the input. I get your point in saying that returns would be skeptical and all I can do now is to wait till the maturity and I guess with these LIC investment plans we get life insurance in addition, so do you think that is a plus. I know I am mixing up insurance with investment but I am new to this field and don’t have much idea about these investments, so just wanted to ask you.

Also as I invested 2 lakh in this samridhi plus after the maturity period ( 5 yr) I get 2 lakh + max of 10% or is it other way round hinghest NAV in first 100 yr/ fund value at that time. Sorry for the trouble but I need to know these basic info as I am planing to invest more, so I am looking at various plans.

Thanks,

Bhanu,

The ‘real’ returns that you get from traditional insurance policies are negative meaning that the money loses its purchasing power to inflation.

The returns that you get from ULIP plans are subdued due to the charges (read LOOT – > because in all highest NAV guarantee plans, they charge a guarantee charge. This is double penalty for the investor. First, these plans lose return potential by choosing to guarantee the highest NAV and second, they charge a fee for choosing to moderate out return generating potential).

Always go for

Term policy for insurance (risk cost)

Mutual Funds for Equity Exposure (inflation beating potential returns)

Bank FDs / PPF for Debt exposure (prevention erosion of rupee value)

Hi Loney,

Thanks for helping & guiding other readers. 🙂 You are making a great contribution to TFL.

dear Hemant,

You are replying to all other comments except my one. i have asked you regarding the below query.please suggest me . waiting for your reply.

All your comments are excellent and good for Investors. you are saying all child plans are expensive then what about HDFC child gift fund (Mutual Fund) . Shall i take this ? and what LIC insurance plans i have to take for my kid and wife. please suggest me.

Hi Bhaskar,

Thanks for keeping patience – may be I missed your last comment.

Avoid even HDFC child gift fund – my suggestion is go for diversified equity funds.

You must read this

https://www.retirewise.in/2009/08/understand-how-to-plan-for-kids-future.html

Hi

i have read all your article and they all are superb and an eye opener for everyone, I want to ask one question i took policy called kotak smart adv. in 2008(4 inst has been paid) 15000/each. and other one kotak super adv. both are ulip plans. i want to know how these plans are ? and should i continue this because if i do redemption then i would not get first installment of 15000 as they say(kotak) it will be given to you on maturity ie after 25yrs Please suggest

Reply

Hi Pankaj,

Can’t help you in this – you have take your decision. Some time back we wrote about similar policy.

https://www.retirewise.in/2009/08/insurance-schemes-or-insurance-scams.html

Hello Hemant, pl also reply on my post. I posted it on May 24, 2011 at 1:09 PM

but still didnt get your attention & answer.

Pl reply.

I want to purchase Some Term Insurance plan for my Mom & Dad(age-58 & 60yrs resp) which can cover accident/death & parmanent disabliity. Pl suggest which would be better?

Rahul

hello Hement,

Today., on 24th I got a call for Samridhi plus from Lic employee & I was ready to purchase this policy. luckily I sercged web for this policy & found your article. that article open my eyes.Thanks a lot. you saved my money.

Hement I can invest upto 1 Lac a year. I want to purchase Term Insurance plan for me of around 50 lac. but LIC is not covereing pamanent handicapped/disability case in their Term Insurance plan. They only covers Natural & accedental death. also they are charging more than other company’s Term Insurance plan. Can you suggest which Term insurance plan covers pamanent handicapped/disablity. From where should I purchase Term insurance plan?

And pl explain what is Mutual fund? which is safe & which is giving highest return now a days?

Thanks

Rahul

Hi Rahul,

Just shared some links – hope you find them useful.

My Agent sold me 12 New Janaraksha policy from LIC previously he din’t mention , but they are 12 diff policy 12 for my husband & 12 for me ……….yearly we are paying 70K , as per his explanation after 18 years we will get 16 lakhs each ……….aur it is risk cover policy also …………….whether it is right investment ?

please comment on this and give some suggestions………..

Hi Shirin,

It is a latest trend in mis-selling – they sell bundle of products saying it is a retirement plan. It is a retirement plan for agent 🙁

Hi Hemanth,

First of all , thanks for the nice piece of info being presented on the investments. I need your advice here. My dad has purchased LIC Samridhi Plus with single premium of Rs 2 Lakhs without seeking any advice. When I was told about this, I have asked him to cancel the polciy during “cooling off Period ( which is 15 days )” , which he has done. Now the respective branch officers are not providing any update on status of cancellation of policy even after one month of placing the request. Could you please advise whom I should be approaching to get the proper answer on my policy status.

Thank you,

Yogesh

Hi Yogesh,

I don’t know how I missed your comment – can you please share current status of your issue.

Hi Hemant,

NP, thanks for your reply. but I haven’t received any status from them. The response what my dad has got is, they ( LIC ) havent initiated any process of refunding the cancelled policies ( for SAMRIDHI PLUS ). Once the comany ( LIC ) starts the process, we will be getting the refund. Please suggest the better way to chase them.

Thank you,

Yogesh

Hi Yogesh,

I really doubt that your policy is cancelled – have you got any receiving of cancellation.

No Hemant, that’s what I was asking my dad to get that atleast. Looks like even the branch manager has cheated mmy dad. Is there any way please?

Hemant,

I have also observed that, when ever I called LIC customer care, and ask about my policy details, they were not able to retrieve my policy details. I have received bond in June and still no details in their system, something which I do not understand.

Thanks

Regards

Yogesh

Hi Yogesh,

You are from which city – just share name of city not your address.

I am from Hyderabad Hemant

Hi Yogesh,

I am trying to get their email id – meanwhile you can send your complain through registered post to:

LIC Customer Zone

6-3-870,Balayogi Paryatak Bhavan(Tourism Plaza)

Begumpet Road,Greenlands

HYDERABAD — 500016.

Also try this number 040-23420771

This is where I called to find out my policy details and status of cancellation request. But to my surprise, they couldn’t retrieve any policy details. This is what the email address I got from them, customerzone_hyderabad @ licindia . I am going to write them in a short while. Thanks…..

Hi Yogesh,

Don’t waste any time & write a mail to them.

Hi Hemant,

I went through you valuable info. and i feel safety now.

please tell me which plane is better in MF i.e. growth plan or divident plan. if i invest 2000 per month for 5 – 10 years, which plan gives me better returns? i need lump sum amt after 5 years. please give your valuable guidance.

Kishor

Hi Kishore,

Go for growth plans.

Hi Hemanth,

My father is interested to invest Rs.5lak, we were told about Birla Sunlife – Foresight Plan ,One time investment. Investment come insurance ULIP plan similar to LIC Samridhi, they say it has no effect on volatile markets, they assuse Minimum Guarantee maturity benefit. Please send me your review about the plan,

Also if you feel that my father can invest elsewhere with 5Laks please give your suggestions, we have no idea about mutual funds, he is looking only for maximum returns not any insurance benefits.

Please kindly reply

C

Hi Bhaskaran,

My suggestion will be that you should avoid this plan – this is even more complex than LIC Samridhi Plus. These plans looks good in back testing but the future is not a carbon copy of past.

My suggestion is if your father is in lower tax brackets – he can go for FDs. But as you looking for higher returns (but you don’t understand Mutual Funds) – my suggestion is start with MIP of balanced funds.

i would like to cal and speak to u if u don mind pls give me ur contacts via mail..

No i am not intrested to meet any agents,…sorry you people are brain washers,…idiots

i already invested in samridhi plus a huge amount wanting to discuss about that..

Hi Kunal,

I think I have shared my views through the article & in comments but if you still would like to contact me – you can visit http://www.arkfp.in

Hi Hemanth

I have already invested in samrudhi plus i have believe on the agents words and done. now i want to withdraw from it how can i please advise me.

iam disturbing alot please get solution for this.

Hi Sairam,

There is an option that you can discontinue it after 1 year – talk to your trusted agent & let me know his reply.

Hi Hemanth

I have already invested a huge amount in samrudhi plus i have believe on the agents words and done. its mean it will not get any returns at end of the 10yrs of period. please tell me, iam confusing. iam scaring that i will not be a looser at end of the maturity of the policy. i have believed on the name of lic brand name thats it.

please suggest me how can i cancel that policy and where i shoud invest my money to get good returns.

Hi Vanaja,

Don’t take any decision in haste – cool down. Don’t go with my words & do your independent research – it will be a great learning exercise for you. Talk to your agent – take his views in writing. (may help you)

Give yourself 1-2 weeks time & make the final decision.

Hi Hemanth,

Thank you for the valuable info. Can you also throw some light on “LIC Bima Gold” as well. I am planning to go for it.

Hi Hemanth,

Thank you for the information. Can you also throw some light on “LIC Bima Gold”. Planning to go for it if its good.

Also suggest the best short term investment plan. I m 26 Now.

Hi Kranthi,

Avoid bima gold.

For short term investment read this

https://www.retirewise.in/2010/06/long-term-and-short-term-investments.html

Hemant,

I am 31 years old and i have one year old Daughter. I really thank you for giving such an insight on Investment. I was about to invest in child plan and Retirement plan. After going thru the several conversations in this website for the past 10 days i learned that i should not be investing in this stupid products, I also approached a CFP for a Comprehensive Financial planning 2 days back. He charges Rs.10,000 first year and 2500p.a from the consecutive years. He also said my portfolio needs to be balanced every year thats why he charges annually. I am in dilemma.

My plan is I would be investing 30k permonth. Please Advise.

My financial Goals are:

1. To have 1 Lac for my Daughter’s Elimentary Education in Sep’12

2. To have 4 Lacs by the end of Oct’12 to buy a car

3. To have 30 Lacs for my Daughter’s Education in Dec 2025

4. To have 50 Lacs for my Daughter’s marriage in Dec 2035

5. To have 1 Crore as Retirement fund in Dec 2038

Please advise.

Thanks.

Hi Ganesh,

Sorry for delayed reply.

Thanks for appreciating our work. My suggestion is immediately you should reach that financial planner – CFP is top most qualification in financial planning profession so there is no need to check about his education qualification. But before starting a relationship you can ask about his past experience, his overall process & what kinds of clients he have. Once you are satisfied with the things you can take all terms & conditions in writing through an engagement letter. He is charging a very nominal fee – just think of mutual fund era before august 2009 when 2.25% entry load was charged. Now compare this with the fees this planner is charging – if entry loads were there you need to pay Rs 8100 every year on your monthly investments of Rs 30000. So don’t you think he is giving you amazing value for money?

Ok.Thank you very much! This is a valuable advise.

Regards,

Ganesh R

Hi Hemant,

Nice article! How is this HDFC SL crest ULIP scheme. I have purchased as they also have highest guarantee NAV.

thanks and regards.

infact, IRDA itself has said that this GUARANTEED NAV plan are bad for the investors and they are about to end them..

best of luck with your HDFC SL Crest ULIP 🙁

Hi Hemant

This was an eye opener for me. I wish i had read it before. I have already gone for this policy and have invested quite a sum. Can you please suggest me how to minimise my loss or for that matter break this policy, if there is a way.

Thanks

Hi Salman,

There is a way by which you can discontinue this policy even after first year – talk to your agent.

hi ,

My name is vivek.i m 23 yr old. now i am working in soft company.apart from expenditure i m having 15k per month..now i have to save the money..so which one shall choose?..lic or sip..i m thinking sip is more good to gain more money..lic for future..so i m ready to do both..is lic will give more profit after 15 or 20 yrs ?..i m very confusing..give me good solution plz

Hi Vivek,

Investing through LIC will be a bad idea – as you are young equity mutual funds will be a better solution for you.

investing in equity mutual funds means sip right..

Hi Vivek,

SIP is a way to invest in Mutual Funds.

Read this

https://www.retirewise.in/2011/02/systematic-investment-plan-mutual-fund-sip-best.html

ya .i have read all ur articles..u told me like equity mutual funds will be a better solution for you. i have only one doubt..investing in equity mutual funds means wat ?..plz explain me ..plz

HI Vivek,

I think before investing you should learn more about Mutual Funds. Read these articles

https://www.retirewise.in/category/mutual-fund

Hemant I read couple of your article. they are really insightful. I just had a baby girl and was thinking to do some investment for her future. can you give some better options out there?

Hi Anuj,

Read this

https://www.retirewise.in/2011/07/child-future-plan.html

Hi Hemant,

I’ve bought LIC Samridhi plus on 30th March 2011. I’ve invested Rs 50,000 as single premium. Today, i read your article. what should i do now? should i close it?

How much can i get after 5 years with this policy? or is it better to close it?

Hi RD,

I will suggest you do analyse this policy – why you bought this? Should you continue or surrender? Discuss this with your agent.

Hi Hemant,

Thanks for reply. It was my mistake. Now, what should i do? If i surrender it, Can i get at least my invested sum or not? is it better to continue it? Please suggest me. My agent is not in my city. I tried his number but it switched off. I think he changed the city.

Hi RD,

You may get surrender value according to current nav i.e. 9.3 right now. Your units will be multipled with NAV & this amount will be given ti you after completion of 5 years. As your policy is single premium – continuing policy looks better idea than surrendering. But make sure you don’t do such mistakes in future.

Hi Hemant,

Thanks for reply and your suggestion. I’m continuing that policy. I didn’t get any expert like you, so i did mistake. I’ll not buy any LIC policy in future.

Hi RD,

Must share TFL with your friends.

Hi Hemant,

I am investing in Bharti Axa True wealth and protect plus since last two years. After reading and understanding the article i am feeling unlucky. Would you please suggest whether should i continue or stop investing in it?

hi hemant culd u plz sujest me that i’ve just taken samridhi plus plan with yearly payemwnt rs 20000, is it good or i shuld terminate this policy, i took this policy juat for the investement purpose, not for insurance if its a wrong dcsn then plz advice me where i can invest so that i culd get gud return in 5 , or 7 yrs time, my agent tld me that maturity time is five yrs n u will get minimum 300000 lcs plus double ur amount plus bonus, she also said me n my family we also took this plan

Hi hemant,

i invested in LIC Samridhi plus half yearly basis.i pay (rs.8500 half yearly)

After reading this article i amreally feelin bad abt my decision..:( please suggest if i terminate this ploicy now.. how should i go abt it? Will i get any amount if i terminate it now. Please help me…

Hi hemant!

I’ve taken samridhi plus plan in March 2011 with yearly payment of rs 15000, after going through (Dont invest article) I’m planning to switch-off from this policy. I took this policy for the investment+insurance cover purpose. So plz advice if i should terminate this policy as my next premium due is in next 2mths. Also let me know if there is a option for transferring the amt to other funds (e.g. Jeeven Anand or other fund of LIC) and if there will be penalty for termination and what will be the amount if i terminate it now. Seek your advice…

Thanks,

Borkar

Hello Sir,

I really appreciate your suggestion. Past 5 months I read your article. it’s so nice & useful for Investors.

I have a LIC’s Wealth plus policy. i m investing 25000 per year in this policy for 3 years just 1 installment is left. (March 2012)

Now I am totally confused for my 3rd & last Premium amount 25000/-. So pls. help me. Can I pay my last premium? should i surrender the same or wait till maturity? If I surrender how much amount I get?

Sachin

wts the qtrly fee for the 5 lakhs insurance policy in jeevan anand my age DOB 12.10.1991

Hi Vikas,

In endowment plans charges are hidden 🙁

Hi Hemanth,

Inspite of attached with ur articles since 2-3 months, I feel sad to say that I bought a Birla SL Plat Prem plan just same as LIC samruddhi plan.It was just because of some family pressure!!!!!!!!! ( Agent was a family friend ). I forgot to read ur this article previously. !!!!! I am inv 25000 p.a for 5 yrs n is a 10 yr term plan. In future I ll never repeat such mistake.

As u rightly said we learn from our mistake.. ok still I am 29yrs…Thanks for making us financial literates. keep going

Thanks Prashant for making confession 🙂 its really tough to share mistakes.

Hello Sir,

I have a LIC’s Wealth plus policy. i m investing 25000 per year in this policy for 3 years just 1 installment is left. (March 2012) i am paying home loan EMI also. So pls. help me. Can I pay my last premium? or pay same in laon amount as a part payment.

Sachin

Hi Sachin,

You should pay one more premium.

what ur opinian about BHARTI AXA LIFE ePROTECT POLICY.

GIVING INSURANCE COVERAGE OF ONE CRORE IN 600/- PER MONTH.

PRESENTLY I M IN INDIA & GOVT . SERVENT . MY AGE 30 YEARS. I M PLANNING TO GO ABROAD IN DEC. 2012 FOR JOB.

SO WHETHER THIS POLICY GIVE ASSURED AMOUNT TO MY NOMINEE IF SOMETHING HAPPEN TO ME AT ABROAD.

AWAITING FOR YOUR VALUABLE REPLY.

Hi Ritesh,

Read this

https://www.retirewise.in/2011/03/best-term-insurance-plan-india.html

Thanks

hello sir,

i buy lic wealth plus policy in 2010 & my premium is 50000 per year .for three year i allready paid two premiums.i alreay paid third & last premium.can you guide me.what i will received in maturity.& in ur poit of view which policy is fine for the age of 37 to 40.

dear sir,

back again ,

i had buy HDFC life insurance.children plan(UL young star suvidha) & i am investing 1500 rs per month from last five years .can you suggest me should i continue or withdraw.

Dear Hemant ji,

I am 28 yrs now and married last year. My monthly salary is 29000/- . I manage a PPF account in which i can deposit 2000/pm. Apart from that 17000 are my family monthly expenses.

Now kindly suggest me how and where to invest the remaining 10,000. I don’t own any health insurance, any insurance policy right now.

Kindly explain totally risk free policies. I shall be highly obliged.

thanks

Vageesh rohilla

Bharti axa life’s e-Protect policy is not at all transparent on the terms and conditions. The policy document does not define death. Only Suicide exclusion clause with in one year is mentioned in the policy documents. When I inquired about about other type of deaths, they came back saying that natural calamities, terrorist attacks are also excluded till one year. They are not clarifying on accidental death coverage. My mail to them are un responded for last 7 days. Even they don’t respond to the mails even after repeated reminders. I was wondering if this is their behaviour while I am alive, what will happen to my family in case of my unfortunate death. In short, Bharti AXA life is a fraud company and I have decided to move to IRDA and Consumer forum too with in few days.

hi

i purchased samrudhi plus LIC Policy i paid 2nd installment on 7th May 2012.

please suggest me whether i should continue with this policy or not ?

Hi hemant,

i invested in LIC Samridhi plus quarterly basis.i pay (rs.4000 qtly)

After reading this article i amreally feelin bad abt my decision..:( please suggest if i terminate this ploicy now.. how should i go abt it? Will i get any amount if i terminate it now. Please help me…

Hi Hemant,

please help if possible, i have invested close to 1.4lakh in samridhi plus, is there anyway i can withdraw this now without any loss ?

Nidhhi Sood

Hi Niddhi,

Talk to your agent – this policy can be surrender after 1st premium.

Hi ,

I invested 1 lakh in Bharti Axa true wealth last year in october, agent said it has minimum guranteed of NAV 12 or whichever is higher in 10 years . in one of thread i saw this is not good fund , can you please suggest why this is not good fund even when there is guranteed return .

Thanks

Prashant Mishra

surrender value of wealth plus table no 134 , policy no 143062048 and 143062030

Hi Hemant,

Want some financial advice how can it be arranged?? Is it possible to meet you and discuss with you?

Kindly let me know the modalities.

Hi Deepak,

Check this

https://www.retirewise.in/services/financial-planning-services

Hi Hemant,

I have just bought HDFC Sampoorna Sambridhi Plan. Just advise is it a good investment, Beacause I am investing 25000 quarterly in it. The riders of non-guaranteed benefit is really disturbing so please advice.

Hi Hemant,

Thank you for your detailed presentation. I am not from finance background, i am totally unaware of all the terms. I just heard of this plan and I took this LIC Samridhi Plus one time Premium of 30k in 2011, i left India. I have no details about that agent now and i just have one piece of paper which says name of the policy with premium paid amount.

Can you please advise me what should i do now ? Your help/advise will highly be appreciated.

Thanks,

Sara

Hi Hemant,

I have invest in LIC Samruthi Plus in 20111 single premium Rs. 1,00,000/-. Now, i read your article. it is very expensive plan. now, in 2013 is right for close this plan. and what is batter then this plan or ulip. Now, also give me advise for ICICI Pru Elite Life & Elite Wealth plan.

Hi Hemant,

i have invested in LICSamridhi plus ,now i read ur article ,how i can get rid off it?

can i withdraw my scheme and invest d amount in another scheme?

Hi Hemant,

i have invested in LICSamridhi plus ,now i read ur article ,how i can get rid off it?

can i withdraw my scheme and invest d amount in another scheme?

I am in discussion with an agent to invest in canara HSBC grow smart ULIP PLAN. please suggest whether it is advice able to proceed. The proposal is for 5.0 lacs per annum premium for 10 years for a cover of 1.25 crore. I do not have other insurance plan.

Hi Hemant

i am invest 90000 in samrudhi plus what is the future condition of this plan